Related Research Articles

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations etc. The recipient incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed.

A payday loan is a short-term unsecured loan, often characterized by high interest rates.

The term annual percentage rate of charge (APR), corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR), is the interest rate for a whole year (annualized), rather than just a monthly fee/rate, as applied on a loan, mortgage loan, credit card, etc. It is a finance charge expressed as an annual rate. Those terms have formal, legal definitions in some countries or legal jurisdictions, but in the United States:

Email marketing is the act of sending a commercial message, typically to a group of people, using email. In its broadest sense, every email sent to a potential or current customer could be considered email marketing. It involves using email to send advertisements, request business, or solicit sales or donations. Email marketing strategies commonly seek to achieve one or more of three primary objectives, to build loyalty, trust, or brand awareness. The term usually refers to sending email messages with the purpose of enhancing a merchant's relationship with current or previous customers, encouraging customer loyalty and repeat business, acquiring new customers or convincing current customers to purchase something immediately, and sharing third-party ads.

A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses.

A shared appreciation mortgage or SAM is a mortgage in which the lender agrees to receive some or all of the repayment in the form of a share of the increase in value of the property.

cahoot is an internet-only division of Santander UK plc, the British subsidiary of the Santander Group. Cahoot was launched in June 2000, as the internet based banking brand of Abbey National plc. Cahoot is based in Belfast, Northern Ireland.

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. For water resources, it can be groundwater in an aquifer. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

Payment protection insurance (PPI), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt. It is not to be confused with income protection insurance, which is not specific to a debt but covers any income. PPI was widely sold by banks and other credit providers as an add-on to the loan or overdraft product.

Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application. Origination generally includes all the steps from taking a loan application up to disbursal of funds. For mortgages, there is a specific mortgage origination process. Loan servicing covers everything after disbursing the funds until the loan is fully paid off. Loan origination is a specialized version of new account opening for financial services organizations. Certain people and organizations specialize in loan origination. Mortgage brokers and other mortgage originator companies serve as a prominent example.

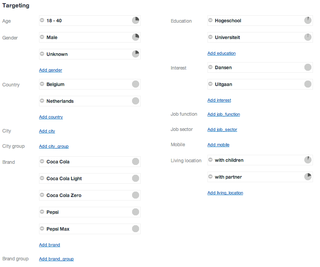

Targeted advertising is a form of advertising, including online advertising, that is directed towards an audience with certain traits, based on the product or person the advertiser is promoting. These traits can either be demographic with a focus on race, economic status, sex, age, generation, level of education, income level, and employment, or psychographic focused on the consumer values, personality, attitude, opinion, lifestyle and interest. This focus can also entail behavioral variables, such as browser history, purchase history, and other recent online activities. Targeted advertising is concentrated in certain traits and consumers who are likely to have a strong preference. These individuals will receive messages instead of those who have no interest and whose preferences do not match a particular product's attributes. This eliminates waste.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

The Revised Payment Services Directive is an EU Directive, administered by the European Commission to regulate payment services and payment service providers throughout the European Union (EU) and European Economic Area (EEA). The PSD's purpose was to increase pan-European competition and participation in the payments industry also from non-banks, and to provide for a level playing field by harmonizing consumer protection and the rights and obligations for payment providers and users. The key objectives of the PSD2 directive are creating a more integrated European payments market, making payments more secure and protecting consumers.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

A representative example is a term used in UK financial advertising regulations that aim to show consumers the typical costs associated with a product being advertised. The representative example must be provided when any financial services provider advertising a product, whether it is a credit card, loan or mortgage.

Payday loans in the United Kingdom are typically small value and for short periods. Payday loans are often used as a term by members of the public generically to refer to all forms of High-cost Short-term credit (HCSTC) including instalment loans, e.g. 3-9 month products, rather than just loans provided until the next pay day.

Wonga.com, also known as Wonga, is a former British payday loan firm that was founded in 2006. The company focused on offering short-term, high-cost loans to customers via online applications, and began processing its first loans in 2007. The firm operated across several countries, including the United Kingdom, Spain, Poland and South Africa; it also operated in Canada until 2016, and in Germany, Switzerland, Austria and the Netherlands through the German payments business, BillPay, between 2013 and 2017.

Credit agreements in South Africa are agreements or contracts in South Africa in terms of which payment or repayment by one party to another is deferred. This entry discusses the core elements of credit agreements as defined in the National Credit Act, and the consequences of concluding a credit agreement in South Africa.

Open banking is a financial services term within financial technology. It refers to:

- The use of open APIs that enable third-party developers to build applications and services around the financial institution.

- Greater financial transparency options for account holders, ranging from open data to private data.

- The use of open source technology to achieve the above.

The Mortgage Credit Directive (MCD) is a body of European legislation for the regulation of first- and second charge mortgages and consumer buy-to-let (CBTL) lending. It was originally adopted by the European Commission on 4 February 2014 and Member states had to transpose the regulations in their national law by March 2016. The European Commission is currently planning to propose amendments to the directive in 2022.

References

- ↑ Department for Business, Innovation and Skills, "Regulations Implementing The Consumer Credit Directive: Quick Start Guide", Aug 2010, page 3

- ↑ CompareAndSave.com, Emma Skinner (Ed.): 'What is a Representative Example?' Published 2010-11-17, Retrieved 2011-11-18

- 1 2 Department for Business, Innovation and Skills, "Regulations Implementing The Consumer Credit Directive: Quick Start Guide", (2010), page 5

- ↑ Bond Pearce "Consumer Credit Directive sets advertising regulations" Published on 2010-06-09, Retrieved 2010-11-18

- ↑ Financial Services Authority: "Mortgages and Home Finance Advertising" - Retrieved 2010-11-18