Related Research Articles

Corporate propaganda refers to propagandist claims made by a corporation, for the purpose of manipulating market opinion with regard to that corporation, and its activities.

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:

False advertising is defined as the act of publishing, transmitting, or otherwise publicly circulating an advertisement containing a false, misleading, or deceptive statement, made intentionally or recklessly to promote the sale of property, goods, or services. A false advertisement can further be classified as deceptive if the advertiser deliberately misleads the consumer, as opposed to making an unintentional mistake. Many governments use regulations to control false advertising.

Email marketing is the act of sending a commercial message, typically to a group of people, using email. In its broadest sense, every email sent to a potential or current customer could be considered email marketing. It involves using email to send advertisements, request business, or solicit sales or donations. Email marketing strategies commonly seek to achieve one or more of three primary objectives, to build loyalty, trust, or brand awareness. The term usually refers to sending email messages with the purpose of enhancing a merchant's relationship with current or previous customers, encouraging customer loyalty and repeat business, acquiring new customers or convincing current customers to purchase something immediately, and sharing third-party ads.

A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses.

The Truth in Lending Act (TILA) of 1968 is a United States federal law designed to promote the informed use of consumer credit, by requiring disclosures about its terms and cost to standardize the manner in which costs associated with borrowing are calculated and disclosed.

The Consumer Credit Act 1974 is an Act of the Parliament of the United Kingdom that significantly reformed the law relating to consumer credit within the United Kingdom.

The Home Mortgage Disclosure Act is a United States federal law that requires certain financial institutions to provide mortgage data to the public. Congress enacted HMDA in 1975.

The Real Estate Settlement Procedures Act (RESPA) was a law passed by the United States Congress in 1974 and codified as Title 12, Chapter 27 of the United States Code, 12 U.S.C. §§ 2601–2617. The main objective was to protect homeowners by assisting them in becoming better educated while shopping for real estate services, and eliminating kickbacks and referral fees which add unnecessary costs to settlement services. RESPA requires lenders and others involved in mortgage lending to provide borrowers with pertinent and timely disclosures regarding the nature and costs of a real estate settlement process. RESPA was also designed to prohibit potentially abusive practices such as kickbacks and referral fees, the practice of dual tracking, and imposes limitations on the use of escrow accounts.

Fine print, small print, or mouseprint is less noticeable print smaller than the more obvious larger print it accompanies that advertises or otherwise describes or partially describes a commercial product or service. The larger print that is used in conjunction with fine print by the merchant often has the effect of deceiving the consumer into believing the offer is more advantageous than it really is. This may satisfy a legal technicality which requires full disclosure of all terms or conditions, but does not specify the manner of disclosure. There is strong evidence that suggests the fine print is not read by the majority of consumers.

Comparative advertising, or combative advertising, is an advertisement in which a particular product, or service, specifically mentions a competitor by name for the express purpose of showing why the competitor is inferior to the product naming it. Also referred to as "knocking copy", it is loosely defined as advertising where "the advertised brand is explicitly compared with one or more competing brands and the comparison is obvious to the audience". An advertising war is said to be occurring when competing products or services exchange comparative or combative advertisements mentioning each other.

The target market typically consists of consumers who exhibit similar characteristics and are considered most likely to buy a business's market offerings or are likely to be the most profitable segments for the business to service by OCHOM

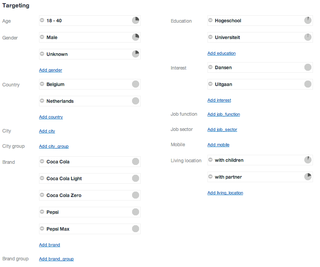

Targeted advertising is a form of advertising, including online advertising, that is directed towards an audience with certain traits, based on the product or person the advertiser is promoting. These traits can either be demographic with a focus on race, economic status, sex, age, generation, level of education, income level, and employment, or psychographic focused on the consumer values, personality, attitude, opinion, lifestyle and interest. This focus can also entail behavioral variables, such as browser history, purchase history, and other recent online activities. Targeted advertising is concentrated in certain traits and consumers who are likely to have a strong preference. These individuals will receive messages instead of those who have no interest and whose preferences do not match a particular product's attributes. This eliminates waste.

The Revised Payment Services Directive is an EU Directive, administered by the European Commission to regulate payment services and payment service providers throughout the European Union (EU) and European Economic Area (EEA). The PSD's purpose was to increase pan-European competition and participation in the payments industry also from non-banks, and to provide for a level playing field by harmonizing consumer protection and the rights and obligations for payment providers and users. The key objectives of the PSD2 directive are creating a more integrated European payments market, making payments more secure and protecting consumers.

Advertising to children refers to the act of advertising products or services to children as defined by national laws and advertising standards.

A Representative APR is a financial service concept in which credit or loan interest rates quoted through advertising media are required to take into account all charges associated with a product, in addition to the interest rate.

Payday loans in the United Kingdom are typically small value and for short periods. Payday loans is often used as a term by members of the public generically to refer to all forms of High-cost Short-term credit (HCSTC) including instalment loans, e.g. 3-9 month products, rather than just loans provided until the next pay day.

The Consumer Rights Directive 2011/83/EU is a consumer protection measure in EU law. It was due to be implemented by 13 December 2013

The California Department of Financial Protection and Innovation (DFPI), formerly the Department of Business Oversight (DBO), regulates a variety of financial services, businesses, products, and professionals. The department operates under the California Business, Consumer Services and Housing Agency.

The Mortgage Credit Directive (MCD) is a body of European legislation for the regulation of first- and second charge mortgages and consumer buy-to-let (CBTL) lending. It was originally adopted by the European Commission on 4 February 2014 and Member states had to transpose the regulations in their national law by March 2016. The European Commission is currently planning to propose amendments to the directive in 2022.

References

- 1 2 3 Department for Business, Innovation and Skills,"Regulations Implementing The Consumer Credit Directive: Quick Start Guide", Aug 2010, p3

- ↑ CompareAndSave.com, Emma Skinner (Ed.): "What is a 'Representative Example'?" Published 2010-11-17, Retrieved 2011-11-24

- 1 2 Department for Business, Innovation and Skills, "Guidance on the regulations implementing the Consumer Credit Directive", Aug 2010, p21

- ↑ Department for Business, Innovation and Skills, "Guidance on the regulations implementing the Consumer Credit Directive", Aug 2010, p22

- ↑ CompareAndSave.com, Emma Skinner (Ed.): What is a 'Representative APR'?" Published 2010-11-17, Retrieved 2010-11-24

- ↑ Financial Services Authority, "Mortgages and Home Finance Advertising" - Retrieved 2010-11-24

- ↑ Department for Business, Innovation and Skills, "Regulations Implementing The Consumer Credit Directive: Quick Start Guide", Aug 2010, p5

- ↑ Department for Business, Innovation and Skills, "Guidance on the regulations implementing the Consumer Credit Directive", Aug 2010 p24

- ↑ Department for Business, Innovation and Skills, "Guidance on the regulations implementing the Consumer Credit Directive", Aug 2010, p25