Related Research Articles

Kent E. Hovind is an American Christian fundamentalist evangelist and tax protester. He is a controversial figure in the Young Earth creationist movement whose ministry focuses on denial of scientific theories in the fields of biology (evolution), geophysics, and cosmology in favor of a literalist interpretation of the Genesis creation narrative found in the Bible. Hovind's views, which combine elements of creation science and conspiracy theory, are dismissed by the scientific community as fringe theory and pseudo-scholarship. He is controversial within the Young Earth Creationist movement, and Answers in Genesis openly criticized him for continued use of discredited arguments abandoned by others in the movement.

The Freedom From Religion Foundation (FFRF) is an American nonprofit organization, which advocates for atheists, agnostics, and nontheists. Formed in 1976, FFRF promotes the separation of church and state, and challenges the legitimacy of many federal and state programs that are faith-based. It supports groups such as nonreligious students and clergy who want to leave their faith.

Garnishment is a legal process for collecting a monetary judgment on behalf of a plaintiff from a defendant. Garnishment allows the plaintiff to take the money or property of the debtor from the person or institution that holds that property. A similar legal mechanism called execution allows the seizure of money or property held directly by the debtor.

Irwin Allen Schiff was an American libertarian and tax resistance advocate known for writing and promoting literature in which he argued that the income tax in the United States is illegal and unconstitutional. Judges in several civil and criminal cases ruled in favor of the federal government and against Schiff. As a result of these judicial rulings Schiff was in a hospital prison serving a sentence of 162 months at the time of his death at the age of 87. The Federal Bureau of Prisons reported that Schiff died on October 16, 2015.

Robert Barnwell Clarkson was an American tax protester in South Carolina.

A tax protester, in the United States, is a person who denies that he or she owes a tax based on the belief that the Constitution, statutes, or regulations do not empower the government to impose, assess or collect the tax. The tax protester may have no dispute with how the government spends its revenue. This differentiates a tax protester from a tax resister, who seeks to avoid paying a tax because the tax is being used for purposes with which the resister takes issue.

The Law That Never Was: The Fraud of the 16th Amendment and Personal Income Tax is a 1985 book by William J. Benson and Martin J. "Red" Beckman which claims that the Sixteenth Amendment to the United States Constitution, commonly known as the income tax amendment, was never properly ratified. In 2007, and again in 2009, Benson's contentions were ruled to be fraudulent.

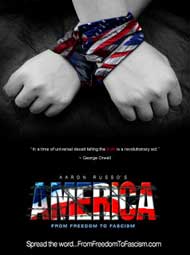

America: Freedom to Fascism is a 2006 film by filmmaker and activist Aaron Russo, covering a variety of subjects that Russo contends are detrimental to Americans. Topics include the Internal Revenue Service (IRS), the income tax, Federal Reserve System, national ID cards, human-implanted RFID tags, Diebold electronic voting machines, globalization, Big Brother, taser weapons abuse, and the use of terrorism by the government as a means to diminish the citizens' rights.

The Internal Revenue Service Restructuring and Reform Act of 1998, also known as Taxpayer Bill of Rights III,, resulted from hearings held by the United States Congress in 1996 and 1997. The Act included numerous amendments to the Internal Revenue Code of 1986. The bill was passed in the Senate unanimously, and was seen as a major reform of the Internal Revenue Service.

Tax protesters in the United States have advanced a number of arguments asserting that the assessment and collection of the federal income tax violates statutes enacted by the United States Congress and signed into law by the President. Such arguments generally claim that certain statutes fail to create a duty to pay taxes, that such statutes do not impose the income tax on wages or other types of income claimed by the tax protesters, or that provisions within a given statute exempt the tax protesters from a duty to pay.

Tax protesters in the United States advance a number of conspiracy arguments asserting that Congress, the courts and various agencies within the federal government—primarily the Internal Revenue Service (IRS)—are involved in a deception deliberately designed to procure from individuals or entities their wealth or profits in contravention of law. Conspiracy arguments are distinct from, though related to, constitutional, statutory, and administrative arguments. Proponents of such arguments contend that all three branches of the United States government are working covertly to defraud the taxpayers of the United States through the illegal imposition, assessment and collection of a federal income tax.

We the People Foundation for Constitutional Education, Inc. also known as We the People Foundation is a non-profit education and research organization in Queensbury, New York with the declared mission "to protect and defend individual Rights as guaranteed by the Constitutions of the United States." It was founded by Robert L. Schulz. At the U.S. Department of Justice, he is known as a "high-profile tax protester". The Southern Poverty Law Center asserts that Schulz is the head of the leading organization in the tax protester movement. The organization formally served a petition for redress of grievances regarding income tax upon the United States government in November 2002. In July 2004, it filed a lawsuit in an unsuccessful attempt to force the government to address the petition. The organization has also served petitions relating to other issues since then.

Tommy Keith Cryer, also known as Tom Cryer, was an attorney in Shreveport, Louisiana who was charged with and later acquitted of willful failure to file U.S. Federal income tax returns in a timely fashion. In a case in United States Tax Court, Cryer contested a determination by the U.S. Internal Revenue Service that he owed $1.7 million in taxes and penalties. Before the case could come to trial, Cryer died June 4, 2012. He was 62.

