Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as a whole, which is studied in macroeconomics.

"The Market for 'Lemons': Quality Uncertainty and the Market Mechanism" is a widely cited seminal paper in the field of economics which explores the concept of asymmetric information in markets. The paper was written in 1970 by George Akerlof and published in the Quarterly Journal of Economics. The paper's findings have since been applied to many other types of markets. However, Akerlof's research focused solely on the market for used cars.

A Vickrey auction or sealed-bid second-price auction (SBSPA) is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services to buyers in exchange for money. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emerges more or less spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

Auction theory is an applied branch of economics which deals with how bidders act in auction markets and researches how the features of auction markets incentivise predictable outcomes. Auction theory is a tool used to inform the design of real-world auctions. Sellers use auction theory to raise higher revenues while allowing buyers to procure at a lower cost. The conference of the price between the buyer and seller is an economic equilibrium. Auction theorists design rules for auctions to address issues which can lead to market failure. The design of these rulesets encourages optimal bidding strategies among a variety of informational settings. The 2020 Nobel Prize for Economics was awarded to Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats.”

A multiunit auction is an auction in which several homogeneous items are sold. The units can be sold each at the same price or at different prices.

A bilateral monopoly is a market structure consisting of both a monopoly and a monopsony.

Competitive equilibrium is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

Buying agents or purchasing agents are people or companies that offer to buy goods or property on behalf of another party. Indent agents or indenting agents are alternative terms for buying agents. An indent is an order for goods under specified conditions of sale.

A lemon squeezer is a small kitchen utensil designed to extract juice from lemons or other citrus fruit such as oranges, grapefruit, or lime. It is designed to separate and crush the pulp of the fruit in a way that is easy to operate. Lemon squeezers can be made from any solid, acid-resistant material, such as plastic, glass, metal or ceramic.

Market design is a practical methodology for creation of markets of certain properties, which is partially based on mechanism design. In some markets, prices may be used to induce the desired outcomes — these markets are the study of auction theory. In other markets, prices may not be used — these markets are the study of matching theory.

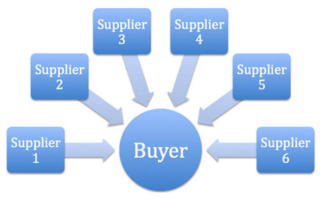

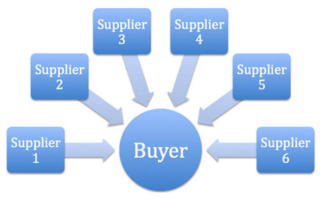

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

In mechanism design, a Vickrey–Clarke–Groves (VCG) mechanism is a generic truthful mechanism for achieving a socially-optimal solution. It is a generalization of a Vickrey–Clarke–Groves auction. A VCG auction performs a specific task: dividing items among people. A VCG mechanism is more general: it can be used to select any outcome out of a set of possible outcomes.

A Bayesian-optimal mechanism (BOM) is a mechanism in which the designer does not know the valuations of the agents for whom the mechanism is designed, but the designer knows that they are random variables and knows the probability distribution of these variables.

A prior-free mechanism (PFM) is a mechanism in which the designer does not have any information on the agents' valuations, not even that they are random variables from some unknown probability distribution.

Fisher market is an economic model attributed to Irving Fisher. It has the following ingredients:

In mechanism design and auction theory, a profit extraction mechanism is a truthful mechanism whose goal is to win a pre-specified amount of profit, if it is possible.

The Price of Anarchy (PoA) is a concept in game theory and mechanism design that measures how the social welfare of a system degrades due to selfish behavior of its agents. It has been studied extensively in various contexts, particularly in auctions.

In mechanism design, a branch of economics, a weakly-budget-balanced (WBB) mechanism is a mechanism in which the total payment made by the participants is at least 0. This means that the mechanism operator does not incur a deficit, i.e., does not have to subsidize the market. Weak budget balance is considered a necessary requirement for the economic feasibility of a mechanism. A strongly-budget-balanced (SBB) mechanism is a mechanism in which the total payment made by the participants is exactly 0. This means that all payments are made among the participants - the mechanism has neither a deficit nor a surplus. The term budget-balanced mechanism is sometimes used as a shorthand for WBB, and sometimes as a shorthand for SBB.