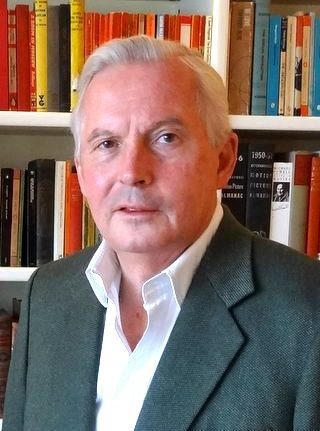

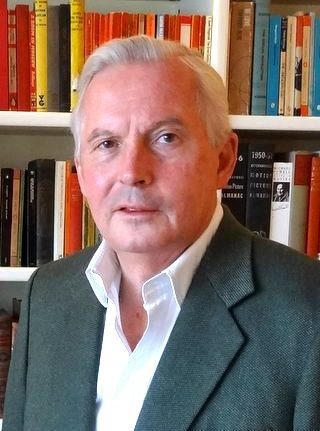

Sir Paul Rupert Judge was an English business and political figure. He served as Chairman of the Royal Society of Arts, President of the Chartered Management Institute, and Deputy Chairman of the American Management Association. He also served as the Director General of the Conservative Party and a Ministerial Advisor to the Cabinet Office. He was educated at Trinity College, Cambridge.

Lawrence M. Tanenbaum is a Canadian businessman and chairman of Maple Leaf Sports & Entertainment (MLSE). He owns a 25% stake in MLSE through his holding company Kilmer Sports Inc.

Aramex is an Emirati multinational logistics, courier and package delivery company based in Dubai, United Arab Emirates. The company was founded by Fadi Ghandour and Bill Kingson in 1982 in Amman, Jordan. It is the first Arab-based company to be listed on the NASDAQ stock exchange. Aramex is listed on the Dubai Financial Market. Othman Aljeda is CEO of the company. Aramex has approximately 18,000 employees in 70 countries.

Sir Mark Moody-Stuart KCMG is a British businessman, He was appointed non-executive chairman of Anglo American PLC in 2001, serving until 2009. He has been chairman of Hermes Equity Ownership Services since 2009.

EFG Holding S.A.E. is an Egyptian financial services company present in the Middle East, North Africa, Sub-Saharan Africa, and South Asia regions and specializes in securities brokerage, asset management, investment banking, private equity and research in addition to finance lease, factoring, microfinance, Financial technology, mortgage, and insurance. EFG Holding serves a range of clients including sovereign wealth funds, endowments, corporations, financial institutions, high-net-worth clients and individual customers. EFG Hermes is listed on the Egyptian Exchange (EGX) and London (LSE) stock exchanges. EFG Hermes has offices in Egypt, the United Arab Emirates (UAE), the Kingdom of Saudi Arabia (KSA), Pakistan, Oman, Kuwait, Jordan, Kenya, Nigeria, UK, United States and Bangladesh with over 4,500 people from 25 nationalities. They serve clients from the Middle East, North Africa, Europe and the United States. Currently, EFG Holding is listed as number 13 in Forbes' Top 50 Listed Companies in Egypt 2023.

Arif Masood Naqvi is a Pakistani-Kittian businessman, who was the founder and chief executive of the Dubai-based private equity firm, The Abraaj Group and Aman Foundation. The Abraaj Group was founded in 2002 and operated in Africa, Asia, Latin America, Middle East, Turkey and Central Asia, and is currently in liquidation due to accusations of fraud.

The Abraaj Group was a private equity firm operating in six continents that is currently in liquidation due to accusations of fraud. The firm was founded by Pakistani businessman Arif Naqvi and was based in Dubai, United Arab Emirates.

RIT Capital Partners plc, formerly Rothschild Investment Trust, is a large British investment trust dedicated to investments in quoted securities and quoted special situations. Established in 1961, the company is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. Sir James Leigh-Pemberton has been chairman since September 2019.

Actis LLP is a global investment firm focused on sustainable infrastructure, in particular the energy, infrastructure, and real estate asset classes.

