Microcredit is the extension of very small loans (microloans) to impoverished borrowers who typically lack collateral, steady employment, or a verifiable credit history. It is designed to support entrepreneurship and alleviate poverty. Many recipients are illiterate, and therefore unable to complete paperwork required to get conventional loans. As of 2009 an estimated 74 million people held microloans that totaled US$38 billion. Grameen Bank reports that repayment success rates are between 95 and 98 percent.

Microfinance is a category of financial services targeted at individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems. Microfinance services are designed to be more affordable to poor and socially marginalized customers and to help them become self-sufficient.

Accion is a global nonprofit with a mission to advance financial inclusion by giving people the financial tools to improve their lives. Founded as a community development initiative serving the poor in Venezuela, Accion is known as a pioneer in the fields of microfinance and fintech impact investing.

The United Nations Capital Development Fund (UNCDF) is the UN’s capital investment agency for the world’s 48 least developed countries.

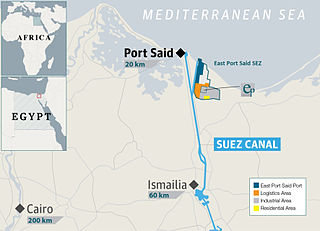

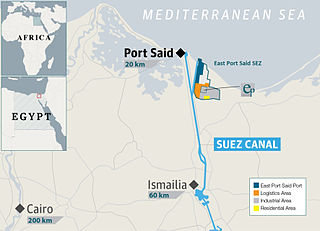

Port Fuad or Port Fouad is a city in Port Said Governorate, Egypt. Port Fuad is located in northeastern Egypt at the northwestern-most tip of the Sinai Peninsula, across from the city of Port Said on the Asian side of the Suez Canal. Port Fuad is considered a suburb of Port Said and together they form a metropolitan area of over one million residents, one of only two in the world that spans two continents along with Istanbul, Turkey. Port Fuad has a population of 81,591.

The Forum for the Future in Bahrain on 11–12 November 2005 brought together, by suggestion of the prime minister of Spain, José Luis Rodríguez Zapatero, the leaders of states of the Middle East, industrialised countries of the Group of Eight (G8) and other partners to promote political, economic and social reform in the region. Delegates at the conference included US Secretary of State, Condoleezza Rice, British Foreign Secretary Jack Straw, French Foreign Minister Philippe Douste-Blazy and Arab League Secretary General, Amr Moussa. The Forum members discussed an agenda to promote the values of human dignity, democracy, economic opportunity, and social justice.

National Bank for Agriculture and Rural Development (NABARD) is an apex development financial institution in India, headquartered at Mumbai with regional offices all over India. The Bank has been entrusted with "matters concerning policy, planning and operations in the field of credit for agriculture and other economic activities in rural areas in India". NABARD is active in developing financial inclusion policy.

Kiva Microfunds is a 501(c)(3) non-profit organization that allows people to lend money via the Internet to low-income entrepreneurs and students in over 80 countries. Kiva's mission is "to connect people through lending to alleviate poverty."

Micro financing in Tanzania started in 1995 with SACCOS and NGOs. It has since then contributed to the increasing success of international micro financing. Microfinance stills remains a relatively new in Tanzania since it has not penetrated yet. Since 1995, microfinance has been linked to poverty alleviation programs and women. The government made efforts to ensure commercial banks have continued to provide financial support to the small entrepreneurial business. However a microfinance National Policy was implemented in 2002 to encourage and support microfinances in the country. Since the implementation, micro financing was officially launched and recognized as a poverty alleviation tool. Due to its increase exposure and use in the nation, commercial banks have developed interests in to offer microfinance. There are various microfinance banks that functions as supporting institutions in the country that usually provide microfinance services. These may include the CRDB, National Microfinance Bank, and AKIBA. However there are also other few banks that are concerned with micro financing in Tanzania such as the PRIDE and SEDA, Tanzania Postal Bank and FINCA. Community and small banks have also expressed interest in the same including the NGOs and other non-profit organizations.

FINCA International is a non-profit, microfinance organization, founded by John Hatch in 1984. Sometimes referred to as the "World Bank for the Poor", FINCA is the innovator of the village banking methodology in microcredit and is widely regarded as one of the pioneers of modern-day microfinance. With its headquarters in Washington, D.C., FINCA has 20 affiliated host-country institutions (affiliates), in Latin America and the Caribbean, Africa, Eurasia and the Middle East and South Asia. Along with Grameen Bank and Accion International, FINCA is considered to be one of the most influential microfinance organizations in the world.

