The Renewables Obligation (RO) is designed to encourage generation of electricity from eligible renewable sources in the United Kingdom. It was introduced in England and Wales and in a different form in Scotland in April 2002 and in Northern Ireland in April 2005, replacing the Non-Fossil Fuel Obligation which operated from 1990.

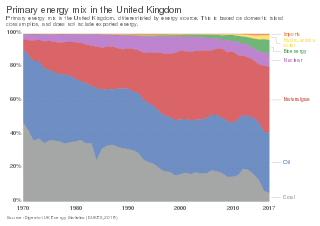

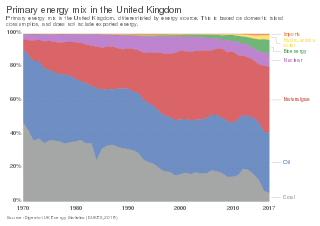

The energy policy of the United Kingdom refers to the United Kingdom's efforts towards reducing energy intensity, reducing energy poverty, and maintaining energy supply reliability. The United Kingdom has had success in this, though energy intensity remains high. There is an ambitious goal to reduce carbon dioxide emissions in future years, but it is unclear whether the programmes in place are sufficient to achieve this objective. Regarding energy self-sufficiency, UK policy does not address this issue, other than to concede historic energy security is currently ceasing to exist.

PreussenElektra was a German electric company that existed from 1927 to 2000. From its founding until around 1970, it was owned by the Republic of Prussia and the Federal Republic of Germany. From 1929 until 2000, it was a subsidiary of VEBA. In 2000, it was merged to create E.ON. During its existence, it was the electric utility for Schleswig-Holstein, Lower Saxony, and parts of North Rhine-Westphalia and Hesse.

The energy policy of the European Union focuses on energy security, sustainability, and integrating the energy markets of member states. An increasingly important part of it is climate policy. A key energy policy adopted in 2009 is the 20/20/20 objectives, binding for all EU Member States. The target involved increasing the share of renewable energy in its final energy use to 20%, reduce greenhouse gases by 20% and increase energy efficiency by 20%. After this target was met, new targets for 2030 were set at a 55% reduction of greenhouse gas emissions by 2030 as part of the European Green Deal. After the Russian invasion of Ukraine, the EU's energy policy turned more towards energy security in their REPowerEU policy package, which boosts both renewable deployment and fossil fuel infrastructure for alternative suppliers.

Financial incentives for photovoltaics are incentives offered to electricity consumers to install and operate solar-electric generating systems, also known as photovoltaics (PV).

The electricity sector in Honduras has been shaped by the dominance of a vertically integrated utility; an incomplete attempt in the early 1990s to reform the sector; the increasing share of thermal generation over the past two decades; the poor financial health of the state utility Empresa Nacional de Energía Eléctrica (ENEE); the high technical and commercial losses in transmission and distribution; and the low electric coverage in rural areas

A feed-in tariff is a policy mechanism designed to accelerate investment in renewable energy technologies by offering long-term contracts to renewable energy producers. This means promising renewable energy producers an above-market price and providing price certainty and long-term contracts that help finance renewable energy investments. Typically, FITs award different prices to different sources of renewable energy in order to encourage the development of one technology over another. For example, technologies such as wind power and solar PV are awarded a higher price per kWh than tidal power. FITs often include a "digression": a gradual decrease of the price or tariff in order to follow and encourage technological cost reductions.

Article 102 of the Treaty on the Functioning of the European Union (TFEU) is aimed at preventing businesses in an industry from abusing their positions by colluding to fix prices or taking action to prevent new businesses from gaining a foothold in the industry. Its core role is the regulation of monopolies, which restrict competition in private industry and produce worse outcomes for consumers and society. It is the second key provision, after Article 101, in European Union (EU) competition law.

Energy laws govern the use and taxation of energy, both renewable and non-renewable. These laws are the primary authorities related to energy. In contrast, energy policy refers to the policy and politics of energy.

The Renewable Energy Sources Act or EEG is a series of German laws that originally provided a feed-in tariff (FIT) scheme to encourage the generation of renewable electricity. The EEG 2014 specified the transition to an auction system for most technologies which has been finished with the current version EEG 2017.

New Jersey has over 4,100 MW of install solar power capacity as of mid-2022, which provides 6.7% of the state's electricity consumption. The's state's growth of solar power is aided by a renewable portfolio standard that requires that 22.5% of New Jersey's electricity come from renewable resources by 2021 and 50% by 2030, by incentives provided for generation of solar power, and by one of the most favorable net metering standards in the country, allowing customers of any size array to use net metering, although generation may not exceed annual demand. As of 2018, New Jersey has the sixth-largest installed solar capacity of all U.S. states and the largest installed solar capacity of the Northeastern States.

Primeo Energie or EBM(Cooperative Elektra Birseck, Münchenstein) is a Swiss energy supplier with head office in Münchenstein. It was founded as a cooperative under private law in 1897. EBM supplies around 230,000 people with electricity in North-West Switzerland and Alsace. The company operates 167 local heat supply systems in Switzerland, Alsace and South Germany.

A feed-in tariff (FIT) is paid by energy suppliers in the United Kingdom if a property or organisation generates their own electricity using technology such as solar panels or wind turbines and feeds any surplus back to the grid. The FIT scheme was imposed on suppliers by the UK government, and applied to installations completed between July 2009 and March 2019.

South Africa has a large energy sector, being the third-largest economy in Africa. The country consumed 227 TWh of electricity in 2018. The vast majority of South Africa's electricity was produced from coal, with the fuel responsible for 88% of production in 2017. South Africa is the 7th largest coal producer in the world. As of July 2018, South Africa had a coal power generation capacity of 39 gigawatts (GW). South Africa is the world's 14th largest emitter of greenhouse gases. South Africa is planning to shift away from coal in the electricity sector and the country produces the most solar and wind energy by terawatt-hours in Africa. The country aims to decommission 34 GW of coal-fired power capacity by 2050. It also aims to build at least 20 GW of renewable power generation capacity by 2030. South Africa aims to generate 77,834 megawatts (MW) of electricity by 2030, with new capacity coming significantly from renewable sources to meet emission reduction targets. Through its goals stated in the Integrated Resource Plan, it announced the Renewable Energy Independent Power Producer Procurement Programme, which aims to increase renewable power generation through private sector investment.

The United Kingdom is committed to legally binding greenhouse gas emissions reduction targets of 34% by 2020 and 80% by 2050, compared to 1990 levels, as set out in the Climate Change Act 2008. Decarbonisation of electricity generation will form a major part of this reduction and is essential before other sectors of the economy can be successfully decarbonised.

In 2013, renewable energy provided 26.44% of the total electricity in the Philippines and 19,903 gigawatt-hours (GWh) of electrical energy out of a total demand of 75,266 gigawatt-hours. The Philippines is a net importer of fossil fuels. For the sake of energy security, there is momentum to develop renewable energy sources. The types available include hydropower, geothermal power, wind power, solar power and biomass power. The government of the Philippines has legislated a number of policies in order to increase the use of renewable energy by the country.

A renewable portfolio standard (RPS) is a regulation that requires the increased production of energy from renewable energy sources, such as wind, solar, biomass, and geothermal. Other common names for the same concept include Renewable Electricity Standard (RES) at the United States federal level and Renewables Obligation in the UK.

The Energy Taxation Directive or ETD (2003/96/EC) is a European directive, which establishes the framework conditions of the European Union for the taxation of electricity, motor and aviation fuels and most heating fuels. The directive is part of European Union energy law; its core component is the setting of minimum tax rates for all Member States.