Alexander Nesis is a Europe-based entrepreneur and the largest stakeholder of a private equity firm ICT Holding Ltd. (Cyprus). He was the founder and the president of the ICT Group, a private equity entity based and operated in Russia from 1991 until 2013.

The LSE SU Alternative Investments Conference is an international financial conference that focuses on hedge funds, private equity and venture capital held annually in London by the Alternative Investments Society (AIC), a Student’s Union society at the London School of Economics and Political Science (LSE).

Samena Capital is an Asia, India and MENA-focused alternative investments group, co-established in 2008 by Shirish Saraf and key partners from a cross section of industries and regions. This name was chosen due to the markets that Samena invests in. These are the Indian Subcontinent, Asia, Middle East and North Africa – a region collectively known as SAMENA. Also in ancient Buddhist script, Samena means "together" or "collective", which reflects the collective investment model the company is based on. The company and its subsidiaries employ 26 people in 3 locations worldwide, and has 48 shareholders.

Sheikh Saud bin Saqr Al Qasimi is the current ruler of the Emirate of Ras Al Khaimah, one of the seven emirates of the United Arab Emirates. He became the chief of the ruler's Emiri court in 1979, the head of the Municipal Council in 1986, and the Crown Prince and Deputy Ruler of the Emirate in June 2003. Then, he officially became the ruler of the Emirate of Ras Al Khaimah in 2010 after his father's death.

Selcuk Yorgancioglu is a Turkish/British financier. 'Yorgancioglu' is the founding partner of Tork Partners, an advisory and investment platform he founded in 2019 to invest with, advise and help manage private and institutional investors into Turkey and regional emerging markets. He also serves on the board of Bluegrove Equity Partners, a fund management firm focused on sustainable investments, and growth opportunities globally. A keen believer in e-commerce in growth markets, Yorgancioglu acted as a strategic advisor to the executive management of GittiGidiyor, a full subsidiary of eBay between 2020 and 2022. He also served as an independent board member and vice chairman of the risk & audit committee in BUPA Acıbadem Insurance company, a full subsidiary of BUPA UK between 2019 and 2023.

Ziad Makkawi is an American entrepreneur and investor, he has French nationality and was born in New York City to Lebanese parents. Makkawi has focused on the development of both the investment banking and asset management industries in the MENA region and resides in Dubia.

Nigel Cayzer is a British businessman and chairman of two London-listed funds: Aberdeen Asian Smaller Companies Investment Trust and Oryx International Growth Fund. He served as chairman of the cancer care charity Maggie's from 2005 to 2014.

Fahad Almubarak is a Minister of State and Member of the Saudi Arabian Council of Ministers and the Saudi Arabia's G20 Sherpa since 2018. He has also been a Royal Court Advisor since 2015 and the Secretary-General of G20 Saudi Secretariat as well as Member of the SABIC Board of Directors' Investment Committee since 2017.

Dr. Salem Ben Nasser Al-Ismaily is an Omani advisor at the Omani Ministry of Foreign Affairs. Al-Ismaily was previously the chairman and chief executive officer of the Sultanate of Oman Public Authority for Investment Promotion and Export Development, or Ithraa. Al Ismaily has been conferred by the Sultan of Oman, Haitham bin Tariq, the second class order of Oman and by Qaboos bin Said bin Taimur, the late Sultan of Oman, the third and the second class orders of Oman.

Fadi Ghandour is a Lebanese Jordanian entrepreneur, investor, and philanthropist. He is the Executive Chairman of Wamda, a platform that builds and invests in entrepreneurship ecosystems across the Middle East and North Africa, Turkey and East Africa through Ecosystem Development programs and a venture capital fund investing in technology-enabled companies that operate in these markets.

Izzat Dajani is a Jordanian banker and executive officer. He served as the chairman and CEO of Citibank in Qatar and is one of the founding members of the Royal Pharmaceutical Society of GB. He also is the co-founder and CEO of IMCapital Partners, and executive vice chairman of Capital Compass.