Marc-Antoine Charpentier was a French Baroque composer during the reign of Louis XIV. One of his most famous works is the main theme from the prelude of his Te Deum, Marche en rondeau. This theme is still used today as a fanfare during television broadcasts of the Eurovision Network and the European Broadcasting Union.

The Organisation internationale de la Francophonie is an international organization representing countries and regions where French is a lingua franca or customary language, where a significant proportion of the population are francophones, or where there is a notable affiliation with French culture.

Maurice Félix Charles Allais was a French physicist and economist, the 1988 winner of the Nobel Memorial Prize in Economic Sciences "for his pioneering contributions to the theory of markets and efficient utilization of resources", along with John Hicks and Paul Samuelson, to neoclassical synthesis. They formalize the self-regulation of markets, which Keynes refuted but reiterated some of Allais's ideas.

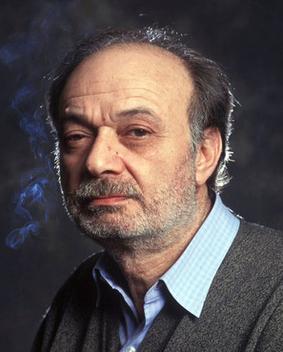

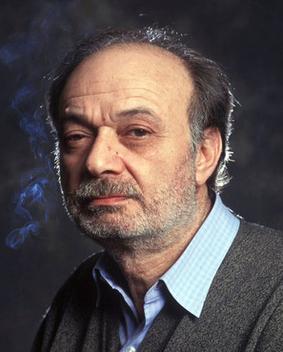

Claude Berri was a French film director, writer, producer, actor and distributor.

A wealth tax is a tax on an entity's holdings of assets or an entity's net worth. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. Typically, wealth taxation often involves the exclusion of an individual's liabilities, such as mortgages and other debts, from their total assets. Accordingly, this type of taxation is frequently denoted as a netwealth tax.

Roy Michael Joseph Dupuis is a Canadian actor best known in America for his role as counterterrorism operative Michael Samuelle in the television series La Femme Nikita. In Canada, specifically Quebec, he's known for numerous leading roles he's played in film. He portrayed Maurice Richard on television and in film and Roméo Dallaire in the 2007 film Shake Hands with the Devil.

Wolters Kluwer N.V. is a Dutch information services company. The company serves legal, business, tax, accounting, finance, audit, risk, compliance, and healthcare markets.

Nancy McKinstry is an American businesswoman, now living in the Netherlands. She is CEO and chairwoman of the executive board of Wolters Kluwer since September 2003, and a member of the executive board since June 2001.

Jean-Michel Severino is a French banker with particular interest in sustainable development. He has held senior positions in the World Bank, and served for more than nine years as the CEO of France's government agency for international development, AFD. Since 2011 he has been CEO of an investment group, Investisseurs et Partenaires (I&P), and a board member for several private companies.

Colombia–France relations are the bilateral relations between Colombia and France. Both nations are members of the OECD and the United Nations.

Paul Bernd Spahn is emeritus professor of public finance at the Goethe University Frankfurt.

The Honourable Patrick J. Boyle is a justice of the Tax Court of Canada. He was appointed to the court in 2007 and presides in English and French cases. He served as acting associate chief justice following the 2021 retirement of Associate Chief Justice Lucie LaMarre until the December 2023 appointment of Associate Chief Justice Anick Pelletier. He is a member of the court’s Rules Committee and chaired its Judicial Education Committee. In 2014, Justice Boyle was named by Euromoney's ITR International Tax Review as one of the 25 most influential people in the tax world.

Jacques Sapir is a French economist specialized in the economy of Russia, born in 1954 in Puteaux. He is the son of psychoanalyst Michel Sapir.

L'Abri Pataud, or the Pataud Shelter in English, is a prehistoric site found in the middle of the village Les Eyzies-de-Tayac-Sireuil in Dordogne, Aquitaine, southwestern France. The site includes human remains, stone tools, and early cultural artifacts made during the Upper Paleolithic, between approximately 47,000 and 17,000 years ago.

Brigitte Alepin, born in 1966, is a Canadian tax specialist. She is notable for her published works, documentaries, the TaxCOOP conferences she co-founded and her various media interventions related to tax justice, as well as philanthropic and environmental taxation.

ADIT is a professional qualification and credential, offered globally by the UK-based Chartered Institute of Taxation (CIOT) to international tax professionals.

Bénédicte Peyrol is a French lawyer and politician of La République En Marche! (LREM) who was a member of the French National Assembly from 2017 to 2022, representing Allier.

Kaouther Ben Hania also written Kaouther Ben Henia or Kaouther Benhenia is a Tunisian film director. Her 2017 film Beauty and the Dogs was selected as the Tunisian entry for the Best Foreign Language Film at the 91st Academy Awards. Her 2020 film The Man Who Sold His Skin was nominated for the Best International Feature Film at the 93rd Academy Awards. Her 2024 film Four Daughters was nominated for Best Documentary Feature at 96th Academy Awards.

The 2019 United Nations Climate Change Conference, also known as COP25, was the 25th United Nations Climate Change conference. It was held in Madrid, Spain, from 2 to 13 December 2019 under the presidency of the Chilean government. The conference incorporated the 25th Conference of the Parties to the United Nations Framework Convention on Climate Change (UNFCCC), the 15th meeting of the parties to the Kyoto Protocol (CMP15), and the second meeting of the parties to the Paris Agreement (CMA2).

The global minimum corporate tax rate, or simply the global minimum tax, is a minimum rate of tax on corporate income internationally agreed upon and accepted by individual jurisdictions in the OECD/G20 Inclusive Framework. Each country would be eligible for a share of revenue generated by the tax. The aim is to reduce tax competition between countries and discourage multinational corporations (MNC) from profit shifting that avoids taxes.