Tax protester Sixteenth Amendment arguments are assertions that the imposition of the U.S. federal income tax is illegal because the Sixteenth Amendment to the United States Constitution, which reads "The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration", was never properly ratified, or that the amendment provides no power to tax income. Proper ratification of the Sixteenth Amendment is disputed by tax protesters who argue that the quoted text of the Amendment differed from the text proposed by Congress, or that Ohio was not a State during ratification, despite its admission to the Union on March 1st, 1803. Sixteenth Amendment ratification arguments have been rejected in every court case where they have been raised and have been identified as legally frivolous.

Public.Resource.Org (PRO) is a 501(c)(3) non-profit corporation dedicated to publishing and sharing public domain materials in the United States and internationally. It was founded by Carl Malamud and is based in Sebastopol, California.

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies, or a moral opposition to taxation in general, not out of a belief that the tax law itself is invalid. The United States has a large and organized culture of people who espouse such theories. Tax protesters also exist in other countries.

Tax protester arguments are arguments made by people, primarily in the United States, who contend that tax laws are unconstitutional or otherwise invalid.

Tax protesters in the United States advance a number of administrative arguments asserting that the assessment and collection of the federal income tax violates regulations enacted by responsible agencies –primarily the Internal Revenue Service (IRS)– tasked with carrying out the statutes enacted by the United States Congress and signed into law by the President. Such arguments generally include claims that the administrative agency fails to create a duty to pay taxes, or that its operation conflicts with some other law, or that the agency is not authorized by statute to assess or collect income taxes, to seize assets to satisfy tax claims, or to penalize persons who fail to file a return or pay the tax.

The lawsuit Microsoft v. Internal Revenue Service, No. 1:14-cv-01982, was filed in U.S. District Court, District of Columbia when Microsoft sued the Internal Revenue Service requesting the IRS comply with a Freedom of Information Act request. According to Microsoft the IRS "unlawfully withheld" information on a contract between law firm Quinn Emmanuel Urqhart and Sullivan and the IRS. The IRS uses the services of the law firm to assess transfer pricing financial audits of Microsoft.

Citizens for Responsibility and Ethics in Washington v. Trump was a case brought before the United States District Court for the Southern District of New York. The plaintiffs, watchdog group Citizens for Responsibility and Ethics in Washington (CREW), hotel and restaurant owner Eric Goode, an association of restaurants known as ROC United, and an Embassy Row hotel event booker named Jill Phaneuf alleged that the defendant, President Donald Trump, was in violation of the Foreign Emoluments Clause, a constitutional provision that bars the president or any other federal official from taking gifts or payments from foreign governments. CREW filed its complaint on January 23, 2017, shortly after Trump was inaugurated as president. An amended complaint, adding the hotel and restaurant industry plaintiffs, was filed on April 18, 2017. A second amended complaint was filed on May 10, 2017. CREW was represented by several prominent lawyers and legal scholars in the case.

References

- ↑ Schulz v. Williams, vol. 44, November 1, 1994, p. 48, retrieved 2019-08-27

- ↑ See generally Schulz v. United States, 2006-2 U.S. Tax Cas. (CCH) paragr. 50,481 (D. Neb. 2006), aff'd per curiam, 2007-2 U.S. Tax Cas. (CCH) paragr. 50,701 (8th Cir. 2007).

- ↑ Decision and Order, Aug. 9, 2007, docket entry 30, United States of America v. Robert L. Schulz, We the People Foundation for Constitutional Education, Inc., and We the People Congress, case no. 1:07-cv-0352, United States District Court for the Northern District of New York.

- ↑ United States v. Robert L. Schulz, We the People Foundation for Constitutional Education, Inc., and We the People Congress, Inc., Feb. 22, 2008, per curiam opinion, p. 3 & 4, case no. 07-3729-cv, United States Court of Appeals for the Second Circuit.

- ↑ Brief in Support of Motion for Contempt, April 7, 2008, docket entry 50, United States of America v. Robert L. Schulz, We the People Foundation for Constitutional Education, Inc., and We the People Congress, case no. 1:07-cv-0352, United States District Court for the Northern District of New York.

- ↑ Reismann, Nick (2008-05-01). "Fort Ann tax protester cited for contempt of court". The Post-Star . Retrieved 2015-12-27.

- ↑ Decision and Order, April 28, 2008, docket entry 54, United States of America v. Robert L. Schulz, We the People Foundation for Constitutional Education, Inc., and We the People Congress, case no. 1:07-cv-0352, United States District Court for the Northern District of New York.

- ↑ "Declaration #15 by Defendant Schulz," May 5, 2008, docket entry 58, United States of America v. Robert L. Schulz, We the People Foundation for Constitutional Education, Inc., and We the People Congress, case no. 1:07-cv-0352, United States District Court for the Northern District of New York.

- ↑ Olkon, Sara; Janega, James. "Tax activist's ad challenges Obama's eligibility for office". Chicago Tribune . Retrieved 2015-12-27.

- ↑ Heidi Beirich, with contribution by Janet Smith, "Midwifing the Militias," Intelligence Report, Southern Poverty Law Center, Spring 2010, Issue Number 137, at .

- ↑ Id.