Financial institutions, otherwise known as banking institutions, are corporations that provide services as intermediaries of financial markets. Broadly speaking, there are three major types of financial institutions:

- Depository institutions – deposit-taking institutions that accept and manage deposits and make loans, including banks, building societies, credit unions, trust companies, and mortgage loan companies;

- Contractual institutions – insurance companies and pension funds

- Investment institutions – investment banks, underwriters, brokerage firms.

Dai-ichi Kangyo Bank, Limited, abbreviated as DKB, was one of the largest banks in the world during the latter half of the 20th century. Dai-Ichi Kangyo Bank was created in 1971 by a consortium of two banks: Dai-Ichi Bank, Japan's oldest bank, and Nippon Kangyo Bank, a state financial institution that granted long-term loans to industry and agriculture.

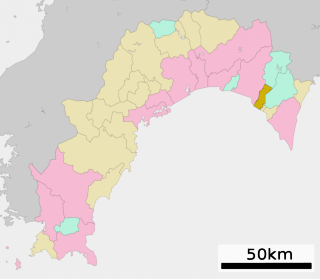

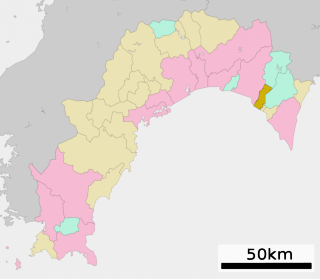

Yasuda is a town located in Aki District, Kōchi Prefecture, Japan.

Kozakai was a town located in Hoi District, Aichi Prefecture, Japan.

A 'financial system' is a system that allows the exchange of funds between lenders, investors, and borrowers. Financial systems operate at national and global levels. They consist of complex, closely related services, markets, and institutions intended to provide an efficient and regular linkage between investors and depositors.

The Canada Deposit Insurance Corporation is a Canadian federal Crown Corporation created by Parliament in 1967 to provide deposit insurance to depositors in Canadian commercial banks and savings institutions. CDIC insures Canadians' deposits held at Canadian banks up to C$100,000 in case of a bank failure. CDIC automatically insures many types of savings against the failure of a financial institution. However, the bank must be a CDIC member and not all savings are insured. CDIC is also Canada's resolution authority for banks, federally regulated credit unions, trust and loan companies as well as associations governed by the Cooperative Credit Associations Act that take deposits.

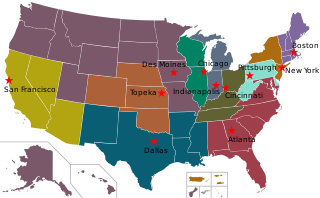

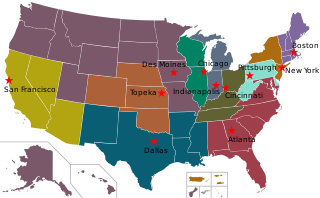

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide reliable liquidity to member financial institutions to support housing finance and community investment. With their members, the FHLBanks represents the largest collective source of home mortgage and community credit in the United States.

The main elements of Japan's financial system are much the same as those of other major industrialized nations: a commercial banking system, which accepts deposits, extends loans to businesses, and deals in foreign exchange; specialized government-owned financial institutions, which fund various sectors of the domestic economy; securities companies, which provide brokerage services, underwrite corporate and government securities, and deal in securities markets; capital markets, which offer the means to finance public and private debt and to sell residual corporate ownership; and money markets, which offer banks a source of liquidity and provide the Bank of Japan with a tool to implement monetary policy.

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

National Life Finance Corporation (NLFC) was a governmental institution of Japan, which provided business loans to small enterprises that have difficulty obtaining loans from private financial institutions.

Financial services in Japan refers to the services provided in Japan by the finance industry: banks, investment banks, insurance companies, credit card companies, consumer finance companies, government sponsored enterprises, and stock brokerages.

During the 1990s and 2000s, China's banking system underwent significant changes: banks are now functioning more like Western banks than before. Nevertheless, China's banking industry has remained in the government's hands even though banks have gained more autonomy. China is now a member of the World Trade Organization, as of December 11, 2001. The central bank of China is the People's Bank of China.

The history of banking in China includes the business of dealing with money and credit transactions in China.

A rural credit cooperative (RCC) or is a cooperative or credit union sanctioned by People's Bank of China to provide credit in the rural areas of the People's Republic of China.

A bank is a financial institution that accepts deposits from the public and creates credit. Lending activities can be performed either directly or indirectly through capital markets. Due to their importance in the financial stability of a country, banks are highly regulated in most countries. Most nations have institutionalized a system known as fractional reserve banking under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, known as the Basel Accords.

H.R. 3584 is a bill that would amend the Federal Home Loan Bank Act to treat certain privately insured credit unions as insured depository institutions for purposes of determining eligibility for membership in a federal home loan bank. This change would make such credit unions "eligible for membership in the Federal Home Loan Bank System."

Amagasaki Shinkin Bank is a bank based in Amagasaki, in Hyogo Prefecture, Japan. It was founded in 1921. As of 31 March 2015, the bank has 94 branches in Osaka and Hyogo Prefectures.

Asahi Shinkin Bank is a bank founded in 1923 and based in Tokyo, Japan. It was established on 3 August 1923. As of 31 March 2015, the bank has 164 branches in Tokyo, Saitama, and Chiba Prefectures. The bank offers customers housing loans, car loans, and loans to finance education, as well as services to companies doing business internationally. As of 29 July 2013, the bank was planning to offer reverse mortgages to customers.