Related Research Articles

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform.

A conglomerate is a type of multi-industry company that consists of several different and unrelated business entities that operate in various industries under one corporate group. A conglomerate usually has a parent company that owns and controls many subsidiaries, which are legally independent but financially and strategically dependent on the parent company. Conglomerates are often large and multinational corporations that have a global presence and a diversified portfolio of products and services. Conglomerates can be formed by merger and acquisitions, spin-offs, or joint ventures.

The Toronto Stock Exchange is a stock exchange located in Toronto, Ontario, Canada. It is the 11th largest exchange in the world and the third largest in North America based on market capitalization. Based in the EY Tower in Toronto's Financial District, the TSX is a wholly owned subsidiary of the TMX Group for the trading of senior equities.

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public company can be listed on a stock exchange, which facilitates the trade of shares, or not. In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are private enterprises in the private sector, and "public" emphasizes their reporting and trading on the public markets.

William Jaird Levitt was an American real-estate developer and housing pioneer. As president of Levitt & Sons, he is widely credited as the father of modern American suburbia. He was named one of Time Magazine's "100 Most Influential People of the 20th Century."

40 Wall Street, also known as the Trump Building, is a 927-foot-tall (283 m) neo-Gothic skyscraper on Wall Street between Nassau and William streets in the Financial District of Manhattan in New York City. Erected in 1929–1930 as the headquarters of the Manhattan Company, the building was formerly known as the Bank of Manhattan Trust Building and the Manhattan Company Building. 40 Wall Street was designed by H. Craig Severance with Yasuo Matsui and Shreve & Lamb. The building is a New York City designated landmark and is listed on the National Register of Historic Places (NRHP); it is also a contributing property to the Wall Street Historic District, an NRHP district.

Arthur Levitt Jr. is the former Chairman of the United States Securities and Exchange Commission (SEC). He served from 1993 to 2001 as the twenty-fifth and longest-serving chairman of the commission. Widely hailed as a champion of the individual investor, he has been criticized for not pushing for tougher accounting rules. Since May 2001 he has been employed as a senior adviser at the Carlyle Group. Levitt previously served as a policy advisor to Goldman Sachs and is a Director of Bloomberg LP, parent of Bloomberg News.

The Manhattan Company was a New York bank and holding company established on September 1, 1799. The company merged with Chase National Bank in 1955 to form the Chase Manhattan Bank. It is the oldest of the predecessor institutions that eventually formed the current JPMorgan Chase & Co.

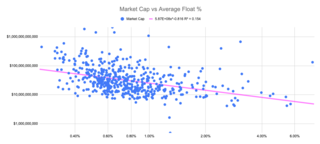

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection of what public investors consider the company to be worth. In this context, the float may refer to all the shares outstanding that can be publicly traded.

V. Vivaudou Inc., was an American perfume manufacturer that operated in New York City. V. Vivaudou Inc., was taken over by the United Drug Company in February 1916, for a price of $1,500,000. Among its perfume and cosmetics line, Mavis Talcum Vivaudou red tin was quite often part of the women's toiletries checklist. In August 1919 the United Drug Company sold V. Vivaudou Inc., to a syndicate of New York City men for $2,500,000. In 1920, it was considered one of the world's largest manufacturers of toiletries.

The Segal Lock and Hardware Company of Manhattan, New York, was a leading manufacturer of hardware merchandise and razor blades in the 1920s and 1930s. Established in Connecticut and Manhattan, the firm relocated to Brooklyn, New York, in the mid-1920s. The Segal Safety Razor Corporation was a subsidiary of the Segal Lock and Hardware Company. The business was at first known as the Burglar-Proof Lock Company.

Deco Refreshments, Inc. was a restaurant chain in Buffalo, New York which operated thirty-nine restaurants in 1929. It was started in December 1926 with an initial capitalization of $150,000. This increased to $250,000 in February 1928. Deco Refreshments, Inc., it experienced major growth in the late 1920s and early 1930s. Its stock was popular and was included in the portfolio of the Niagara Share Corporation, which held 7,580 shares of Deco Refreshments, Inc., in February 1931.

