The Coors Brewing Company is an American brewery and beer company based in Golden, Colorado, that was founded in 1873. In 2005, Adolph Coors Company, the holding company that owned Coors Brewing, merged with Molson, Inc. to become Molson Coors. The first Coors brewery location in Golden, Colorado is the largest single brewing facility operating in the world.

The Seagram Company Ltd. was a Canadian multinational conglomerate formerly headquartered in Montreal, Quebec. Originally a distiller of Canadian whisky based in Waterloo, Ontario, it was in the 1990s the largest owner of alcoholic beverage brands in the world.

PNC Park is a baseball stadium on the North Shore of Pittsburgh, Pennsylvania. It is the fifth location to serve as the ballpark of Major League Baseball's Pittsburgh Pirates. Opened during the 2001 MLB season, PNC Park sits along the Allegheny River with a view of the Downtown Pittsburgh skyline. Constructed of steel and limestone, it has a natural grass playing surface and can seat 38,747 people for baseball. It was built just to the east of its predecessor, Three Rivers Stadium, which was demolished in 2001.

The PNC Financial Services Group, Inc. is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 states and the District of Columbia, with 2,629 branches and 9,523 ATMs. PNC Bank is on the list of largest banks in the United States by assets and is one of the largest banks by number of branches, deposits, and number of ATMs.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first mortgage in America. The company operated through an extensive banking network primarily in Ohio, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania, Florida, and Wisconsin, and also served customers in selected markets nationally. Its core businesses included commercial and retail banking, mortgage financing and servicing, consumer finance, and asset management. The bank reached out to customers primarily through mass advertising and offered comprehensive banking services online. In its last years, the company was commonly known in the media by the abbreviated NatCity, with its investment banking arm even bearing the official name NatCity Investments.

The Stroh Brewery Company was a beer brewery in Detroit, Michigan. In addition to its own Stroh's brand, the company produced or bought the rights to several other brands including Goebel, Schaefer, Schlitz, Augsburger, Erlanger, Old Style, Lone Star, Old Milwaukee, Red River, and Signature, as well as manufacturing Stroh's Ice Cream. The company was taken over and broken up in 2000, but some of its brands continued to be made by the new owners. The Stroh's brand is currently owned and marketed by Pabst Brewing Company, except in Canada where the Stroh brands are owned by Sleeman Breweries.

Pittsburgh Brewing Company is a beer company headquartered in the Lawrenceville neighborhood of Pittsburgh, Pennsylvania, United States, best known for producing brands such as Iron City Beer, I.C. Light Beer, I.C. Light Mango, Old German, and Block House Brewing. Until August 2009, all production was conducted at its Lawrenceville facility. From August 2009 to 2021, their products were contract brewed at City Brewing Company in the facility that once produced Rolling Rock. On February 4, 2021, Iron City Beer's Instagram account announced that Pittsburgh Brewing Company would resume production of its own product in a new production brewery in Creighton, Pennsylvania, in the original Pittsburgh Plate Glass Company plant. At its opening, the facility is capable of producing 150,000 BBLs of beer annually.

Zagnut is a candy bar produced and sold in the United States. Its main ingredients are peanut butter and toasted coconut.

The Pabst Brewing Company is an American company that dates its origins to a brewing company founded in 1844 by Jacob Best and was, by 1889, named after Frederick Pabst. It outsources the brewing of over two dozen brands of beer and malt liquor. These include its own flagship Pabst Blue Ribbon, as well as brands from many defunct breweries.

Latrobe Brewing Company was founded in 1893 in Latrobe, Pennsylvania as part of the Pittsburgh Brewing Company. Forced to close in 1920 due to prohibition, it was purchased by the Tito brothers and reopened in 1933 selling “Latrobe Old German” and “Latrobe Pilsner” beers. The year 1939 saw the introduction of Rolling Rock beer and Latrobe became one of the largest breweries in the United States. It was purchased by Labatt Brewing Company in 1987, which in turn was purchased in 1995 by the Belgian brewing conglomerate corporation Interbrew, which merged later into InBev in 2004.

The Coffee Bean & Tea Leaf is an American coffee chain founded in 1963. It is owned and operated by International Coffee & Tea, LLC, which has its corporate headquarters in Los Angeles, California.

