A business plan is a formal written document containing the goals of a business, the methods for attaining those goals, and the time-frame for the achievement of the goals. It also describes the nature of the business, background information on the organization, the organization's financial projections, and the strategies it intends to implement to achieve the stated targets. In its entirety, this document serves as a road-map that provides direction to the business.

A nonprofit organization (NPO) or non-profit organisation, also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrast with an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without securing tax-exempt status.

In the United States, federal grants are economic aid issued by the United States government out of the general federal revenue. A federal grant is an award of financial assistance from a federal agency to a recipient to carry out a public purpose of support or stimulation authorized by a law of the United States.

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

- The efficient allocation of available resources;

- The distribution of income among citizens; and

- The stability of the economy.

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms.

In many states with political systems derived from the Westminster system, a consolidated fund or consolidated revenue fund is the main bank account of the government. General taxation is taxation paid into the consolidated fund, and general spending is paid out of the consolidated fund.

Fundraising or fund-raising is the process of seeking and gathering voluntary financial contributions by engaging individuals, businesses, charitable foundations, or governmental agencies. Although fundraising typically refers to efforts to gather money for non-profit organizations, it is sometimes used to refer to the identification and solicitation of investors or other sources of capital for for-profit enterprises.

The United States Navy Working Capital Fund (NWCF) is a branch of the family of United States Department of Defense (DoD) Working Capital Funds. The NWCF is a revolving fund, an account or fund that relies on sales revenue rather than direct Congressional appropriations to finance its operations. It is intended to generate adequate revenue to cover the full costs of its operations, and to finance the fund's continuing operations without fiscal year limitation. A revolving fund is intended to operate on a break-even basis over time; that is, it neither makes a profit nor incurs a loss.

Matching funds are funds that are set to be paid in proportion to funds available from other sources. Matching fund payments usually arise in situations of charity or public good. The terms cost sharing, in-kind, and matching can be used interchangeably but refer to different types of donations.

The financing of electoral campaigns in the United States happens at the federal, state, and local levels by contributions from individuals, corporations, political action committees, and sometimes the government. Campaign spending has risen steadily at least since 1990.

A Revolving Loan Fund (RLF) is a source of money from which loans are made for multiple small business development projects. Revolving loan funds share many characteristics with microcredit, micro-enterprise, and village banking, namely providing loans to persons or groups of people that do not qualify for traditional financial services or are otherwise viewed as being high risk. Borrowers tend to be small producers of goods and services: typically, they are artisans, farmers, and women with no credit history or access to other types of loans from financial institutions. Organizations that offer revolving loan fund lending aim to help new project or business owners become financially independent and eventually to become eligible for loans from commercial banks.

In the United States, a donor-advised fund is a charitable giving vehicle administered by a public charity created to manage charitable donations on behalf of organizations, families, or individuals. To participate in a donor-advised fund, a donating individual or organization opens an account in the fund and deposits cash, securities, or other financial instruments. They surrender ownership of anything they put in the fund, but retain advisory privileges over how their account is invested, and how it distributes money to charities.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

In the United States, federal assistance, also known as federal aid, federal benefits, or federal funds, is defined as any federal program, project, service, or activity provided by the federal government that directly assists domestic governments, organizations, or individuals in the areas of education, health, public safety, public welfare, and public works, among others.

A charitable organization in Canada is regulated under the Canadian Income Tax Act through the Charities Directorate of the Canada Revenue Agency (CRA).

The Budget of the State of Oklahoma is the Governor's proposal to the Oklahoma Legislature which recommends funding levels to operate the state government for the next fiscal year, beginning July 1. Legislative decisions are governed by rules and legislation regarding the state budget process.

Non-profit housing developers build affordable housing for individuals under-served by the private market. The non-profit housing sector is composed of community development corporations (CDC) and national and regional non-profit housing organizations whose mission is to provide for the needy, the elderly, working households, and others that the private housing market does not adequately serve. Of the total 4.6 million units in the social housing sector, non-profit developers have produced approximately 1.547 million units, or roughly one-third of the total stock. Since non-profit developers seldom have the financial resources or access to capital that for-profit entities do, they often use multiple layers of financing, usually from a variety of sources for both development and operation of these affordable housing units.

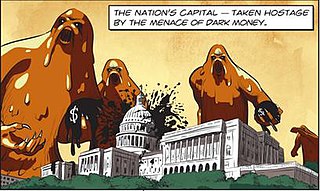

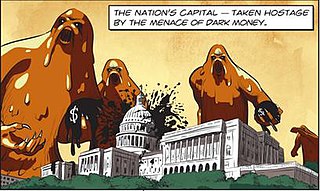

In the politics of the United States, dark money refers to spending to influence elections where the source of the money is not disclosed to voters. In the United States, some types of nonprofit organizations may spend money on campaigns without disclosing who their donors are. The most common type of dark money group is the 501(c)(4). Such organizations can receive unlimited donations from corporations, individuals and unions. Proponents of dark money maintain it is protected under the First Amendment, while critics complain recipients of dark money "knows exactly who he owes a favor", but voters are kept in the dark about connections between donor and politician when favors are paid back.

Assets for Independence (AFI) is a federal program that distributes discretionary grants to help the impoverished achieve one of three goals: (1) homeownership; (2) business ownership; and (3) post-secondary education. AFI was created by the Assets for Independence Act.

A green bank is a financial institution, typically public or quasi-public, that uses innovative financing techniques and market development tools in partnership with the private sector to accelerate deployment of clean energy technologies. Green banks use public funds to leverage private investment in clean energy technologies that, despite being commercially viable, have struggled to establish a widespread presence in consumer markets. Green banks seek to reduce energy costs for ratepayers, stimulate private sector investment and economic activity, and expedite the transition to a low-carbon economy.