The Racketeer Influenced and Corrupt Organizations (RICO) Act is a United States federal law that provides for extended criminal penalties and a civil cause of action for acts performed as part of an ongoing criminal organization.

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law or criminal law, or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, for example by obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements.

Identity theft, identity piracy or identity infringement occurs when someone uses another's personal identifying information, like their name, identifying number, or credit card number, without their permission, to commit fraud or other crimes. The term identity theft was coined in 1964. Since that time, the definition of identity theft has been legally defined throughout both the U.K. and the U.S. as the theft of personally identifiable information. Identity theft deliberately uses someone else's identity as a method to gain financial advantages or obtain credit and other benefits. The person whose identity has been stolen may suffer adverse consequences, especially if they are falsely held responsible for the perpetrator's actions. Personally identifiable information generally includes a person's name, date of birth, social security number, driver's license number, bank account or credit card numbers, PINs, electronic signatures, fingerprints, passwords, or any other information that can be used to access a person's financial resources.

Mail fraud and wire fraud are terms used in the United States to describe the use of a physical or electronic mail system to defraud another, and are U.S. federal crimes. Jurisdiction is claimed by the federal government if the illegal activity crosses interstate or international borders.

The Guinness share-trading fraud was a major business scandal of the 1980s. It involved the manipulation of the London stock market to inflate the price of Guinness shares to thereby assist Guinness's £4 billion takeover bid for the Scottish drinks company Distillers. Four businessmen were convicted of criminal offences for taking part in the manipulation. The scandal was discovered in testimony given by the US stock trader Ivan Boesky as part of a plea bargain. Ernest Saunders, Gerald Ronson, Jack Lyons and Anthony Parnes, the so-called Guinness four, were charged, paid large fines and, with the exception of Lyons, who was suffering from ill health, served prison sentences. The case was brought by the Serious Fraud Office.

The Serious Fraud Office is the public service department of New Zealand charged with detecting, investigating and prosecuting financial crimes, including corruption, of a serious and complex nature.

Edward Ormus Sharrington Davenport is a convicted English fraudster, socialite, and property developer.

In the United States, Medicare fraud is the claiming of Medicare health care reimbursement to which the claimant is not entitled. There are many different types of Medicare fraud, all of which have the same goal: to collect money from the Medicare program illegitimately.

Bernard Lawrence Madoff was an American financial criminal and financier who was the admitted mastermind of the largest known Ponzi scheme in history, worth an estimated $65 billion. He was at one time chairman of the Nasdaq stock exchange. Madoff's firm had two basic units: a stock brokerage and an asset management business; the Ponzi scheme was centered in the asset management business.

David Garrett is a lawyer and former member of the New Zealand House of Representatives. He entered parliament at the 2008 general election as a list MP for ACT New Zealand, having been ranked fifth on that party's list. He was ACT's spokesman on law and order until he resigned from the party on 17 September 2010. On 23 September 2010, he resigned from Parliament, following revelations that he had fraudulently obtained a passport in the name of a deceased infant in 1984.

The Madoff investment scandal was a major case of stock and securities fraud discovered in late 2008. In December of that year, Bernie Madoff, the former Nasdaq chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate multi-billion-dollar Ponzi scheme.

The Sensible Sentencing Trust was a political advocacy group based in Napier, New Zealand. The Trust's stated goal is "to educate both the public and victims of serious violent and/or sexual crime and homicide" It focuses on advocating for the rights of victims and tougher penalties against offenders.

Crime in New Zealand encompasses criminal law, crime statistics, the nature and characteristics of crime, sentencing, punishment, and public perceptions of crime. New Zealand criminal law has its origins in English criminal law, which was codified into statute by the New Zealand parliament in 1893. Although New Zealand remains a common law jurisdiction, all criminal offences and their penalties are codified in New Zealand statutes.

Honest services fraud is a crime defined in 18 U.S.C. § 1346, added by the United States Congress in 1988, which states "For the purposes of this chapter, the term scheme or artifice to defraud includes a scheme or artifice to deprive another of the intangible right of honest services."

14% of New Zealand Catholic diocesan clergy have been accused of abuse since 1950. Several high profile cases are linked to Catholic schools.

Under the federal law of the United States of America, tax evasion or tax fraud, is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law. Conviction of tax evasion may result in fines and imprisonment. Compared to other countries, Americans are more likely to pay their taxes on time and law-abidingly.

Between May 2006 and the end of 2012 there were sixty-seven finance company collapses in New Zealand; including companies entering into liquidation, receivership or moratoria. An inquiry by the New Zealand Parliament estimated losses at over $3 billion that affected between 150,000 and 200,000 depositors. The most high-profile collapses were South Canterbury Finance, Hanover Finance and Bridgecorp Holdings. The collapse radically reduced the size and importance of the non-bank finance sector in New Zealand. According to the Reserve Bank, at the height of financial expansion prior to the 2007 crisis, non-bank lenders had assets of about $25 billion and made up 8 percent of lending by financial institutions. By late 2013 the size of the finance sector was half its previous size and accounted for only 3 percent of institutional lending. In the years following the beginning of the collapses, sweeping legislative and regulatory changes were made, aimed at improving oversight and regulation of the finance industry.

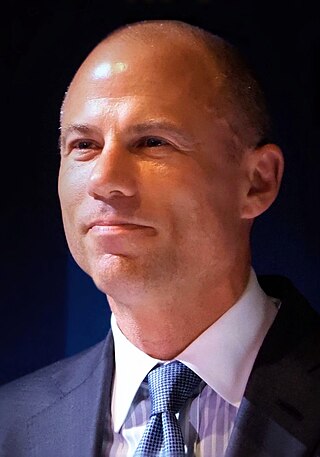

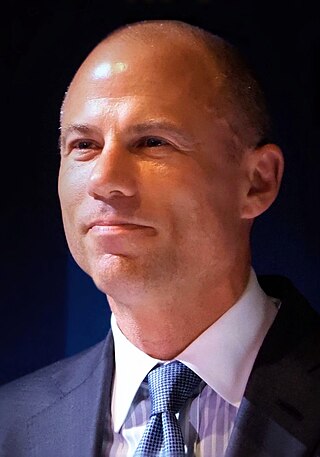

Michael John Avenatti is an American former attorney and convicted felon, currently incarcerated in federal prison at FCI Terminal Island. He is best known for his legal representation of adult film actress Stormy Daniels in lawsuits against then U.S. President Donald Trump, and his multiple convictions for attempting to extort sports apparel company Nike and defrauding and embezzling settlement money from a series of other clients. Avenatti has appeared extensively on television and in print as a legal and political commentator, and as a representative for prominent clients.