Related Research Articles

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as floating, or going public, a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded.

Utpal Bhattacharya is a finance professor at the Hong Kong University of Science and Technology. He is known for his research on market integrity, especially on insider trading.

The Gerald Loeb Awards, also referred to as the Gerald Loeb Awards for Distinguished Business and Financial Journalism, is a recognition of excellence in journalism, especially in the fields of business, finance and the economy. The award was established in 1957 by Gerald Loeb, a founding partner of E.F. Hutton & Co. Loeb's intention in creating the award was to encourage reporters to inform and protect private investors as well as the general public in the areas of business, finance and the economy.

Laurence Douglas Fink is an American billionaire businessman. He is a co-founder, chairman and CEO of BlackRock, an American multinational investment management corporation. BlackRock is the largest money-management firm in the world with more than US$10 trillion in assets under management. In April 2024, Fink's net worth was estimated at US$1.2 billion according to Forbes. He sits on the boards of the Council on Foreign Relations and the World Economic Forum.

The John E. Anderson Graduate School of Management is the graduate business school at the University of California, Los Angeles. The school offers MBA, PGPX, Financial Engineering, Business Analytics, and PhD degrees. It was named after American billionaire John E. Anderson in 1987, after he donated $15 million to the School of Management—the largest gift received from an individual by the University of California at the time.

Aswath Damodaran, is a Professor of Finance at the Stern School of Business at New York University, where he teaches corporate finance and equity valuation.

Rebecca P. Mark-Jusbasche, known during her international business career as Rebecca Mark, is the former head of Enron International, a subsidiary of Enron. She was also CEO of Azurix Corp., a publicly traded water services company originally developed by Enron International. Mark was promoted to Vice Chairman of Enron in 1998 and was a member of its board of directors. She resigned from Enron in August 2000.

David Hirshleifer is an American economist who is currently the David G. Kirby Professor of Behavior Economics at the University of Southern California Marshall School of Business. From 2006-2021 he was a Distinguished Professor of Finance and Economics at the University of California, Irvine, where he also held the Merage Chair in Business Growth. From 2018 to 2019, he served as President of the American Finance Association, and is an associate at the NBER. Previously, he was a professor at UCLA, the University of Michigan, and Ohio State University. His research is mostly related to behavioral finance and informational cascades. In 2007, he was listed as one of the 100 most-cited economists in the world by Web of Science. On Google Scholar, he has more than 60,000 citations.

Jeffrey D. Gramlich is a professor of accounting, a Howard D. and B. Phyllis Hoops Endowed Chair in Accounting, and a director of the Hoops Institute of Taxation Research and Policy at Washington State University (WSU). Previously, Gramlich served as the L.L. Bean/Lee Surace Endowed Chair at the University of Southern Maine. He has been a guest professor at Copenhagen Business School on several occasions. Earlier in his academic career he was a professor at the University of Hawaii's Shidler College of Business Administration.

The Friedman doctrine, also called shareholder theory, is a normative theory of business ethics advanced by economist Milton Friedman which holds that the social responsibility of business is to increase its profits. This shareholder primacy approach views shareholders as the economic engine of the organization and the only group to which the firm is socially responsible. As such, the goal of the firm is to increase its profits and maximize returns to shareholders. Friedman argues that the shareholders can then decide for themselves what social initiatives to take part in, rather than have an executive whom the shareholders appointed explicitly for business purposes decide such matters for them.

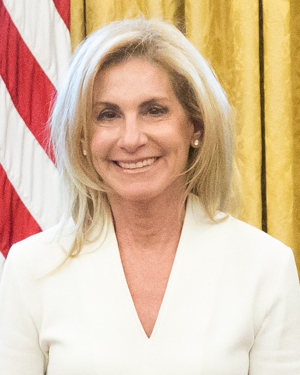

Jamie D. McCourt is the former United States Ambassador to France and Monaco who served from 2017 to 2021. She was confirmed by the Senate and sworn in on November 2, 2017. Ambassador McCourt is also the United States Permanent Observer to the Council of Europe. McCourt is the founder and CEO of Jamie Enterprises and a former executive of the Los Angeles Dodgers. She became the highest-ranking woman in Major League Baseball, appointed first as vice chairman of the Dodgers in 2004, then president in 2005, and finally CEO in 2009.

