Related Research Articles

GSK plc is a British multinational pharmaceutical and biotechnology company with headquarters in London. It was established in 2000 by a merger of Glaxo Wellcome and SmithKline Beecham, which was itself a merger of a number of pharmaceutical companies around the Smith, Kline & French firm.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many international financial centers. Goldman Sachs is the second-largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. In the Forbes Global 2000 of 2024, Goldman Sachs ranked 23rd. It is considered a systemically important financial institution by the Financial Stability Board.

Judith Carol Lewent is a business executive who served as chief financial officer of Merck & Co. from 1990 until her retirement from the company in 2007. Since her retirement from Merck, she has continued to serve on multiple corporate boards, including the boards of GlaxoSmithKline, Thermo Fisher Scientific and Motorola Solutions. She also served on the board of Purdue Pharma until her departure from the company in 2014.

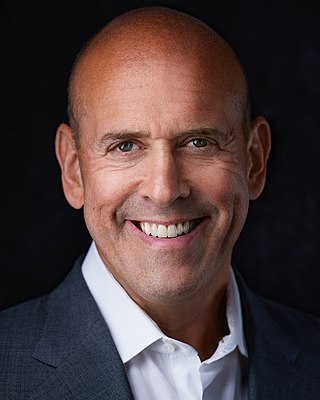

Peter Oppenheimer is the former senior vice president and Chief Financial Officer of Apple Inc. and has been a member of the board of directors of Goldman Sachs since 2014.

John Lawson Thornton is an American businessman and professor and director of the Global Leadership Program at Tsinghua University in Beijing. He is also chairman of Barrick Gold Corporation, chairman of RedBird Capital Partners and non-executive chairman of PineBridge Investments. Thornton stepped down as co-president of Goldman Sachs in 2003.

The Financial Reporting Council (FRC) is an independent regulator in the UK and Ireland based in London Wall in the City of London, responsible for regulating auditors, accountants and actuaries, and setting the UK's Corporate Governance and Stewardship Codes. The FRC seeks to promote transparency and integrity in business by aiming its work at investors and others who rely on company reports, audits and high-quality risk management.

The Hundred Group, also referred to as "The 100 Group", represents the views of the Finance Directors of FTSE 100 and several large UK private companies.

Sir Philip Roy Hampton is a British businessman. He was the first chairman of UK Financial Investments Limited in 2008 and chairman of government-owned The Royal Bank of Scotland Group between 2009 and 2015. He has also chaired GlaxoSmithKline and J Sainsbury.

Goldman Sachs Asset Management Private Equity is the private equity arm of Goldman Sachs, focused on leveraged buyout and growth capital investments globally. The group, which is based in New York City, was founded in 1986.

Sensodyne is a brand name of toothpaste and mouthwash targeted at people with sensitive teeth. Sensodyne is owned by Haleon and is marketed under the name Shumitect in Japan.

Smith, Kline & French (SKF) was an American pharmaceutical company that is now a part of the British group GSK plc.

Sir Andrew Philip Witty is a British business executive, who is the chief executive officer (CEO) of UnitedHealth Group. He was the CEO of GlaxoSmithKline between 2008 and 2017. He formerly held the role of chancellor of the University of Nottingham.

David Alan Viniar is an American businessman who was the CFO and executive vice president at Goldman Sachs from 1999 until January 31, 2013. He is currently on the board of directors of Goldman Sachs.

Harvey M. Schwartz is an American businessman. He is CEO of The Carlyle Group, the world's sixth-largest private equity firm. He is also group chairperson and a non-executive director of The Bank of London, a clearing and transaction bank. He is on the board of SoFi, a San Francisco-based fintech company, and One Mind, a mental health and brain research nonprofit organization. He worked at Goldman Sachs from 1997 to 2018, with his last post there being president and co-chief operating officer.

Anthony Noto is an American businessman and the CEO of SoFi. Previously, he was a managing director at Goldman Sachs, CFO of the National Football League, COO of Twitter, and head of Twitter Ventures.

