Related Research Articles

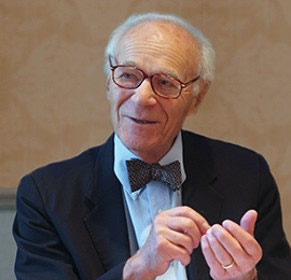

Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students, young professors and academics who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, and Robert Lucas Jr.

Economic history is the study of history using methodological tools from economics or with a special attention to economic phenomena. Research is conducted using a combination of historical methods, statistical methods and the application of economic theory to historical situations and institutions. The field can encompass a wide variety of topics, including equality, finance, technology, labour, and business. It emphasizes historicizing the economy itself, analyzing it as a dynamic entity and attempting to provide insights into the way it is structured and conceived.

The Tariff Act of 1930, commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff, was a law that implemented protectionist trade policies in the United States. Sponsored by Senator Reed Smoot and Representative Willis C. Hawley, it was signed by President Herbert Hoover on June 17, 1930. The act raised US tariffs on over 20,000 imported goods.

Joseph Eugene Stiglitz is an American New Keynesian economist, a public policy analyst, and a full professor at Columbia University. He is a recipient of the Nobel Memorial Prize in Economic Sciences (2001) and the John Bates Clark Medal (1979). He is a former senior vice president and chief economist of the World Bank. He is also a former member and chairman of the Council of Economic Advisers. He is known for his support for the Georgist public finance theory and for his critical view of the management of globalization, of laissez-faire economists, and of international institutions such as the International Monetary Fund and the World Bank.

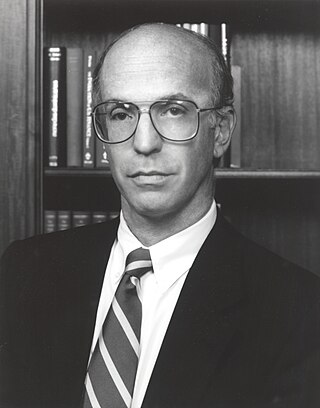

Robert Emerson Lucas Jr. was an American economist at the University of Chicago. Widely regarded as the central figure in the development of the new classical approach to macroeconomics, he received the Nobel Prize in Economics in 1995 "for having developed and applied the hypothesis of rational expectations, and thereby having transformed macroeconomic analysis and deepened our understanding of economic policy". He was characterized by N. Gregory Mankiw as "the most influential macroeconomist of the last quarter of the 20th century". In 2020, he ranked as the 10th most cited economist in the world.

Lawrence Robert Klein was an American economist. For his work in creating computer models to forecast economic trends in the field of econometrics in the Department of Economics at the University of Pennsylvania, he was awarded the Nobel Memorial Prize in Economic Sciences in 1980 specifically "for the creation of econometric models and their application to the analysis of economic fluctuations and economic policies." Due to his efforts, such models have become widespread among economists. Harvard University professor Martin Feldstein told the Wall Street Journal that Klein "was the first to create the statistical models that embodied Keynesian economics," tools still used by the Federal Reserve Bank and other central banks.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

Alan Stuart Blinder is an American economics professor at Princeton University and is listed among the most influential economists in the world according to IDEAS/RePEc. He is a leading macro-economist, politically liberal, and a champion of Keynesian economics and policies.

Muhammad Umer Chapra is a Pakistani-Saudi economist. As of November 1999, he serves as Advisor at the Islamic Research and Training Institute (IRTI) of the Islamic Development Bank (IDB) in Jeddah, Saudi Arabia. Prior to this position, he worked at the Saudi Arabian Monetary Agency (SAMA), Riyadh, for nearly 35 years, as Economic Advisor and then Senior Economic Advisor.

