In religion and theology, revelation is the disclosing of some form of truth or knowledge through communication with a deity (god) or other supernatural entity or entities.

Arrow's impossibility theorem, the general possibility theorem or Arrow's paradox is an impossibility theorem in social choice theory that states that when voters have three or more distinct alternatives (options), no ranked voting electoral system can convert the ranked preferences of individuals into a community-wide ranking while also meeting the specified set of criteria: unrestricted domain, non-dictatorship, Pareto efficiency, and independence of irrelevant alternatives. The theorem is often cited in discussions of voting theory as it is further interpreted by the Gibbard–Satterthwaite theorem. The theorem is named after economist and Nobel laureate Kenneth Arrow, who demonstrated the theorem in his doctoral thesis and popularized it in his 1951 book Social Choice and Individual Values. The original paper was titled "A Difficulty in the Concept of Social Welfare".

In economics, resource allocation is the assignment of available resources to various uses. In the context of an entire economy, resources can be allocated by various means, such as markets, or planning.

Monotone refers to a sound, for example music or speech, that has a single unvaried tone. See: pure tone and monophony.

A surah is an Arabic word meaning 'chapter' in the Quran. Its plural form is surah.

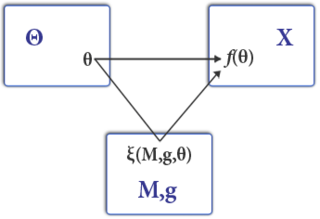

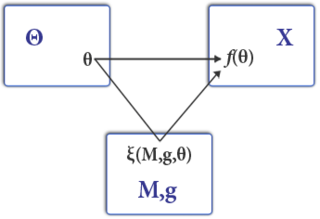

Mechanism design is a branch of economics, social choice theory, and game theory that deals with designing games to implement a given social choice function. Because it starts at the end of the game and then works backwards to find a game that implements it, it is sometimes called reverse game theory.

Contingent valuation is a survey-based economic technique for the valuation of non-market resources, such as environmental preservation or the impact of externalities like pollution. While these resources do give people utility, certain aspects of them do not have a market price as they are not directly sold – for example, people receive benefit from a beautiful view of a mountain, but it would be tough to value using price-based models. Contingent valuation surveys are one technique which is used to measure these aspects. Contingent valuation is often referred to as a stated preference model, in contrast to a price-based revealed preference model. Both models are utility-based. Typically the survey asks how much money people would be willing to pay to maintain the existence of an environmental feature, such as biodiversity.

The Night of Power, is, in Islamic belief, the night when Muslims believe the Quran was first sent down from heaven to the world and also the night when the first verses of the Quran were revealed to the Islamic prophet Muhammad; it is described to be better than a thousand months of worshipping. According to various hadiths, its exact date is uncertain but it was one of the odd-numbered nights of the last ten days of Ramadan, the ninth month of the Islamic calendar. Since that time, Muslims have regarded the last ten nights of Ramadan as being especially blessed. Muslims believe that the Night of Qadr comes again every year, with blessings and mercy of God in abundance. They believe that sins are forgiven, supplications are accepted, and that the annual decree is revealed to the angels who carry it out according to God's grace.

Social choice theory or social choice is a branch of economics dealing with the analysis of rules for combining individual opinions, preferences, or measures of well-being to make collective decisions for society as a whole.

Occasions or circumstances of revelation names the historical context in which Quranic verses were revealed from the perspective of traditional Islam. Though of some use in reconstructing the Qur'an's historicity, asbāb is by nature an exegetical rather than a historiographical genre, and as such usually associates the verses it explicates with general situations rather than specific events. The study of asbāb al-nuzūl is part of the study of Tafsir.

A Lindahl tax is a form of taxation conceived by Erik Lindahl in which individuals pay for public goods according to their marginal benefits. In other words, they pay according to the amount of satisfaction or utility they derive from the consumption of an additional unit of the public good. Lindahl taxation is designed to maximize efficiency for each individual and provide the optimal level of a public good.

A mechanism is called incentive-compatible (IC) if every participant can achieve the best outcome to themselves just by acting according to their true preferences. For example, there is incentive compatibility if high-risk clients are better off in identifying themselves as high-risk to insurance firms, who only sell discounted insurance to high-risk clients. Likewise, they would be worse off if they pretend to be low-risk. Low-risk clients who pretend to be high-risk would also be worse off.

The revelation principle is a fundamental principle in mechanism design. It states that if a social choice function can be implemented by an arbitrary mechanism, then the same function can be implemented by an incentive-compatible-direct-mechanism with the same equilibrium outcome (payoffs).

In Mormonism, revelation is communication from God to man. Latter Day Saints teach that the Latter Day Saint movement began with a revelation from God, which began a process of restoring the gospel of Jesus Christ to the earth. Latter Day Saints also teach that revelation is the foundation of the church established by Jesus Christ and that it remains an essential element of his true church today. Continuous revelation provides individual Latter Day Saints with a "testimony", described by Richard Bushman as "one of the most potent words in the Mormon lexicon".

Implementation theory is an area of research in game theory concerned with whether a class of mechanisms can be designed whose equilibrium outcomes implement a given set of normative goals or welfare criteria.

Muhammad's first revelation was an event described in Islamic tradition as taking place in 610 CE, during which the Islamic Prophet Muhammad was visited by the angel Jibril (Gabriel), who revealed to him the beginnings of what would later become the Qur'an. The event took place in a cave called Hira, located on the mountain Jabal An-Nour near Mecca.

Distributed algorithmic mechanism design (DAMD) is an extension of algorithmic mechanism design.

Flipism, sometimes spelled "flippism", is a pseudophilosophy under which decisions are made by flipping a coin. It originally appeared in the Donald Duck Disney comic "Flip Decision" by Carl Barks, published in 1953. Barks called a practitioner of "flipism" a "flippist".

Prey switching is frequency-dependent predation, where the predator preferentially consumes the most common type of prey. The phenomenon has also been described as apostatic selection, however the two terms are generally used to describe different parts of the same phenomenon. Apostatic selection has been used by authors looking at the differences between different genetic morphs. In comparison, prey switching has been used when describing the choice between different species.

Edward Hedrick Clarke was an American Senior Economist with the Office of Management and Budget, involved in transportation regulatory affairs.