Related Research Articles

Shareholder activism is a form of activism in which shareholders use equity stakes in a corporation to put pressure on its management. A fairly small stake may be enough to launch a successful campaign. In comparison, a full takeover bid is a much more costly and difficult undertaking. The goals of shareholder activism range from financial to non-financial. Shareholder activists can address self-dealing by corporate insiders, although large stockholders can also engage in self-dealing to themselves at the expense of smaller minority shareholders.

GGP Inc. was an American commercial real estate company and the second-largest shopping mall operator in the United States. It was founded by brothers Martin, Matthew and Maurice Bucksbaum in Cedar Rapids, Iowa, in 1954, and was headquartered in Chicago, Illinois, from 2000. It was subject to the largest real estate bankruptcy in American history at the time of its filing in 2009.

Whitbread is a British multinational hotel and restaurant company headquartered in Houghton Regis, England. The business was founded as a brewery in 1742 by Samuel Whitbread in partnership with Godfrey and Thomas Shewell, with premises in London at the junction of Old Street and Upper Whitecross Street, along with a brewery in Brick Lane, Spitalfields. Samuel Whitbread bought out his partners, expanding into porter production with the purchase of a brewery in Chiswell Street, and the company had become the largest brewery in the world by the 1780s.

MBIA Inc. is an American financial services company. It was founded in 1973 as the Municipal Bond Insurance Association. It is headquartered in Purchase, New York, and as of January 1, 2015 had approximately 180 employees. MBIA is the largest bond insurer.

Ewing Hunter Harrison was a railway executive who served as the CEO of Illinois Central Railroad (IC), Canadian National Railway (CN), Canadian Pacific Railway (CP), and CSX Corporation. He is known for introducing precision scheduled railroading to the companies he ran. He died on December 16, 2017, two days after taking medical leave from CSX.

Perella Weinberg Partners is an American global financial services firm focused on investment banking advisory services.

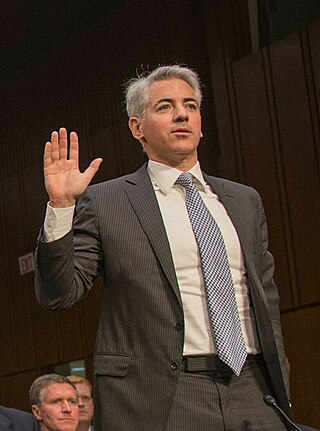

William Albert Ackman is an American billionaire hedge fund manager who is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company. His investment approach has made him an activist investor. As of June 2024, Ackman's net worth was estimated at $9.3 billion by Forbes.

The Sohn Conference Foundation was founded in 2006 to raise money to support medical research, the development of research equipment, and programs to help children with cancer and other childhood illnesses. As of 2018 more than $85 million has been raised. The Sohn Conference was founded in 1995 in memory of Ira Sohn, a Wall Street professional, who died of cancer at the age of 29. At that time the conference raised money for Tomorrow's Children's Fund. The foundation has 501(c)(3) non-profit status.

Sculptor Capital Management is an American global diversified alternative asset management firm. They are one of the largest institutional alternative asset managers in the world.

Impact investing refers to investments "made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return". At its core, impact investing is about an alignment of an investor's beliefs and values with the allocation of capital to address social and/or environmental issues.

Bruce R. (Robert) Berkowitz is an American equity fund manager and registered investment adviser. Berkowitz founded Fairholme Capital Management in 1997 and was formerly a senior portfolio manager at Lehman Brothers Holdings and a managing director of Smith Barney. Berkowitz was named 2009 Domestic-Stock Fund Manager of the Year and Domestic-Stock Fund Manager of the Decade by Morningstar, Inc.

Elliott Investment Management L.P. is an American investment management firm. It is also one of the largest activist funds in the world.

New Silk Route Partners LLC (NSR) is an Indian private equity firm that invests in private companies in India, Asia, and the Middle East.

Pershing Square Capital Management is an American hedge fund management company founded and run by Bill Ackman, headquartered in New York City.

Maneet Ahuja is an American author, journalist, television news producer, and hedge fund specialist. She is a producer of CNBC's morning business news program, Squawk Box. Her 2012 book, The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds, was published by John Wiley & Sons and nominated for an FT / Goldman Sachs Book of the Year Award. Forbes named her to their "30 Under 30" list of media figures for 2012. Ahuja has also produced a number of business events including CNBC's Delivering Alpha conference, a hedge fund summit that she created and co-developed. Ahuja serves on the Council of Advocates for Mt. Sinai Hospital and is on the United Nations Commission on the Status of Women. Her next book is The Techtonics.

Betting on Zero is a 2016 American documentary directed by Ted Braun. It investigates the allegation that Herbalife is a pyramid scheme, and follows Bill Ackman's short investment in Herbalife, which is ostensibly a billion-dollar bet that the company will soon collapse.

Jeffrey Glynn Tarrant was an American investor. He was the founder and chairman of MOV37 and Protégé Partners, firms specializing in identifying, seeding and early stage investing in investment funds. He was also a founding partner of film production company Candescent Films. He died from brain cancer in 2019.

Paul Charles Hilal is an American businessman and investor. He is the CEO of Mantle Ridge LP, which he founded in 2016.

Barry S. Rosenstein is an American hedge fund manager and billionaire. He is the founder and managing partner of JANA Partners LLC, an activist hedge fund firm. He made $300 million over the merger of Whole Foods with Amazon in April–July 2017.

John Hempton is an Australian investor. He is the founder, co-owner and CIO of Bronte Capital Management Pty Ltd, a hedge fund management company.

References

- 1 2 3 Hargrave, Marshall (16 March 2016). "Bill Ackman's Pershing Protégés are Struggling Too". Fortune. Retrieved 2019-03-01.

- 1 2 Herbst-Bayliss, Svea (1 April 2024). "Twilio appoints Sachem Head partner Andy Stafman to board" . Retrieved 22 May 2024.

- 1 2 Butt, Rachel (2016-06-17). "Here are the 10 biggest activist money managers and some of their most impressive bets". nordic.businessinsider.com. Retrieved 2019-03-01.

- 1 2 Taub, Stephen (24 February 2017). "Scott Ferguson's Sachem Head Loses a Partner". Institutional Investor. Retrieved 2019-03-01.

- ↑ Martin, Ben (2018-01-17). "Activist investor Sachem Head pushes Whitbread to consider break-up". Reuters. Archived from the original on February 9, 2019. Retrieved 2019-03-01.