Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

In economics, inflation is a general increase of the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but sudden deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e., when inflation declines to a lower rate but is still positive.

Purchasing power parity (PPP) is a measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries' currencies. PPP is effectively the ratio of the price of a basket of goods at one location divided by the price of the basket of goods at a different location. The PPP inflation and exchange rate may differ from the market exchange rate because of tariffs, and other transaction costs.

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate, housing starts, consumer price index, Inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and changes in credit conditions.

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro.

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time. The CPI is calculated by using a representative basket of goods and services. The basket is updated periodically to reflect changes in consumer spending habits. The prices of the goods and services in the basket are collected monthly from a sample of retail and service establishments. The prices are then adjusted for changes in quality or features. Changes in the CPI can be used to track inflation over time and to compare inflation rates between different countries. The CPI is not a perfect measure of inflation or the cost of living, but it is a useful tool for tracking these economic indicators.

Pricing is the process whereby a business sets the price at which it will sell its products and services, and may be part of the business's marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the marketplace, competition, market condition, brand, and quality of product.

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability. Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since that, though it is still the official strategy in a number of emerging economies.

An estate agent is a person or business that arranges the selling, renting, or managing of properties and other buildings. An agent that specialises in renting is often called a letting or management agent. Estate agents are mainly engaged in the marketing of property available for sale, and a solicitor or licensed conveyancer is used to prepare the legal documents. In Scotland, however, many solicitors also act as estate agents, a practice that is rare in England and Wales.

Household final consumption expenditure (POES) is a transaction of the national account's use of income account representing consumer spending. It consists of the expenditure incurred by resident households on individual consumption goods and services, including those sold at prices that are not economically significant. It also includes various kinds of imputed expenditure of which the imputed rent for services of owner-occupied housing is generally the most important one. The household sector covers not only those living in traditional households, but also those people living in communal establishments, such as retirement homes, boarding houses and prisons.

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services.

The Harmonised Index of Consumer Prices (HICP) is an indicator of inflation and price stability for the European Central Bank (ECB). It is a consumer price index which is compiled according to a methodology that has been harmonised across EU countries. The euro area HICP is a weighted average of price indices of member states who have adopted the euro. The primary goal of the ECB is to maintain price stability, defined as keeping the year on year increase HICP below but close to 2% for the medium term. In order to do that, the ECB can control the short-term interest rate through Eonia, the European overnight index average, which affects market expectations. The HICP is also used to assess the convergence criteria on inflation which countries must fulfill in order to adopt the euro. In the United Kingdom, the HICP is called the CPI and is used to set the inflation target of the Bank of England.

The United States Consumer Price Index (CPI) is a set of various consumer price indices published monthly by the U.S. Bureau of Labor Statistics (BLS). The most commonly used are the CPI-U and the CPI-W, though many alternative versions exist. The CPI-U is the most popular measure of consumer inflation in the United States.

A flat fee, also referred to as a flat rate or a linear rate refers to a pricing structure that charges a single fixed fee for a service, regardless of usage. Less commonly, the term may refer to a rate that does not vary with usage or time of use.

Constant purchasing power accounting (CPPA) is an accounting model that is an alternative to model historical cost accounting under high inflation and hyper-inflationary environments. It has been approved for use by the International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB). Under this IFRS and US GAAP authorized system, financial capital maintenance is always measured in units of constant purchasing power (CPP) in terms of a Daily CPI during low inflation, high inflation, hyperinflation and deflation; i.e., during all possible economic environments. During all economic environments it can also be measured in a monetized daily indexed unit of account or in terms of a daily relatively stable foreign currency parallel rate, particularly during hyperinflation when a government refuses to publish CPI data.

Inflation rate in India was 5.5% as of May 2019, as per the Indian Ministry of Statistics and Programme Implementation. This represents a modest reduction from the previous annual figure of 9.6% for June 2011. Inflation rates in India are usually quoted as changes in the Wholesale Price Index (WPI), for all commodities.

In economics, shrinkflation, also known as the grocery shrink ray, deflation, or package downsizing, is the process of items shrinking in size or quantity, or even sometimes reformulating or reducing quality, while their prices remain the same or increase. The word is a portmanteau of the words shrink and inflation. First usage of the term "shrinkflation" with its current meaning has been attributed to the economist Pippa Malmgren, though the same term had been used earlier by historian Brian Domitrovic to refer to an economy shrinking while also suffering high inflation.

Also known as partitioned pricing or shrouded pricing, drip pricing is a technique used by online retailers of goods and services whereby a headline price is advertised at the beginning of the purchase process, following which additional fees, taxes or charges, which may be unavoidable, are then incrementally disclosed or "dripped". The objective of drip pricing is to gain a consumer's interest in a misleadingly low headline price without the true final price being disclosed until the consumer has invested time and effort in the purchase process and made a decision to purchase. Naïve consumers will purchase based on headline price and sophisticated consumers will consider total cost when comparing offers. Drip pricing can distort competition because it can make it difficult for businesses with more transparent pricing practices to compete on a level playing field.

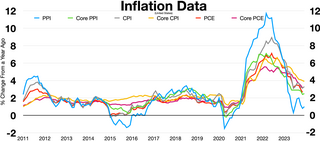

A worldwide increase in inflation began in mid-2021, with many countries seeing their highest inflation rates in decades. It has been attributed to various causes, including pandemic-related economic dislocation, supply chain problems, the fiscal and monetary stimuli provided in 2020 and 2021 by governments and central banks around the world in response to the pandemic, and price gouging. Recovery in demand through 2021 ultimately led to historic and broad supply shortages amid increasing consumer demand. Worldwide construction sectors were also hit.