A social fund is an institution, typically in a developing country, that provides financing for small-scale public investments targeted at meeting the needs of poor and vulnerable communities. Social Funds also aim at contributing to social capital and development at the local level. In many cases they serve as innovators and demonstrators of new methods of decentralized participatory decision-making, management, and accountability that may be adopted for broader application by public sector organizations.

The Ministry of Interior of Egypt is a part of the Cabinet of Egypt. It is responsible for law enforcement in Egypt. On March 5, 2015 Magdy Abdel Ghaffar was appointed Minister of Interior.

Pathways to Higher Education (PHE/EG) is a soft-skills oriented training program funded by Ford Foundation in fourteen different countries across the globe, and implemented in Egypt by Cairo University represented by CAPSCU in three phases over a period of ten years, starting 2002 through 2012. The main objectives of PHE/EG is to enhance the skills of socially disadvantaged (underprivileged) groups among the university students and graduates, focusing on students and graduates of humanities and social sciences specializations preserving gender equal opportunity, with a primary view to improving their chances of access to postgraduate studies, enhancing their prospects to benefit from any scholarships programs, and/or maximizing their potential for acquiring better employment opportunities. These developmental issues are in-line with the overall objectives and reform strategy of the Egyptian Ministry of Higher Education (MOHE) that is being implemented in phases by the Projects Management Unit (PMU/MOHE). To achieve an effective outreach, CAPSCU established partnerships with counterpart stakeholders concerned with skills-oriented human resources capacity building. One of the partners is the Social Fund for Development (SFD)] a government funding mechanism that provides support for graduates to start their own businesses. In addition, the main beneficiaries are the ten Egyptian public universities participating in Phase-I & Phase-II of the PHE/EG project, namely Cairo, Ain-Shams, Assiut, Helwan, Minia, South Valley, Fayoum, Beni-Suef, Benha and Suhag, as well as the remaining eight of the existing eighteen public universities that will participate in Phase-III, namely, Alexandria, Mansoura, Zagazig, Menoufia, Tanta, Suez Canal, Kafr El-Sheikh, Port Said and Damanhoor. The Management Team of PHE/EG project established a management network infrastructure/mechanism that allows for the concurrent implementation of the PHE/EG training programs in all public universities, biannually during mid-term and summer holidays. This entails having a project coordinator in each university working closely with the PHE/EG management team to cater for all logistical matters for running the training programs , including; interviews of applicants that meet the preliminary online screening criteria, providing them with automated online assessment tests and selecting the successful applicants for the training programs. In addition, project coordinators, being senior faculty members in their respective universities, were able to provide job opportunities to some of the distinguished trainees.

The National Anti-Poverty Commission (NAPC) is a government agency of the Republic of the Philippines. It coordinates poverty reduction programs by national and local governments and ensures that marginalized sectors participate in government decision-making processes.

AccessBank Liberia (ABL), is a microfinance commercial bank in Liberia. It is one of the commercial banks licensed by the Central Bank of Liberia, the national banking regulator.

Ministry of Housing, Utilities and Urban Communities (MOHUUC) is the Egyptian ministry responsible for the construction, and infrastructure of urban communities and utilities. Its headquarters are located in Cairo and Mostafa Madbouli has served as minister since 2014. This ministry works in affiliation with the New Urban Communities Authority.

Gray Matters Capital is an impact investing foundation founded by Bob Pattillo. Its mission is to achieve "An education leading to a purpose filled life for 100, Million Women by 2036." GMC is based in Atlanta, Georgia with global offices in Nairobi, Kenya and Bangalore, India. The scale and the use of business practices with social enterprises makes it one of the leaders in impact investing.

East Port Said Industrial Zone is an industrial park with a total area of 1600 ha in Port Fuad, Egypt. The main developer and promoter of the park is East Port Said Development Co; It is located at the northern end of the Suez Canal Special Economic Zone.

The National Telecommunications Regulatory Authority, commonly known as NTRA, is the Egypt government-approved regulatory and competition authority that was established in accordance of the Egyptian telecommunication regulation law No. 10/ 2003 as the national authority equipped to regulate and administer the telecommunications region..Regulating the competition environment between the operators inside the industry according to the Egyptian constitution was a huge mandatory case after the huge rate of telecommunication technology growth, as well as ensuring the availability of qualitative and green telecommunications services.

The Uganda Microfinance Regulatory Authority (UMRA), is a government agency responsible for the licensing, supervision and regulation of Tier-4 micro finance institutions, money lenders, savings cooperatives and any money-lending institution with capital of less that USh500 million (US$140,000). Tier-4 institutions are those that do not accept financial deposits and are not under the supervision of the Bank of Uganda, the central bank and national banking regulator.