Greenhill & Co., Inc. is an American investment banking advisory firm founded in 1996 in New York by Robert F. Greenhill. The firm provides advice on significant mergers, acquisitions, restructurings, financings, and capital raisings to leading corporations, partnerships, institutions and governments across a number of industries. Since its inception, Greenhill has advised on transactions valued at close to $3 trillion.

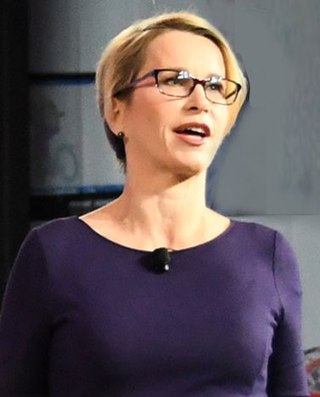

Dame Emma Natasha Walmsley is the chief executive officer (CEO) of GSK plc. She succeeded Sir Andrew Witty, who retired in March 2017. Before GSK, she worked for L'Oréal for 17 years, and was a non-executive director of Diageo until September 2016. She grew up in Barrow-in-Furness, Cumbria, England.

Jessica Rodgers Uhl is an American business executive. She is the president of GE Vernova, the vice chair of Mission Possible Partnership, an independent director of Goldman Sachs, and a member of the School of International and Public Affairs, Columbia University (SIPA) Center on Global Energy Policy advisory board. She is a former CFO of Shell and serves as a director. She has been recognized as one of the top 50 "Most Powerful Women" by Forbes for her global leadership, and by Fortune for her business leadership.

Ramon Martin Chavez is an American investment banker and entrepreneur. He is vice chairman and partner of Sixth Street Partners. Previously, he served in a variety of senior roles at Goldman Sachs, including chief information officer (2014–2017), chief financial officer, and global co-head of the firm's Securities Division. Marty was also a partner and member of Goldman's management committee. He was the chief technology officer and co-founder of Quorum Software Systems and CEO and co-founder of Kiodex. He is chairman of the board of computational pharmaceutical company Recursion, Board Observer of biotech company Earli and longevity biopharma company Cambrian Biopharma, and board member of Alphabet Inc.

The Audit, Reporting and Governance Authority is a proposed Audit regulator intended to be established in the United Kingdom to replace the Financial Reporting Council. The government announced plans for a new regulator in March 2019, and published detailed proposals in March 2021; the new regulator was expected to be fully implemented in 2023 but is delayed without a clear timetable.

References

- ↑ "Simon Paul DINGEMANS". Companies House. Retrieved 23 July 2019.

- 1 2 3 "New Chair of Financial Reporting Council announced". Gov.uk - Department for Business, Energy & Industrial Strategy. 23 July 2019. Retrieved 23 July 2019.

- 1 2 Baker, Martin, 2 July 2006, The Rainmaker: Dingemans bags his prey Telegraph. Accessed: 15 June 2020

- 1 2 3 Jack, Andrew (15 December 2011). "Pharmaceutical giant gives new finance chief a soft landing". Financial Times. Retrieved 23 July 2019.

- 1 2 Graham, Ruddick (9 September 2010). "Goldman Sachs rainmaker Simon Dingemans to join GlaxoSmithKline". Telegraph. Retrieved 23 July 2019.

- ↑ Howard, Tom (9 May 2018). "GlaxoSmithKline CFO Simon Dingemans to retire next May". Proactive Investors. Retrieved 15 June 2020.

- 1 2 Carrick, Angharad (15 June 2020). "Former FRC chairman Simon Dingemans joins Carlyle". City AM. Retrieved 15 June 2020.

- ↑ FRC’s former chairman joins private equity firm Carlyle, Financial Times

- ↑ Hemley, Matthew (16 May 2018). "Martha Lane Fox joins Donmar Warehouse board". The Stage. Retrieved 23 July 2019.

- ↑ Foster, Mike. "Ex-Goldman bankers back City's newest robo-adviser" . Retrieved 2017-12-22.

- ↑ Goldsmith, Courtney (2017-09-19). "Wealth manager Netwealth raises £10m in second funding round" . Retrieved 2017-12-22.

- ↑ "Bonham Carter backs launch of online discretionary manager Netwealth". investmentweek.co.uk. Retrieved 2017-12-22.