Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation.

Dumping, in economics, is a form of predatory pricing, especially in the context of international trade. It occurs when manufacturers export a product to another country at a price below the normal price with an injuring effect. The objective of dumping is to increase market share in a foreign market by driving out competition and thereby create a monopoly situation where the exporter will be able to unilaterally dictate price and quality of the product. Trade treaties might include mechanisms to alleviate problems related to dumping, such as countervailing duty penalties and anti-dumping statutes.

The special territories of members of the European Economic Area (EEA) are the 32 special territories of EU member states and EFTA member states which, for historical, geographical, or political reasons, enjoy special status within or outside the European Union and the European Free Trade Association.

The presence of the logo on commercial products indicates that the manufacturer or importer affirms the goods' conformity with European health, safety, and environmental protection standards. It is not a quality indicator or a certification mark. The CE marking is required for goods sold in the European Economic Area (EEA); goods sold elsewhere may also carry the mark.

The Undertakings for Collective Investment in Transferable Securities Directive (UCITS) 2009/65/EC is a consolidated EU directive that allows collective investment schemes to operate freely throughout the EU on the basis of a single authorisation from one member state. EU member states are entitled to have additional regulatory requirements for the benefit of investors.

Intrastat is the system for collecting information and producing statistics on the trade in goods between countries of the European Union (EU). It began operation on 1 January 1993, when it replaced customs declarations as the source of trade statistics within the EU. The requirements of Intrastat are similar in all member states of the EU, although there are important exceptions.

The TARIC code is designed to show the various rules applying to specific products when imported into the EU. This includes the provisions of the harmonised system and the combined nomenclature but also additional provisions specified in Community legislation such as tariff suspensions, tariff quotas and tariff preferences, which exist for the majority of the Community’s trading partners. In trade with third countries, the 10-digit Taric code must be used in customs and statistical declarations.

A Certificate of Origin or Declaration of Origin is a document widely used in international trade transactions which attests that the product listed therein has met certain criteria to be considered as originating in a particular country. A certificate of origin / declaration of origin is generally prepared and completed by the exporter or the manufacturer, and may be subject to official certification by an authorized third party. It is often submitted to a customs authority of the importing country to justify the product's eligibility for entry and/or its entitlement to preferential treatment. Guidelines for issuance of Certificates of Origin by chambers of commerce globally are issued by the International Chamber of Commerce.

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. It is a globally accepted guarantee for customs duties and taxes which can replace the security deposit required by each customs authority. It can be used in multiple countries in multiple trips up to its one-year validity. The acronym ATA is a combination of French and English terms "Admission Temporaire/Temporary Admission". The ATA carnet is now the document most widely used by the business community for international operations involving temporary admission of goods.

Currently, all of the European microstates have some form of relations with the European Union (EU).

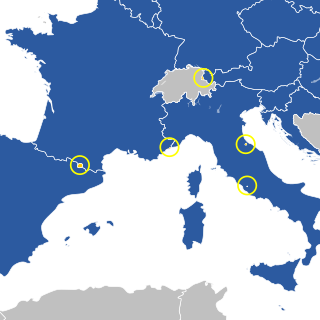

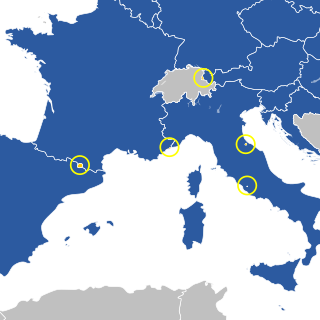

The European Union Customs Union (EUCU), formally known as the Community Customs Union, is a customs union which consists of all the member states of the European Union (EU), Monaco, and the British Overseas Territory of Akrotiri and Dhekelia. Some detached territories of EU states do not participate in the customs union, usually as a result of their geographic separation. In addition to the EUCU, the EU is in customs unions with Andorra, San Marino and Turkey, through separate bilateral agreements.

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

The Body of European Regulators for Electronic Communications (BEREC) is the body in which the regulators of the telecommunications markets in the European Union work together. Other participants are the representatives of the European Commission, as well as telecommunication regulators from the member states of the EEA and of states that are in the process of joining the EU.

Regulation No. 305/2011 of the European Parliament and of the Council of the European Union is a regulation of 9 March 2011 which lays down harmonised conditions for the marketing of construction products and replaces Construction Products Directive (89/106/EEC). This EU regulation is designed to simplify and clarify the existing framework for the placing on the market of construction products. It replaced the earlier (1989) Construction Products Directive (89/106/EEC).

The Treaties of the European Union are a set of international treaties between the European Union (EU) member states which sets out the EU's constitutional basis. They establish the various EU institutions together with their remit, procedures and objectives. The EU can only act within the competences granted to it through these treaties and amendment to the treaties requires the agreement and ratification of every single signatory.

A customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory. Most countries require travellers to complete a customs declaration form when bringing notified goods across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

The United Kingdom's post-Brexit relationship with the European Union and its members is governed by the Brexit withdrawal agreement and the EU–UK Trade and Cooperation Agreement. The latter was negotiated in 2020 and has applied since January 2021.

An Economic Operators Registration and Identification number is a European Union registration and identification number for businesses which undertake the import or export of goods into or out of the EU.

The Brexit withdrawal agreement, officially titled Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community, is a treaty between the European Union (EU), Euratom, and the United Kingdom (UK), signed on 24 January 2020, setting the terms of the withdrawal of the UK from the EU and Euratom. The text of the treaty was published on 17 October 2019, and is a renegotiated version of an agreement published half a year earlier. The earlier version of the withdrawal agreement was rejected by the House of Commons on three occasions, leading to the resignation of Theresa May as Prime Minister and the appointment of Boris Johnson as the new prime minister on 24 July 2019.