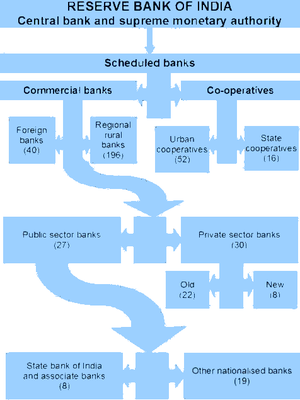

The Reserve Bank of India is India's central bank and regulatory body responsible for regulation of the Indian banking system. Owned by the Ministry of Finance of the Government of the Republic of India, it is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development.

The Indian rupee is the official currency in the Republic of India. The rupee is subdivided into 100 paise. The issuance of the currency is controlled by the Reserve Bank of India. The Reserve Bank manages currency in India and derives its role in currency management based on the Reserve Bank of India Act, 1934.

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791.

Bank rate, also known as discount rate in American English, and (familiarly) the base rate in British English, is the rate of interest which a central bank charges on its loans and advances to a commercial bank. The bank rate is known by a number of different terms depending on the country, and has changed over time in some countries as the mechanisms used to manage the rate have changed.

The IDBI Bank Limited is a Scheduled Commercial Bank under the ownership of Life Insurance Corporation of India (LIC) and Government of India. It was established by Government of India as a wholly owned subsidiary of Reserve Bank of India in 1964 as Industrial Development Bank of India, a Development Finance Institution, which provided financial services to industrial sector. In 2005, the institution was merged with its subsidiary commercial division, IDBI Bank, and was categorised as "Other Public Sector Bank" category. Later in March 2019, Government of India asked LIC to infuse capital in the bank due to high NPA and capital adequacy issues and also asked LIC to manage the bank to meet the regulatory norms. Consequent upon LIC acquiring 51% of the total paid-up equity share capital, the bank was categorised as a 'Private Sector Bank' for regulatory purposes by Reserve Bank of India with effect from 21 January 2019. IDBI was put under Prompt Corrective Action of the Reserve Bank of India and on 10 March 2021 IDBI came out of the same. At present direct and indirect shareholding of Government of India in IDBI Bank is approximately 95%, which Government of India (GoI) vide its communication F.No. 8/2/2019-BO-II dated 17 December 2019, has clarified and directed all Central/State Government departments to consider IDBI Bank for allocation of Government Business. Many national institutes find their roots in IDBI like SIDBI, EXIM, National Stock Exchange of India, SEBI, National Securities Depository Limited. Presently, IDBI Bank is one of the largest Commercial Banks in India.

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

Chennai, formerly known as Madras, is the capital city of the Indian state of Tamil Nadu. As of 2022 the Nominal GDP of the Chennai metropolitan area is ₹756,055 crore

CSB Limited is an Indian private sector bank with its headquarters at Thrissur, Kerala, India. The bank has a network of over 785 branches and more than 746 ATMs across India.

Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 of India, engaged in the business of loans and advances, acquisition of shares, stock, bonds, hire-purchase insurance business or chit-fund business, but does not include any institution whose principal business is that of agriculture, industrial activity, purchase or sale of any goods or providing any services and sale/purchase/construction of immovable property.

Saraswat Co-operative Bank Ltd. is an urban co-operative banking institution, having its headquarters in Mumbai, Maharashtra, India and operating as a co-operative society since 1918. The Founding Members of the society were J.K. Parulkar as chairman, N.B. Thakur as vice-chairman, P.N. Warde as Secretary, and Shivram Gopal Rajadhyaksha as Treasurer.

National Payments Corporation of India (NPCI) is an Indian public sector company that operates retail payments and settlement systems in India. The organization is an initiative of the Reserve Bank of India (RBI) and the Indian Banks' Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust payment and settlement infrastructure in India.

Payments banks are a new model of banks, conceptualised by the Reserve Bank of India (RBI), which cannot issue credit. These banks can accept a restricted deposit, which is currently limited to ₹200,000 per customer and may be increased further. These banks cannot issue loans and credit cards. Both current account and savings accounts can be operated by such banks. Payments banks can issue ATM cards or debit cards and provide online or mobile banking. Bharti Airtel set up India's first payments bank, Airtel Payments Bank.

Small finance banks (SFB) are a type of niche banks in India. Banks with a SFB license can provide basic banking service of acceptance of deposits and lending. The aim behind these is to provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

Paytm is an Indian multinational financial technology company, that specializes in digital payments and financial services, based in Noida, India. Paytm was founded in 2010 by Vijay Shekhar Sharma under One97 Communications. The company offers mobile payment services to consumers and enables merchants to receive payments through QR code payment, Soundbox, Android-based-payment terminal, and online payment gateway. In partnership with financial institutions, Paytm also offers financial services such as microcredit and buy now, pay later to its consumers and merchants.

The Tamil Nadu State Apex Co-operative Bank, also known as TNSC Bank, is an Indian cooperative banking company headquartered in Chennai. It was incorporated in 1905 as an urban cooperative bank. As of 2015, TNSC Bank had 51 branches in Chennai. TNSC Bank coordinates India's entire short-term cooperative credit structure.

Airtel Payments Bank is an Indian payments bank with its headquarters in New Delhi. The company is a subsidiary of Bharti Airtel. On 5 January 2022, it was granted the scheduled bank status by the Reserve Bank of India under the second schedule of RBI Act, 1934.

Paytm Payments Bank (PPBL) was an Indian payments bank, founded in 2017 and headquartered in Noida. In the same year, it received the license to run a payments bank from the Reserve Bank of India and was launched in November 2017. In 2021, the bank received a scheduled bank status from the RBI.

Kerala State Co-operative Bank Limited, branded as Kerala Bank, is an Indian co-operative bank set up by the Government of Kerala, India.

The Digital Rupee (e₹) or eINR or E-Rupee is a tokenised digital version of the Indian Rupee, issued by the Reserve Bank of India (RBI) as a central bank digital currency (CBDC). The Digital Rupee was proposed in January 2017 and launched on 1 December 2022. Digital Rupee is using blockchain distributed-ledger technology.

Financial regulation in India is governed by a number of regulatory bodies. Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the stability and integrity of the financial system. This may be handled by either a government or non-government organization. Financial regulation has also influenced the structure of banking sectors by increasing the variety of financial products available. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law.