Credit Suisse First Boston was the investment banking affiliate of Credit Suisse headquartered in New York.

Donaldson, Lufkin & Jenrette (DLJ) was a U.S. investment bank founded by William H. Donaldson, Richard Jenrette, and Dan Lufkin in 1959. Its businesses included securities underwriting; sales and trading; investment and merchant banking; financial advisory services; investment research; venture capital; correspondent brokerage services; online, interactive brokerage services; and asset management.

Wasserstein Perella & Co. was a boutique investment bank established by Bruce Wasserstein, Joseph R. Perella, Bill Lambert, and Charles Ward in 1988, former bankers at First Boston Corp., until its eventual sale to Dresdner Bank in 2000 for some $1.4 billion in stock. The private equity business of the investment firm was not included in the sale and was to be sold off to existing Wasserstein shareholders.

Richard Hampton Jenrette was an American businessman who co-founded the investment bank Donaldson, Lufkin & Jenrette (DLJ).

The First Boston Corporation was a New York–based bulge bracket investment bank, founded in 1932 and acquired by Credit Suisse in 1988. After the acquisition, it operated as an independent investment bank known as CS First Boston until 2006, when the company was fully integrated into Credit Suisse. In 2022, Credit Suisse revived the "First Boston" brand as part of an effort to spin out the business.

Phoenix Equity Partners is a United Kingdom mid-market private equity firm. It specialises in working with management teams to help grow their businesses. It invests in companies valued at up to £150m.

aPriori Capital Partners is a private equity investment firm focused on leveraged buyout transactions. The firm was founded as an affiliate of Credit Suisse and traces its roots to Donaldson, Lufkin & Jenrette, the investment bank acquired by Credit Suisse First Boston in 2000. The private equity arm also manages a group of investment vehicles including Real Estate Private Equity, International Private Equity, Growth capital, Mezzanine debt, Infrastructure, Energy and Commodities Focused, fund of funds, and Secondary Investments.

Blackstone Credit, formerly known as GSO Capital Partners (GSO) is an American hedge fund and the credit investment arm of The Blackstone Group. Blackstone Credit is one of the largest credit-oriented alternative asset managers in the world and a major participant in the leveraged finance marketplace. The firm invests across a variety of credit oriented strategies and products including collateralized loan obligation vehicles investing in secured loans, hedge funds focused on special situations investments, mezzanine debt funds and private equity funds focused on rescue financing.

Diamond Castle Holdings is a private equity firm focused on leveraged buyout and growth capital investments in middle-market companies across a range of industries including the media, healthcare, financial services, power and industrial sectors.

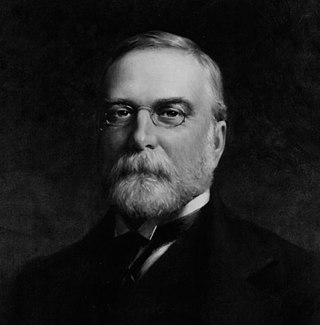

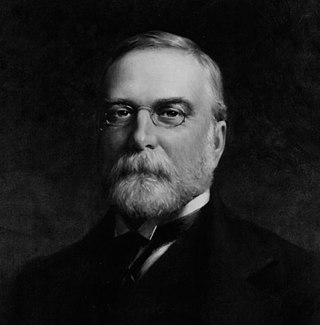

Robert Winthrop was a wealthy banker and capitalist in New York City.

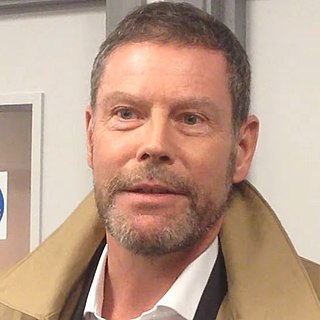

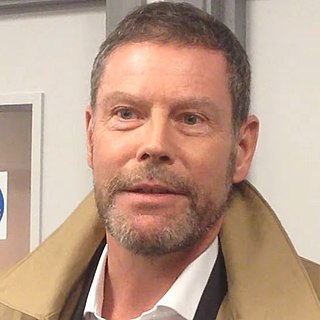

Henry D. Jackson is an American investor and entrepreneur, who has been a UK citizen since 2005. He is chief executive of OpCapita LLP, a London-based private equity firm. Jackson founded OpCapita in early 2006 alongside operating partners David Hamid and John von Spreckelsen.

Kenneth D. Moelis is an American billionaire investment banker. He is also the founder, chairman and CEO of Moelis & Company, a global independent investment banking firm.

Sir Hector William Hepburn Sants is a British investment banker. He was appointed chief executive officer of the Financial Services Authority in July 2007 and stepped down in June 2012. He took up a new position with Barclays Bank at the end of January 2013, but resigned from the bank on 13 November 2013.

Haas Wheat & Partners is a private equity firm focused on leveraged buyout transactions. The firm targets specialty middle-market manufacturing, distribution and service companies, particularly family-controlled companies and corporate spin-outs.

John P. Costas is an American businessman, banker, and trader. He is the former chairman and CEO of UBS Investment Bank, where he oversaw the growth of the Swiss bank's investment banking franchise globally from 2000 to 2005. From 2005 through 2007, Costas was the chairman and CEO of Dillon Read Capital Management, a UBS proprietary trading unit and alternatives management company.

Peter Thacher Grauer is an American businessman. He has been a member of the Bloomberg L.P. board since October 1996 and was chairman of the board from 2001 to 2023. Grauer joined Bloomberg full-time in his executive capacities in March 2002. Prior to becoming a member of Bloomberg L.P. in 1996, Grauer was the founder of DLJ Merchant Banking Partners and Investment. He is the lead independent director of DaVita Inc.

Dominick and Dickerman LLC is an investment and merchant banking firm headquartered in New York City. It also has offices in Basel, Switzerland. From 1899 to 2015, the firm was known as Dominick and Dominick but after selling off its wealth management business, the firm reverted to its original name, Dominick and Dickerman.

Hamilton Evans "Tony" James is an American billionaire investment banker. He is the former president, chief operating officer, and executive vice chairman of Blackstone, a New York–based global asset management firm. James has been chairman of the multinational retail chain Costco since August 2017. Since 2021, he has been co-chair of the board of trustees of the Metropolitan Museum of Art in New York.

George Sumner Bradford Dana Gould was an American financier and banker. Gould was a member of the board of Municipal Assistance Corporation that was constituted during the 1975 New York City fiscal crisis and briefly served as its chairman in 1979. He was the Undersecretary of the Treasury in the late 1980s during the Reagan administration. During this period he oversaw the savings and loan crisis, the aftermath of the 1987 Black Monday stock market crash, and the raising of the country's debt ceiling.

Charles D. Harman is a British banker and businessman. He was vice chairman of J.P.Morgan Cazenove in 2015–2022. He has been a member of council of the University of Oxford since 2018.