Related Research Articles

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional companies. Before its bankruptcy on December 2, 2001, Enron employed approximately 20,600 staff and was a major electricity, natural gas, communications, and pulp and paper company, with claimed revenues of nearly $101 billion during 2000. Fortune named Enron "America's Most Innovative Company" for six consecutive years.

Nortel Networks Corporation (Nortel), formerly Northern Telecom Limited, was a Canadian multinational telecommunications and data networking equipment manufacturer headquartered in Ottawa, Ontario, Canada. It was founded in Montreal, Quebec in 1895 as the Northern Electric and Manufacturing Company. Until an antitrust settlement in 1949, Northern Electric was owned mostly by Bell Canada and the Western Electric Company of the Bell System, producing large volumes of telecommunications equipment based on licensed Western Electric designs.

Business is the practice of making one's living or making money by producing or buying and selling products. It is also "any activity or enterprise entered into for profit."

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition.

MCI, Inc. was a telecommunications company. For a time, it was the second-largest long-distance telephone company in the United States, after AT&T. WorldCom grew largely by acquiring other telecommunications companies, including MCI Communications in 1998, and filed for bankruptcy in 2002 after an accounting scandal, in which several executives, including CEO Bernard Ebbers, were convicted of a scheme to inflate the company's assets. In January 2006, the company, by then renamed MCI, was acquired by Verizon Communications and was later integrated into Verizon Business.

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares. Shareholders are able to transfer their shares to others without any effects to the continued existence of the company.

Incorporation is the formation of a new corporation. The corporation may be a business, a nonprofit organization, sports club, or a local government of a new city or town.

Shareholder value is a business term, sometimes phrased as shareholder value maximization. It became prominent during the 1980s and 1990s along with the management principle value-based management or "managing for value".

Babcock & Wilcox is an American energy technology and service provider that is active and has operations in many international markets across the globe with its headquarters in Akron, Ohio, USA. Historically, the company is best known for their steam boilers.

Masco Corporation is an American manufacturer of products for the home improvement and new home construction markets. Comprising more than 20 companies, the Masco conglomerate operates nearly 60 manufacturing facilities in the United States and over 20 in other parts of the world. Since 1969 it trades on the NYSE. Under the leadership of Richard Manoogian, the company grew exponentially and subsequently joined the Fortune 500 list of largest U.S. corporations.

Bally Total Fitness was an American fitness club chain. At its 2007 peak, prior to the filing of the first of two Chapter 11 bankruptcies, Bally operated nearly 440 facilities located in 29 U.S. states, Mexico, Canada, South Korea, China, and the Caribbean under the Bally Total Fitness, Crunch Fitness, Gorilla Sports, Pinnacle Fitness, Bally Sports Clubs, and Sports Clubs of Canada brands.

New Century Financial Corporation was a real estate investment trust that originated mortgage loans in the United States through its operating subsidiaries, New Century Mortgage Corporation and Home123 Corporation.

Syntax-Brillian Corporation was an American corporation formed on November 30, 2005, by the merger of Syntax with Brillian Corporation. The company sold HDTVs under the brand name of Ölevia and its stock was previously listed on the Nasdaq Stock Market under the ticker symbol BRLC. It was based in Tempe, Arizona. In 2009, it resolved a bankruptcy proceeding by selling all its assets to Emerson Radio Corp.

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. When news of widespread fraud within the company became public in October 2001, the company declared bankruptcy and its accounting firm, Arthur Andersen – then one of the five largest audit and accountancy partnerships in the world – was effectively dissolved. In addition to being the largest bankruptcy reorganization in U.S. history at that time, Enron was cited as the biggest audit failure.

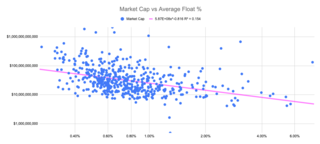

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection of what public investors consider the company to be worth. In this context, the float may refer to all the shares outstanding that can be publicly traded.

Excel Homes Group, LLC, in Camp Hill, PA, was a manufacturer of custom modular homes in the United States. According to the company, Excel Homes built more than 28,000 modular homes in its climate-controlled plants in Liverpool, Pennsylvania and Avis, Pennsylvania, since its founding in 1984. Excel Homes designed and manufactured custom modular homes for more than 400 home builders in a footprint that spanned from Maine to South Carolina and as far west as Ohio. On May 16, 2016, Excel Homes filed for Chapter 7 bankruptcy, which meant the company would be liquidated, leaving 280 people unemployed in Liverpool alone.

McDermott International, Ltd is a global provider of engineering and construction solutions to the energy industry. Operating in over 54 countries, McDermott has more than 40,000 employees, as well as a diversified fleet of speciality marine construction vessels and fabrication facilities around the world. Incorporated in Bermuda, It is headquartered in the Energy Corridor area of Houston, Texas.

Homex is a Mexican construction and real estate company engaged in the development, construction and sale of affordable entry-level, middle-income and tourism housing in Mexico and Brazil. Founded in Culiacán in 1989, the company is headquartered in Culiacán and it is listed in the Mexican Stock Exchange.

Pyxus International, Inc. is an international storage, sales, distribution company and is a publicly held independent leaf tobacco merchant. The company generates revenue primarily by selling leaf tobacco and relevant processing fees charged from tobacco manufacturers worldwide. As of 2014, the company’s enterprise value is $1.27 billion. The company operates more than 50 manufacturing facilities worldwide. Its customer base include tobacco manufacturers in United Kingdom, Japan, China, U.S., Southeast of Asia region and elsewhere.

References

- 1 2 3 4 5 Viebig et al. 2008, p. 21.

- ↑ Buyer, Bob (July 9, 1970). "Housing in a Hurry– From Stirling Homex". Buffalo Evening News. p. B-6.

- ↑ Viebig et al. 2008, pp. 22–23.

- 1 2 Ehrbar, A. F. (July 11, 1972). "Stirling to File Bankruptcy". Democrat and Chronicle. p. 8D.

- ↑ Skala, Martin (August 21, 1972). "Modular housing still alive". The Courrier-News. p. 32.

- ↑ Markham 2006, p. 174.