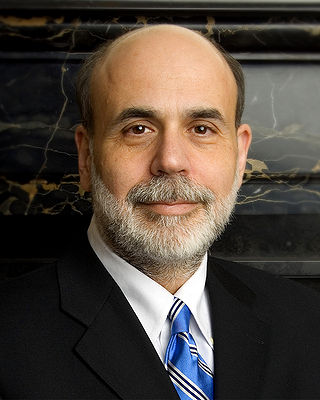

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the late-2000s financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

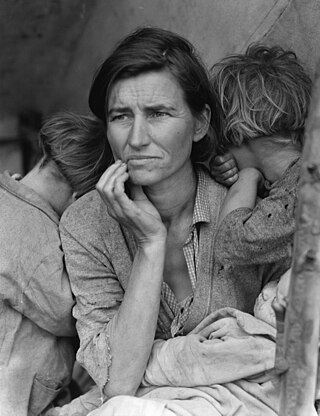

In the United States, the Great Depression began with the Wall Street Crash of October 1929 and then spread worldwide. The nadir came in 1931–1933, and recovery came in 1940. The stock market crash marked the beginning of a decade of high unemployment, poverty, low profits, deflation, plunging farm incomes, and lost opportunities for economic growth as well as for personal advancement. Altogether, there was a general loss of confidence in the economic future.

Robert Patrick Murphy is an American economist. Murphy is research assistant professor with the Free Market Institute at Texas Tech University. He has been affiliated with Laffer Associates, the Pacific Research Institute, the Institute for Energy Research (IER), the Independent Institute, the Ludwig von Mises Institute, and the Fraser Institute.

Robert Higgs is an American economic historian and economist combining material from Public Choice, the New institutional economics, and the Austrian school of economics; and describes himself as a "libertarian anarchist" in political and legal theory and public policy. His writings in economics and economic history have most often focused on the causes, means, and effects of government power and growth.

Dr Kent Deng, FRHistS, is full professor in Economic History at the London School of Economics. He is a member of the Asian Research Centre and has been Secretary of the History and Economic Development Group UK since 2000.

A debate exists within the United States government and American society at large over whether the one-cent coin, the penny, should be eliminated as a unit of currency in the United States. The penny costs more to produce than the one cent it is worth, meaning the seigniorage is negative – the government loses money on every penny that is created. Several bills introduced in the U.S. Congress would have ceased production of pennies, but none have been approved. Such bills would leave the five-cent coin, or nickel, as the lowest-value coin minted in the United States.

Amity Ruth Shlaes is an American conservative author, writer, and columnist. Shlaes has written five books, including three New York Times Bestsellers. She currently chairs the board of trustees of the Calvin Coolidge Presidential Foundation and serves as a Presidential Scholar at The King's College in New York City. She is a recipient of the Bastiat Prize and, more recently, the Bradley Prize.

The Great Depression (1929–1939) was a severe global economic downturn that affected many countries across the world. It became evident after a sharp decline in stock prices in the United States, leading to a period of economic depression. The economic contagion began around September 1929 and led to the Wall Street stock market crash of 24 October. This crisis marked the start of a prolonged period of economic hardship characterized by high unemployment rates and widespread business failures.

Christina Duckworth Romer is the Class of 1957 Garff B. Wilson Professor of Economics at the University of California, Berkeley and a former chair of the Council of Economic Advisers in the Obama administration. She resigned from her role on the Council of Economic Advisers on September 3, 2010.

The Depression of 1920–1921 was a sharp deflationary recession in the United States, United Kingdom and other countries, beginning 14 months after the end of World War I. It lasted from January 1920 to July 1921. The extent of the deflation was not only large, but large relative to the accompanying decline in real product.

References

- 1 2 3 Keuffel, Ken (11 March 2009). "On the Money: When Robert Whaples, an economics professor at Wake Forest University, speaks, people listen". Winston-Salem Journal. Retrieved 14 November 2015.

- ↑ "Robert M. Whaples". Independent Institute. Retrieved 15 November 2015.

- 1 2 "Robert Whaples". Wake Forest University. Retrieved 14 November 2015.

- ↑ "Professor's research supports eliminating penny". Wake Forest University. 18 July 2006. Archived from the original on 1 December 2006. Retrieved 15 November 2015.

- ↑ Bandyk, Matthew (11 April 2008). "Did the New Deal Work?". U.S. News & World Report. Retrieved 15 November 2015.