Related Research Articles

The goods and services tax is a value added tax introduced in Canada on January 1, 1991, by the government of Prime Minister Brian Mulroney. The GST, which is administered by Canada Revenue Agency (CRA), replaced a previous hidden 13.5% manufacturers' sales tax (MST).

The harmonized sales tax (HST) is a consumption tax in Canada. It is used in provinces where both the federal goods and services tax (GST) and the regional provincial sales tax (PST) have been combined into a single value-added tax.

In a tax system, the tax rate is the ratio at which a business or person is taxed. The tax rate that is applied to an individual's or corporation's income is determined by tax laws of the country and can be influenced by many factors such as income level, type of income, and so on. There are several methods used to present a tax rate: statutory, average, marginal, flat, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive.

Goods and Services Tax (GST) in Australia is a value added tax of 10% on most goods and services sales, with some exemptions and concessions. GST is levied on most transactions in the production process, but is in many cases refunded to all parties in the chain of production other than the final consumer.

An ad valorem tax is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ad valorem tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event. In some countries, a stamp duty is imposed as an ad valorem tax.

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

Taxes in New Zealand are collected at a national level by the Inland Revenue Department (IRD) on behalf of the New Zealand Government. National taxes are levied on personal and business income, and on the supply of goods and services. Capital gains tax applies in limited situations, such as the sale of some rental properties within 10 years of purchase. Some "gains" such as profits on the sale of patent rights are deemed to be income – income tax does apply to property transactions in certain circumstances, particularly speculation. There are currently no land taxes, but local property taxes (rates) are managed and collected by local authorities. Some goods and services carry a specific tax, referred to as an excise or a duty, such as alcohol excise or gaming duty. These are collected by a range of government agencies such as the New Zealand Customs Service. There is no social security (payroll) tax.

Tax-free shopping (TFS) is the buying of goods in another country or state and obtaining a refund of the sales tax which has been collected by the retailer on those goods. The sales tax may be variously described as a sales tax, goods and services tax (GST), value added tax (VAT), or consumption tax.

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office (ATO). Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

Goods and Services Tax (GST) in Singapore is a value added tax (VAT) of 9% levied on import of goods, as well as most supplies of goods and services. Exemptions are given for the sales and leases of residential properties, importation and local supply of investment precious metals and most financial services. Export of goods and international services are zero-rated. GST is also absorbed by the government for public healthcare services, such as at public hospitals and polyclinics.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

Inland Revenue or Inland Revenue Department is the public service department of New Zealand charged with advising the government on tax policy, collecting and disbursing payments for social support programmes, and collecting tax.

Under Article 108 of the Basic Law of Hong Kong, the taxation system in Hong Kong is independent of, and different from, the taxation system in mainland China. In addition, under Article 106 of the Hong Kong Basic Law, Hong Kong has independent public finance, and no tax revenue is handed over to the Central Government in China. The taxation system in Hong Kong is generally considered to be one of the simplest, most transparent and straightforward systems in the world. Taxes are collected through the Inland Revenue Department (IRD).

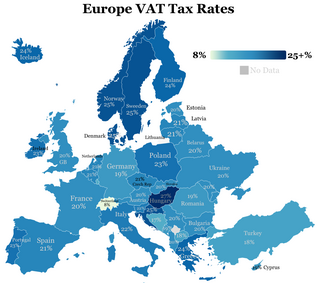

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

Sales taxes in British Columbia come in the form of the Goods and Services Tax (GST) and Provincial Sales Tax (PST).

Digital goods are software programs, music, videos or other electronic files that users download exclusively from the Internet. Some digital goods are free, others are available for a fee. The taxation of digital goods and/or services, sometimes referred to as digital tax and/or a digital services tax, is gaining popularity across the globe.

The Goods and Services Tax (GST) is an abolished value-added tax in Malaysia. GST is levied on most transactions in the production process, but is refunded with exception of Blocked Input Tax, to all parties in the chain of production other than the final consumer.

The Maldives Inland Revenue Authority (MIRA) is a fully autonomous body responsible for tax administration in the Maldives. The main responsibilities of MIRA include execution of tax laws, implementation of tax policies and providing technical advice to the government in determining tax policies. The Tax Administration Act stipulates the other responsibilities of MIRA.

Tax pooling allows New Zealand taxpayers to pool their provisional tax payments together in an account held by a registered tax pooling intermediary at Inland Revenue (IRD) so that underpayments by some can be offset by overpayments of others. Taxpayers receive/pay an interest rate that is higher/lower than IRD's rates if they overpay/underpay provisional tax. Intermediaries operate under legislation set out in the Income Tax Act 2007 and Tax Administration Act 1994.

A value-added tax is a consumption tax that is levied on the value added at each stage of a product's production and distribution. VAT is similar to, and is often compared with, a sales tax. VAT is an indirect tax, because the consumer who ultimately bears the burden of the tax is not the entity that pays it. Specific goods and services are typically exempted in various jurisdictions.

References

- ↑ "Exempt supplies (GST on exempt, zero-rated, special supplies and receiving remote services)". Inland Revenue. Retrieved 7 March 2020.

- ↑ "Publication search | The Treasury New Zealand". www.treasury.govt.nz. 7 November 2024. Retrieved 2 December 2024.

- ↑ "What GST is". Inland Revenue. Retrieved 7 March 2020.

- ↑ "Goods and Services Tax Act introduced". nzhistory.govt.nz. Retrieved 2 December 2024.

- ↑ "How to register GST in New Zealand".

- ↑ Registering for GST.

- ↑ "Goods and Services Tax Act 1985, section 51(1)(a)" (PDF). Inland Revenue. Retrieved 9 April 2023.

- ↑ "Goods and Services Tax Amendment Act (No 2) 1990, section 9(1)" (PDF). Inland Revenue. Retrieved 9 April 2023.

- ↑ "Taxation (GST and Miscellaneous Provisions) Act 2000, section 109(1)" (PDF). Inland Revenue. Retrieved 9 April 2023.

- ↑ "Taxation (Business Tax Measures) Act 2009, section 27". Inland Revenue. Retrieved 9 April 2023.

- ↑ "Netflix tax" bill passed – New Zealand Parliament, 11 May 2016

- ↑ Entertainment bargains likely ahead of 'Netflix tax' in October – Stuff.co.nz, 15 August 2016

- ↑ GST on "remote" services – Deloitte, April 2016

- ↑ "GST Calculator". Friday, 19 October 2018

- ↑ "GST on imported services and digital products". Australian Taxation Office. Retrieved 26 October 2023.

- ↑ Sandford, Cedric (1992). The compliance costs of business taxes in New Zealand. Wellington: Institute of Policy Studies. ISBN 978-0-908935-79-6.