Related Research Articles

Microeconomics is a branch of mainstream economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as whole, which is studied in macroeconomics.

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory, a theory that has come under considerable question in recent years.

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good, or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics.

Pareto efficiency or Pareto optimality is a situation where no action or allocation is available that makes one individual better off without making another worse off. The concept is named after Vilfredo Pareto (1848–1923), Italian civil engineer and economist, who used the concept in his studies of economic efficiency and income distribution. The following three concepts are closely related:

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts to the theory of partial equilibrium, which analyzes a specific part of an economy while its other factors are held constant. In general equilibrium, constant influences are considered to be noneconomic, therefore, resulting beyond the natural scope of economic analysis. The noneconomic influences is possible to be non-constant when the economic variables change, and the prediction accuracy may depend on the independence of the economic factors.

Kenneth Joseph Arrow was an American economist, mathematician, writer, and political theorist. He was the joint winner of the Nobel Memorial Prize in Economic Sciences with John Hicks in 1972.

In economics, "rational expectations" are model-consistent expectations, in that agents inside the model are assumed to "know the model" and on average take the model's predictions as valid. Rational expectations ensure internal consistency in models involving uncertainty. To obtain consistency within a model, the predictions of future values of economically relevant variables from the model are assumed to be the same as that of the decision-makers in the model, given their information set, the nature of the random processes involved, and model structure. The rational expectations assumption is used especially in many contemporary macroeconomic models.

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the values of economic variables will not change. For example, in the standard text perfect competition, equilibrium occurs at the point at which quantity demanded and quantity supplied are equal.

Welfare economics is a branch of economics that uses microeconomic techniques to evaluate well-being (welfare) at the aggregate (economy-wide) level.

Nominal rigidity, also known as price-stickiness or wage-stickiness, is a situation in which a nominal price is resistant to change. Complete nominal rigidity occurs when a price is fixed in nominal terms for a relevant period of time. For example, the price of a particular good might be fixed at $10 per unit for a year. Partial nominal rigidity occurs when a price may vary in nominal terms, but not as much as it would if perfectly flexible. For example, in a regulated market there might be limits to how much a price can change in a given year.

In economics, a model is a theoretical construct representing economic processes by a set of variables and a set of logical and/or quantitative relationships between them. The economic model is a simplified, often mathematical, framework designed to illustrate complex processes. Frequently, economic models posit structural parameters. A model may have various exogenous variables, and those variables may change to create various responses by economic variables. Methodological uses of models include investigation, theorizing, and fitting theories to the world.

A macroeconomic model is an analytical tool designed to describe the operation of the problems of economy of a country or a region. These models are usually designed to examine the comparative statics and dynamics of aggregate quantities such as the total amount of goods and services produced, total income earned, the level of employment of productive resources, and the level of prices.

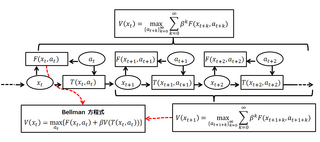

A Bellman equation, named after Richard E. Bellman, is a necessary condition for optimality associated with the mathematical optimization method known as dynamic programming. It writes the "value" of a decision problem at a certain point in time in terms of the payoff from some initial choices and the "value" of the remaining decision problem that results from those initial choices. This breaks a dynamic optimization problem into a sequence of simpler subproblems, as Bellman's “principle of optimality" prescribes. The equation applies to algebraic structures with a total ordering; for algebraic structures with a partial ordering, the generic Bellman's equation can be used.

The overlapping generations (OLG) model is one of the dominating frameworks of analysis in the study of macroeconomic dynamics and economic growth. In contrast, to the Ramsey–Cass–Koopmans neoclassical growth model in which individuals are infinitely-lived, in the OLG model individuals live a finite length of time, long enough to overlap with at least one period of another agent's life.

In economics, the long-run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long-run contrasts with the short-run, in which there are some constraints and markets are not fully in equilibrium. More specifically, in microeconomics there are no fixed factors of production in the long-run, and there is enough time for adjustment so that there are no constraints preventing changing the output level by changing the capital stock or by entering or leaving an industry. This contrasts with the short-run, where some factors are variable and others are fixed, constraining entry or exit from an industry. In macroeconomics, the long-run is the period when the general price level, contractual wage rates, and expectations adjust fully to the state of the economy, in contrast to the short-run when these variables may not fully adjust.

Computable general equilibrium (CGE) models are a class of economic models that use actual economic data to estimate how an economy might react to changes in policy, technology or other external factors. CGE models are also referred to as AGE models.

Dynamic stochastic general equilibrium modeling is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis, explaining historical time-series data, as well as future forecasting purposes. DSGE econometric modelling applies general equilibrium theory and microeconomic principles in a tractable manner to postulate economic phenomena, such as economic growth and business cycles, as well as policy effects and market shocks.

Recursive economics is a branch of modern economics based on a paradigm of individuals making a series of two-period optimization decisions over time.

Jacques H. Drèze was a Belgian economist noted for his contributions to economic theory, econometrics, and economic policy as well as for his leadership in the economics profession. Drèze was the first President of the European Economic Association in 1986 and was the President of the Econometric Society in 1970.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.

References

- 1 2 Mehra, Rajnish. "Recursive Competitive Equilibrium" (PDF). Retrieved 2008-05-07.

- ↑ Lucas, Robert (1989). Recursive Methods in Economic Dynamics. Cambridge, Massachusetts: Harvard University Press. ISBN 0-674-75096-9.

- ↑ Sargent, Thomas (2004). Recursive Macroeconomic Theory. Cambridge, Massachusetts: The MIT Press. ISBN 0-262-12274-X.