Grain Belt is a brand of beer brewed in the American state of Minnesota, by the August Schell Brewing Company. The beer has been produced in a number of varieties. Grain Belt Golden was the original style introduced in 1893. The current offerings are: Grain Belt Premium, first introduced in 1947; Grain Belt Premium Light; Grain Belt Nordeast, introduced on April 7, 2010; and the newest offering, Grain Belt Lock & Dam, introduced in 2016. It was originally produced by the Minneapolis Brewing Company which formed with the merger of four smaller brewers in 1891. Soon after introduction, Grain Belt became the company's flagship product. It was brewed at the original Grain Belt brewery in Minneapolis, Minnesota until 1976. A series of other owners followed, and Schell took over the product line in 2002.

Necco was an American manufacturer of candy created in 1901 as the New England Confectionery Company through the merger of several small confectionery companies located in the Greater Boston area, with ancestral companies dating back to the 1840s.

The Clark Bar is a candy bar consisting of a crispy peanut butter/spun taffy core and coated in milk chocolate. It was introduced in 1917 by David L. Clark and was popular during and after both World Wars. It was the first American "combination" candy bar to achieve nationwide success. Two similar candy bars followed the Clark Bar, the Butterfinger bar (1923) made by the Curtiss Candy Company and the 5th Avenue bar (1936) created by Luden's.

Farley's & Sathers Candy Company was created as an umbrella company to roll up many small companies, brands and products under a common management team. The confectionery business segment is made up of many small companies, often with intertwined relationships and histories.

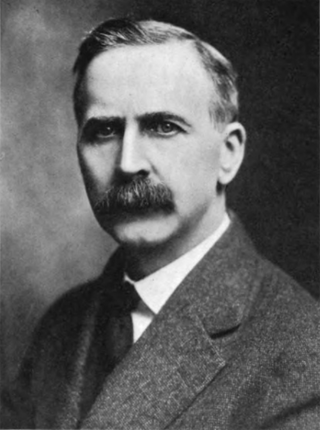

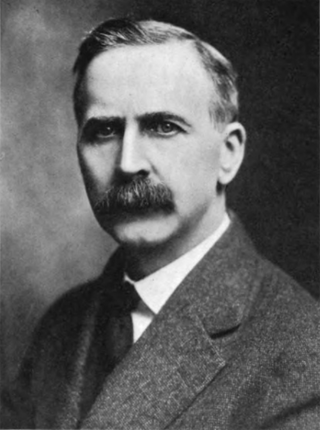

David Lytle Clark was an Irish entrepreneur who founded the D. L. Clark Company confectioners in 1886 in Allegheny, Pennsylvania, now part of Pittsburgh. He was born in County Londonderry, Ireland, the son of Samuel and Jane Clark. He had come to the U.S. with his family from Ireland when he was eight years old, and educated in the public schools. He began making candy in a one-room location in Allegheny City at the age of 19, and later expanded into making gum when learning in 1886 of a new approach using chicle. This he would use bright food coloring and flavor it with extracts of woodland leaves he had chewed as a boy. He is best known for his creation of the D. L. Clark Company, a confectionary, and for creating some of its best known products, including the Clark bar and the Zagnut, as well as for its spinoff, the Clark Chewing Gum Company with its Clark's Teaberry gum.

The D. L. Clark Company was founded in 1886 in Allegheny, Pennsylvania, now part of Pittsburgh, by David L. Clark (1864–1939), an Irish-born candy salesman. In 1921, Clark Brothers Chewing Gum Company was spun off as a separate corporation. In 1955, when the family-owned D. L. Clark company was sold to Beatrice Foods, they had production facilities in Pittsburgh and Evanston, Illinois. Beatrice sold it in 1983 to Leaf, and they in turn sold Clark in 1991, though Leaf retained the rights to Clark's Zagnut and P. C. Crunchers bars. The new owner, entrepreneur Michael P. Carlow, would operate it under the umbrella of the Pittsburgh Food & Beverage Company.

ReaLemon is an American brand of lemon juice that debuted in 1934, and is manufactured and marketed as of 2016 by Mott's, part of Keurig Dr Pepper. ReaLime is a brand of lime juice that debuted in 1944, is produced in the same manner as ReaLemon, and is also produced and marketed by Mott's.

Bun Bars are a line of candy bars manufactured by Pearson's Candy Company of Saint Paul, Minnesota, and available in the United States. Despite the name, Bun Bars are not bars at all, but actually round and flat, containing a disc made of maple or vanilla-flavored crème, or caramel, coated in milk chocolate and topped with a roasted peanut-chocolate cluster.

The Christian Schmidt Brewing Company was an American brewing company headquartered in Philadelphia, Pennsylvania. Founded in 1860, it was the largest brewing company in the history of Philadelphia, producing nearly 4,000,000 barrels of beer a year in the late 1970s. When it closed in 1987, it marked the first time in over 300 years that there was no brewery operating in Philadelphia.