Related Research Articles

25 Bank Street is an office tower in Canary Wharf, in the Docklands area of London. It is currently home to the European headquarters of the investment bank JPMorgan Chase.

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

Nomura Securities Co., Ltd. is a Japanese financial services company and a wholly owned subsidiary of Nomura Holdings, Inc. (NHI), which forms part of the Nomura Group. It plays a central role in the securities business, the group's core business. Nomura is a financial services group and global investment bank. Based in Tokyo, Japan, with regional headquarters in Hong Kong, London, and New York, Nomura employs about 26,000 staff worldwide; it is known as Nomura Securities International in the US, and Nomura International plc. in EMEA. It operates through five business divisions: retail, global markets, investment banking, merchant banking, and asset management.

Nomura Holdings, Inc. is a financial holding company and a principal member of the Nomura Group, which is Japan's largest investment bank and brokerage group. It, along with its broker-dealer, banking and other financial services subsidiaries, provides investment, financing and related services to individual, institutional, and government customers on a global basis with an emphasis on securities businesses.

Banca Monte dei Paschi di Siena S.p.A., known as BMPS or just MPS, is an Italian bank. Tracing its history to a mount of piety founded in 1472 and established in its present form in 1624, it is the world's oldest or second oldest bank, depending on the definition, and the fifth largest Italian commercial and retail bank.

Schroders plc is a British multinational asset management company headquartered in London, England. Founded in 1804, it employs over 6,000 people worldwide in 38 locations around Europe, America, Asia, Africa and the Middle East. It is traded on the London Stock Exchange and is a constituent of the FTSE 100 Index.

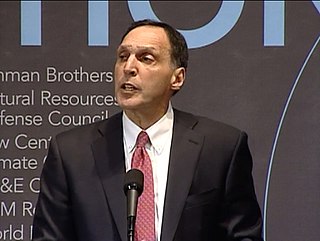

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from April 1, 1994 after the firm's spinoff from American Express until September 15, 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

Mediobanca is an Italian investment bank founded in 1946 at the initiative of Raffaele Mattioli and Enrico Cuccia to facilitate the post-World War II reconstruction of Italian industry. Cuccia led Mediobanca from 1946 to 1982. Today, it is an international banking group with offices in Milan, Frankfurt, London, Madrid, Luxembourg, New York and Paris.

Evercore Inc., formerly known as Evercore Partners, is a global independent investment banking advisory firm founded in 1995 by Roger Altman, David Offensend, and Austin Beutner. The firm has advised on over $4.7 trillion of merger, acquisition, and restructuring transactions since its founding.

TP ICAP Group plc is a financial services firm headquartered in London, United Kingdom. Its stock is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

Robert (Bob) Wigley, OStJ, BSc, HonDBA, FCA, CCMI, is Chairman of UK Finance, a Non Executive Director of

The bankruptcy of Lehman Brothers, also known as the Crash of '08 and the Lehman Shock, on September 15, 2008, was the climax of the subprime mortgage crisis. After the financial services firm was notified of a pending credit downgrade due to its heavy position in subprime mortgages, the Federal Reserve summoned several banks to negotiate financing for its reorganization. These discussions failed, and Lehman filed a Chapter 11 petition that remains the largest bankruptcy filing in U.S. history, involving more than US$600 billion in assets.

HBOS plc is a banking and insurance company in the United Kingdom, a wholly owned subsidiary of the Lloyds Banking Group, having been taken over in January 2009. It was the holding company for Bank of Scotland plc, which operated the Bank of Scotland and Halifax brands in the UK, as well as HBOS Australia and HBOS Insurance & Investment Group Limited, the group's insurance division.

Shaukat Fayyaz Ahmed Tarin is a former Pakistani Senator and banker who served as Finance Minister of Pakistan from 2008 to 2010 in the Gillani cabinet also and worked with the help of the Pakistan People’s Party's cabinet members.

Hugh E. "Skip" McGee III is an American investment banker who was formerly a senior executive at Lehman Brothers and Barclays. He is presently co-founder and chief executive officer of Intrepid Financial Partners, a power and energy focused merchant bank.