American Phenix Corporation of New York was a business incorporated in October 1927 to act as an agent for reinsurance and other insurance companies. It owned and held capital stock and purchased all the stock of the Reinsurance Corporation of America. The business was noteworthy because of its involvement in New York City insurance affairs and its increasing capitalization, prior to its liquidation in November 1932.

Levitt & Sons was a real estate development company founded by Abraham Levitt and later managed by his son William Levitt. The company is most famous for having built the town of Levittown, New York. The company's designs and building practices revolutionized the home building industry and altered the north eastern landscape of the United States with massive suburban communities.

Actua Corporation was a venture capital firm. During the dot com bubble, the company had a market capitalization of over $50 billion. The company was originally known as Internet Capital Group, Inc. and changed its name to Actua Corporation in September 2014. In 2018, the company underwent liquidation.

Thompson–Starrett Co. was an American construction contracting and engineering firm based in New York City that operated from 1899 until 1968.

Sorgente Group Italy and Sorgente Group of America (US) are part of Sorgente Group Alternative Investment (US) in which the major shareholder is Valter Mainetti. The operative real estate companies, financial and real estate services companies are 94 and are located in Italy, France, Switzerland, Great Britain, Luxembourg, USA and Brazil, with field offices in Rome, New York and Luxembourg. The total real estate assets owned, managed and administrated by the funds and the underlying companies amounts to €5 billion at January 2019. 30% of the 'Gazzetta del Mezzogiorno' was acquired through the Group, the percentage has fallen at 2% in 29.06.2018. By means of a subsidiary called 'Musa Comunicazione', the Group also holds 100% shares of the newspaper ‘Il Foglio Quotidiano’ and 80% shares of ‘Tempi’.

The American Stock Exchange Building, formerly known as the New York Curb Exchange Building and also known as 86 Trinity Place or 123 Greenwich Street, is the former headquarters of the American Stock Exchange. Designed in two sections by Starrett & van Vleck, it is located between Greenwich Street and Trinity Place in the Financial District of Lower Manhattan in New York City, with its main entrance at Trinity Place. The building represents a link to the historical practices of stock trading outside the strictures of the New York Stock Exchange (NYSE), which took place outdoors "on the curb" prior to the construction of the structure.

RXR Realty is a real estate and infrastructure owner, investor, operator, and developer headquartered in New York. Many of RXR's holdings are located in New York City, but the firm owns buildings and development sites across the United States. RXR is a private company, and is led by Scott Rechler as CEO. Rechler serves on the Board of Directors for the Federal Reserve Bank of New York, was formerly appointed by New York Governor Andrew Cuomo as vice chairman of the board of commissioners of the Port Authority of New York and New Jersey, and also served as a member of the board of the New York Metropolitan Transportation Authority and as chair of the Regional Plan Association.

Brookfield Property Partners L.P. is a global commercial real estate firm that is a publicly traded limited partnership and a subsidiary of Brookfield Asset Management, an alternative asset management company. Its portfolio includes properties in the office, multi-family residential, retail, hospitality, and logistics industries throughout North America, Europe, and Australia. Its subsidiary Brookfield Properties is responsible for the management of these facilities.

References

- 1 2 Jackson, Kenneth T., ed. (2010). The Encyclopedia of New York City (2nd ed.). New Haven: Yale University Press. p. 1230. ISBN 978-0-300-11465-2.

- 1 2 3 4 "New Starrett Company: Corporation to Acquire Capital of Construction Concern" (PDF). The New York Times . March 4, 1929.

- ↑ Starrett Corporation, Wall Street Journal, February 22, 1929, pg. 14.

- 1 2 3 4 5 Funding Universe: Starrett Corporation" retrieved May 26, 2017

- ↑ "Buyout to proceed". Crains News. Retrieved July 6, 2017.

- 1 2 "Investor to Pay $80.4 Million To Buy Starrett Corporation", New York Times , June 27, 1997, pg. B5.

- ↑ Croghan, Lore. "New Starrett dusts off drawing board, shifts its focus to local development". Crains News. Retrieved July 7, 2017.

- ↑ "Investors to take over Starrett for 80 million". NY Times. Retrieved July 6, 2017.

- ↑ "Starrett gets new leader", New York Times , April 14, 1998.

- ↑ Starrett Corporation, Wall Street Journal, December 16, 1929, pg. 12.