Gilles Hilary is an accountant academic, working as a Professor of Accounting and Control at Georgetown University.

Raymond J. (Ray) Ball is a researcher and educator in accounting and financial economics. He is the Sidney Davidson Distinguished Service Professor of Accounting in the University of Chicago’s Booth School of Business. He has published foundational research on the economics of financial reporting and financial markets.

Ulrike M. Malmendier is a German economist who is currently a professor of economics and finance at the University of California, Berkeley. Her work focuses on behavioral economics, corporate finance, and law and economics. In 2013, she was awarded the Fischer Black Prize by the American Finance Association.

Snap Inc. is a technology company, founded on September 16, 2011, by Evan Spiegel, Bobby Murphy, and Reggie Brown based in Santa Monica, California. The company developed and maintains technological products and services, namely Snapchat, Spectacles, and Bitmoji. The company was named Snapchat Inc. at its inception, but it was rebranded Snap Inc. on September 24, 2016, in order to include the Spectacles product under the company name.

The Gerald Loeb Award is given annually for multiple categories of business reporting: "News or Wire Service" in 2002, "News Services Online Content" in 2003–2007, "News Services" in 2008–2014, "Online" in 2008–2009 and 2013–2014, "Online Commentary and Blogging" in 2010, "Online Enterprise" in 2011–2012, and "Blogging" in 2011–2012.

The Gerald Loeb Award is given annually for multiple categories of business reporting. The "Personal Finance" category was awarded in 2010–2018, with eligibility open to print, online, and broadcast journalists who have a track record of informing and protecting individual investors and consumers without having a personal agenda or conflict of interest. The category was renamed "Personal Service" in 2019 and expanded to include journalists in all media. It was renamed "Personal Finance & Consumer Reporting" in 2020.

Francesca Cornelli is an economist who is Dean for Northwestern University's Kellogg School of Management.

Paul A. Griffin is an accountant, academic, and author. He is Distinguished Professor Emeritus at the Graduate School of Management, University of California, Davis.

Lin Peng holds the Krell Chair in Finance at the City University of New York. She is known for her work on behavioral economics.

References

- ↑ "The Accounting Review | American Accounting Association". aaahq.org. Retrieved 2022-08-14.

- ↑ "Review of Accounting Studies". Springer. Retrieved 2022-08-14.

- ↑ Management, UCLA Anderson School of (2021-08-04). "Teoh". UCLA Anderson School of Management. Retrieved 2022-08-14.

- ↑ Teoh, Siew Hong; Welch, Ivo; Wong, T.J. (December 1998). "Earnings Management and the Long-Run Market Performance of Initial Public Offerings". The Journal of Finance. 53 (6): 1935–1974. doi:10.1111/0022-1082.00079. hdl: 2027.42/95683 . S2CID 16502177.

- ↑ Hirshleifer, David; Low, Angie; Teoh, Siew Hong (August 2012). "Are Overconfident CEOs Better Innovators?". The Journal of Finance. 67 (4): 1457–1498. doi:10.1111/j.1540-6261.2012.01753.x.

- 1 2 Adams, Susan. "Overconfident CEOs Are Better Innovators". Forbes. Retrieved 2022-08-14.

- ↑ Teoh, Siew Hong (2024-05-29). "Siew Hong Teoh". scholar.google.com. Retrieved 2022-08-14.

- ↑ "Top Female Economists Rankings | IDEAS/RePEc". ideas.repec.org. Retrieved 2022-08-14.

- ↑ "Index Rules and Analyst Fatigue". Bloomberg.com. 2017-08-01. Retrieved 2022-08-14.

- ↑ Becker, Tobias (2016-06-30). "Narzissmus: Die größte Liebe unseres Lebens". Der Spiegel (in German). ISSN 2195-1349 . Retrieved 2022-08-14.