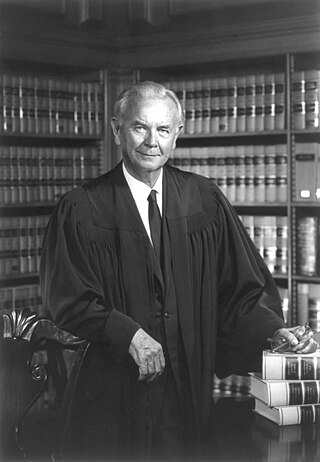

Robert N. Armen Jr. (born Pennsylvania, 1947) is a former special trial judge of the United States Tax Court.

Robert N. Armen Jr. (born Pennsylvania, 1947) is a former special trial judge of the United States Tax Court.

Armen graduated from Duquesne University with a B.A. in 1969, and earned his J.D. at Georgetown University in 1973. He and went on to receive an LL.M. from Cleveland State University in 1979. [1]

After working for the Office of Chief Counsel for the Internal Revenue Service (Cleveland District Counsel) from 1973 to 1978, Armen worked in the Criminal Tax Division from 1978 to 1979, as Washington District Counsel from 1979 to 1981, and as a law clerk to United States Tax Court Judge Howard A. Dawson, Jr. from 1981 to 1983.

He was Assistant Clerk of the Court from 1983 to 1985, and then became Deputy Counsel to the Chief Judge, 1986–93. He was made adjunct professor at University of Baltimore Law School (Graduate Tax Program, 1988–90), and the Northern Virginia Community College (Business Division, 1981–89). [2] Armen was appointed as a Special Trial Judge, United States Tax Court on August 27, 1993. [2] [3]

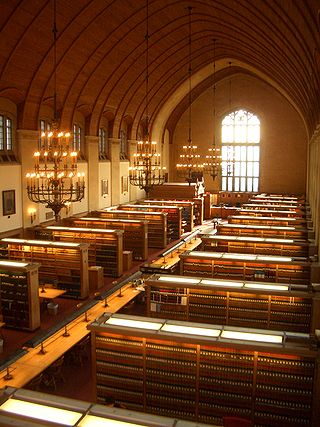

Cornell Law School is the law school of Cornell University, a private Ivy League university in Ithaca, New York. One of the five Ivy League law schools, it offers four law degree programs, JD, LLM, MSLS and JSD, along with several dual-degree programs in conjunction with other professional schools at the university. Established in 1887 as Cornell's Department of Law, the school today is one of the smallest top-tier JD-conferring institutions in the country, with around 200 students graduating each year.

The University of Georgia School of Law is the law school of the University of Georgia, a public research university in Athens, Georgia. It was founded in 1859, making it among the oldest American university law schools in continuous operation. Georgia Law accepted 14.83% of applicants for the Class entering in 2022.

The United States Tax Court is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides that the Congress has the power to "constitute Tribunals inferior to the supreme Court". The Tax Court specializes in adjudicating disputes over federal income tax, generally prior to the time at which formal tax assessments are made by the Internal Revenue Service.

Vanderbilt University Law School is a graduate school of Vanderbilt University. Established in 1874, it is one of the oldest law schools in the southern United States. Vanderbilt Law School is one of the most selective law schools in the United States and has a 14.25% acceptance rate. Vanderbilt Law enrolls approximately 640 students, with each entering Juris Doctor class consisting of approximately 175 students.

Case Western Reserve University School of Law is one of eight schools at Case Western Reserve University in Cleveland, Ohio. It was one of the first schools accredited by the American Bar Association. It is a member of the Association of American Law Schools (AALS). It was initially named for Franklin Thomas Backus, a justice of the Ohio Supreme Court, whose widow donated $50,000 to found the school in 1892.

Lewis R. Carluzzo, is a special trial judge of the United States Tax Court.

Robert Paul Ruwe was a former judge of the United States Tax Court.

Villanova University's Charles Widger School of Law is the law school of Villanova University, a private Roman Catholic research university in Villanova, Pennsylvania. It was opened in 1953 and is approved by the American Bar Association (ABA) and a member of the Association of American Law Schools (AALS). Approximately 720 students study full-time in the J.D. program which offers more than 100 offerings including foundation courses, specialty offerings, drafting courses, clinical experiences, seminars, simulation courses and externships.

William J. Brennan, Jr., who authored the opinion in New York Times Co. v. Sullivan, has several awards named in his honor, which are presented to individuals for dedication to public interest and free expression. Awards named after William J. Brennan, Jr. are presented by the following organizations.

Ann Claire Williams is a retired United States circuit judge of the United States Court of Appeals for the Seventh Circuit and a former United States District Judge of the United States District Court for the Northern District of Illinois. She is currently of counsel at Jones Day.

Irma Elsa Gonzalez is a retired United States district judge of the United States District Court for the Southern District of California, who was the first Mexican-American female federal judge. She is married to former federal prosecutor and trial attorney Robert S. Brewer Jr. who served as the U.S. attorney for Southern California from 2019 to 2021.

Joseph Anthony Greenaway Jr. is an American lawyer who served as a United States circuit judge of the United States Court of Appeals for the Third Circuit from 2010 to 2023. He also previously sat on the United States District Court for the District of New Jersey from 1996 to 2010. On February 9, 2010, he was confirmed to his seat on the Third Circuit, filling the vacancy created by Justice Samuel Alito's elevation to the United States Supreme Court. Greenaway had been mentioned as a possible candidate for the Supreme Court by President Barack Obama.

Timothy Belcher Dyk is a United States circuit judge of the United States Court of Appeals for the Federal Circuit.

Francis Marion Allegra was an American federal judge on the United States Court of Federal Claims.

B. John Williams is an American lawyer who served as a judge of the United States Tax Court from 1985 to 1990.

Chief Judge Maurice B. Foley announced today that, effective August 31, 2019, Special Trial Judge Robert N. Armen, Jr. has retired.

Material on this page was copied from the website of the United States Tax Court, which is published by a United States government agency, and is therefore in the public domain.