Keith Reginald Harris is a London-based investment banker and financier with a 30-year career as a senior corporate finance and takeover advisor, having held senior executive positions at leading institutions Morgan Grenfell, Drexel Burnham Lambert, Apax Partners, and HSBC Investment Bank. He is a private equity investor with interests in varied private equity holdings in financials, media, and sport.

Barclays plc is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services.

Simon Borrows is a British investment banker. He is the former head of mergers & acquisitions at Barings Bank and the former chairman of the investment bank Greenhill & Co. Since 2012, he has served as the chief executive of the private equity and venture capital firm 3i.

Silkbank Limited was a Pakistani commercial bank headquartered in Karachi. It was the smallest bank of Pakistan.

Shibata Takumi (Japanese: 柴田拓美) is a Japanese fund manager who is one of Japan's most high-profile financial executives. He is currently founding partner at Fiducia, a venture capital fund based in Tokyo.

References

- 1 2 ltd, company check. "MR SADEQ SAYEED director information. Free director information. Director id 914205692". Company Check.

- ↑ "Stocks". www.bloomberg.com.

- 1 2 3 4 5 "Financial and Business News | Financial News London". www.fnlondon.com.

- 1 2 3 4 "Nomura's European Chief Plans to Retire". New York Times. 16 March 2010. Retrieved 12 January 2012.

- ↑ Imperial College Business School, London Speaker – Financial Crises and the Behaviour of Government and Regulators from Sadeq Sayeed

- ↑ Board of Directors | JS Investments Ltd Archived 10 December 2011 at the Wayback Machine

- ↑ www.bloomberg.com https://www.bloomberg.com/research/stocks/private/relationship.asp?personId=43834614.

{{cite web}}: Missing or empty|title=(help) - ↑ "Board of Directors | Silk Bank Ltd". Archived from the original on 16 January 2012.

- ↑ "Sadeq SAYEED personal appointments - Find and update company information - GOV.UK". find-and-update.company-information.service.gov.uk.

- 1 2 3 "Record £22m Payoff For Outgoing Nomura Boss". Sky News. Retrieved 12 January 2012.

- 1 2 "Nomura to close acquisition of Lehman Brothers Europe and Middle East investment banking and equities businesses on October 13, London, 6 October 2008" (Nomura press release). Retrieved 12 January 2012.

- 1 2 "Nomura London chief set for summer retirement". Telegraph. 17 March 2010. Retrieved 12 January 2012.

- 1 2 3 "Sadeq Sayeed". The Banker. 4 June 2009. Archived from the original on 2 February 2010. Retrieved 31 January 2010.

- 1 2 3 "A biography of Sadeq Sayeed". Efinancialnews.com. 29 September 2008. Retrieved 31 January 2010.

- ↑ "History of Silkbank" Archived 17 January 2012 at the Wayback Machine Silkbank Website, accessed 4 September 2009

- ↑ "Consortium led by senior bankers Shaukat Tarin and Sadeq Sayeed completes acquisition of SPCB" The News Website, accessed 12 January 2009

- ↑ "Nomura Names Sadeq Sayeed as Executive Vice Chairman of Nomura International and Chief Executive of Acquired Businesses". Euro Investor. Retrieved 31 January 2010.

- ↑ Hosking, Patrick (22 December 2008). "Business big shot: Sadeq Sayeed". London: Times Online. Archived from the original on 11 June 2011. Retrieved 31 January 2010.

- ↑ "Sadeq Sayeed". World Bank. 3 October 2009. Retrieved 31 January 2010.

- ↑ "Ex-Deutsche Bank, Nomura Bankers Get Jail for Paschi Roles". news.bloomberglaw.com.

- ↑ "Jail terms for 13 bankers over Monte Paschi scandal". The Irish Times.

- ↑ "Ex-Deutsche Bank, Nomura Bankers Cleared in Paschi Appeals Case". Bloomberg. 6 May 2022. Retrieved 6 May 2022.