The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government,created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

Investment banking is an advisory-based financial service for institutional investors,corporations,governments,and similar clients. Traditionally associated with corporate finance,such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making,trading of derivatives and equity securities,FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry,it is broken up into the Bulge Bracket,Middle Market,and boutique market.

HSBC Holdings plc is a British universal bank and financial services group headquartered in London,England,with historical and business links to East Asia and a multinational footprint. It is the largest Europe-based bank by total assets,ahead of BNP Paribas,with US$2.919 trillion as of December 2023. In 2021,HSBC had $10.8 trillion in assets under custody (AUC) and $4.9 trillion in assets under administration (AUA).

The Goldman Sachs Group,Inc. is an American multinational investment bank and financial services company. Founded in 1869,Goldman Sachs is headquartered in Lower Manhattan in New York City,with regional headquarters in many international financial centers. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. In the Forbes Global 2000 of 2024,Goldman Sachs ranked 23rd. It is considered a systemically important financial institution by the Financial Stability Board.

The Commodity Futures Modernization Act of 2000 (CFMA) is United States federal legislation that ensured financial products known as over-the-counter (OTC) derivatives remained unregulated. It was signed into law on December 21,2000 by President Bill Clinton. It clarified the law so most OTC derivative transactions between "sophisticated parties" would not be regulated as "futures" under the Commodity Exchange Act of 1936 (CEA) or as "securities" under the federal securities laws. Instead,the major dealers of those products would continue to have their dealings in OTC derivatives supervised by their federal regulators under general "safety and soundness" standards. The Commodity Futures Trading Commission's (CFTC) desire to have "functional regulation" of the market was also rejected. Instead,the CFTC would continue to do "entity-based supervision of OTC derivatives dealers". The CFMA's treatment of OTC derivatives such as credit default swaps has become controversial,as those derivatives played a major role in the financial crisis of 2008 and the subsequent 2008–2012 global recession.

Bradley Belt is an American businessman. He is the CEO of Palisades Capital and the managing director of the Milken Institute. He is vice chairman of Orchard Global Asset Management.

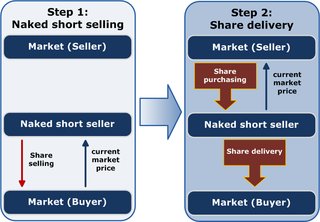

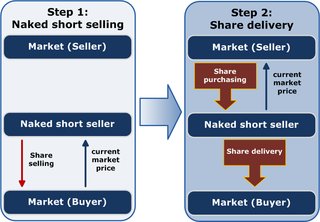

Naked short selling,or naked shorting,is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame,the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller,or the seller's broker settles the trade on their behalf.

The Securities Industry and Financial Markets Association (SIFMA) is a United States industry trade group representing securities firms,banks,and asset management companies. SIFMA was formed on November 1,2006,from the merger of the Bond Market Association and the Securities Industry Association. It has offices in New York City and Washington,D.C.

In politics,a revolving door can refer to two distinct phenomena.

Annette LaPorte Nazareth is an American attorney who served as a Commissioner of the U.S. Securities and Exchange Commission from August 4,2005 to January 31,2008. She is currently a partner at Davis Polk &Wardwell,where she works on regulatory matters and transactions in the firm's Washington,D.C. office. In 2021,she was appointed as Co-Chair of the Integrity Council for the Voluntary Carbon Market.

Kim Lee Ward is an American politician who served as acting lieutenant governor of Pennsylvania and currently serves as President pro tempore of the Pennsylvania Senate. She represents the 39th Senatorial District which covers the central portions of Westmoreland County,Pennsylvania. Following the resignation of Lieutenant Governor John Fetterman,Ward became acting lieutenant governor of Pennsylvania on January 3,2023,and served until January 17,2023. She is the first female president pro tempore of the Pennsylvania Senate. She was succeeded by Austin Davis as Lieutenant Governor.

The Committee on Capital Markets Regulation is an independent and nonpartisan 501(c)(3) research organization financed by contributions from individuals,foundations,and corporations.

The Committee for a Responsible Federal Budget (CRFB) is a non-profit public policy organization based in Washington,D.C. that addresses federal budget and fiscal issues. It was founded in 1981 by former United States Representative Robert Giaimo (D-CT) and United States Senator Henry Bellmon (R-OK),and its board of directors includes past heads of the House and Senate Budget Committees,the Congressional Budget Office,the Office of Management and Budget,and the Government Accountability Office.

The Dodd–Frank Wall Street Reform and Consumer Protection Act,commonly referred to as Dodd–Frank,is a United States federal law that was enacted on July 21,2010. The law overhauled financial regulation in the aftermath of the Great Recession,and it made changes affecting all federal financial regulatory agencies and almost every part of the nation's financial services industry.

Wall Street and the Financial Crisis:Anatomy of a Financial Collapse is a report on the financial crisis of 2007–2008 issued on April 13,2011 by the United States Senate Permanent Subcommittee on Investigations. The 639-page report was issued under the chairmanship of Senators Carl Levin and Tom Coburn,and is colloquially known as the Levin-Coburn Report. After conducting "over 150 interviews and depositions,consulting with dozens of government,academic,and private sector experts" found that "the crisis was not a natural disaster,but the result of high risk,complex financial products,undisclosed conflicts of interest;and the failure of regulators,the credit rating agencies,and the market itself to rein in the excesses of Wall Street." In an interview,Senator Levin noted that "The overwhelming evidence is that those institutions deceived their clients and deceived the public,and they were aided and abetted by deferential regulators and credit ratings agencies who had conflicts of interest." By the end of their two-year investigation,the staff amassed 56 million pages of memos,documents,prospectuses and e-mails. The report,which contains 2,800 footnotes and references thousands of internal documents focused on four major areas of concern regarding the failure of the financial system:high risk mortgage lending,failure of regulators to stop such practices,inflated credit ratings,and abuses of the system by investment banks. The Report also issued several recommendations for future action regarding each of these categories.

Mark A. Patterson is an American lobbyist,former vice president and managing director of Goldman Sachs,and former Chief of Staff to the United States Secretary of the Treasury. In 2018,he was hired as general counsel for Senator Chuck Schumer,overseeing investigations and appropriations and leaving his position at law firm Perkins Coie.

Charles Wiener de Croisset is a French banker.

Hester Maria Peirce is an American lawyer who serves as a Commissioner on the Securities and Exchange Commission (SEC). She previously served as the director of the Financial Markets Working Group at George Mason University's Mercatus Center. Peirce was confirmed by the United States Senate in December 2017 to fill a Republican vacancy on the SEC. She was sworn in on January 11,2018,for a term ending in 2020,and her second term expires in 2025. Peirce is a former staff member of the United States Senate Committee on Banking,Housing,and Urban Affairs and of the SEC. In 2016,she was nominated by President Barack Obama for Commissioner on the SEC,but the United States Senate did not act on her nomination.

Jelena McWilliams is a Serbian-American business executive and a former Chairman of the Federal Deposit Insurance Corporation. She was nominated to the position and to the FDIC Board of Directors by President Donald Trump,and the Senate confirmed her appointment on May 24,2018. She was sworn in as chairman on June 5,2018. Previously,McWilliams was executive vice president and chief legal officer of Fifth Third Bank in Cincinnati,Ohio. She resigned from her position as chairman of the Board of the FDIC on February 4,2022.