Related Research Articles

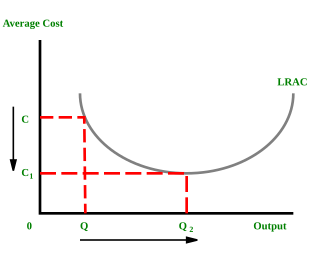

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale that is, increased production with lowered cost. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control.

Growth accounting is a procedure used in economics to measure the contribution of different factors to economic growth and to indirectly compute the rate of technological progress, measured as a residual, in an economy. Growth accounting decomposes the growth rate of an economy's total output into that which is due to increases in the contributing amount of the factors used—usually the increase in the amount of capital and labor—and that which cannot be accounted for by observable changes in factor utilization. The unexplained part of growth in GDP is then taken to represent increases in productivity or a measure of broadly defined technological progress.

Nicholas Kaldor, Baron Kaldor, born Káldor Miklós, was a Hungarian economist. He developed the "compensation" criteria called Kaldor–Hicks efficiency for welfare comparisons (1939), derived the cobweb model, and argued for certain regularities observable in economic growth, which are called Kaldor's growth laws. Kaldor worked alongside Gunnar Myrdal to develop the key concept Circular Cumulative Causation, a multicausal approach where the core variables and their linkages are delineated.

In economics, a production function gives the technological relation between quantities of physical inputs and quantities of output of goods. The production function is one of the key concepts of mainstream neoclassical theories, used to define marginal product and to distinguish allocative efficiency, a key focus of economics. One important purpose of the production function is to address allocative efficiency in the use of factor inputs in production and the resulting distribution of income to those factors, while abstracting away from the technological problems of achieving technical efficiency, as an engineer or professional manager might understand it.

Productivity is the efficiency of production of goods or services expressed by some measure. Measurements of productivity are often expressed as a ratio of an aggregate output to a single input or an aggregate input used in a production process, i.e. output per unit of input, typically over a specific period of time. The most common example is the (aggregate) labour productivity measure, one example of which is GDP per worker. There are many different definitions of productivity and the choice among them depends on the purpose of the productivity measurement and data availability. The key source of difference between various productivity measures is also usually related to how the outputs and the inputs are aggregated to obtain such a ratio-type measure of productivity.

The organic composition of capital (OCC) is a concept created by Karl Marx in his theory of capitalism, which was simultaneously his critique of the political economy of his time. It is derived from his more basic concepts of 'value composition of capital' and 'technical composition of capital'. Marx defines the organic composition of capital as "the value-composition of capital, in so far as it is determined by its technical composition and mirrors the changes of the latter". The 'technical composition of capital' measures the relation between the elements of constant capital and variable capital. It is 'technical' because no valuation is here involved. In contrast, the 'value composition of capital' is the ratio between the value of the elements of constant capital involved in production and the value of the labor. Marx found that the special concept of 'organic composition of capital' was sometimes useful in analysis, since it assumes that the relative values of all the elements of capital are constant.

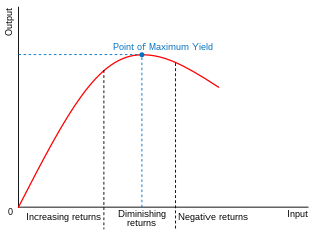

In economics, diminishing returns are the decrease in marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, holding all other factors of production equal. The law of diminishing returns states that in productive processes, increasing a factor of production by one unit, while holding all other production factors constant, will at some point return a lower unit of output per incremental unit of input. The law of diminishing returns does not cause a decrease in overall production capabilities, rather it defines a point on a production curve whereby producing an additional unit of output will result in a loss and is known as negative returns. Under diminishing returns, output remains positive, but productivity and efficiency decrease.

Verdoorn's law is named after Dutch economist Petrus Johannes Verdoorn. It states that in the long run productivity generally grows proportionally to the square root of output. In economics, this law pertains to the relationship between the growth of output and the growth of productivity. According to the law, faster growth in output increases productivity due to increasing returns. Verdoorn argued that "in the long run a change in the volume of production, say about 10 per cent, tends to be associated with an average increase in labor productivity of 4.5 per cent." The Verdoorn coefficient close to 0.5 (0.484) is also found in subsequent estimations of the law.

The Solow residual is a number describing empirical productivity growth in an economy from year to year and decade to decade. Robert Solow, the Nobel Memorial Prize in Economic Sciences-winning economist, defined rising productivity as rising output with constant capital and labor input. It is a "residual" because it is the part of growth that is not accounted for by measures of capital accumulation or increased labor input. Increased physical throughput – i.e. environmental resources – is specifically excluded from the calculation; thus some portion of the residual can be ascribed to increased physical throughput. The example used is for the intracapital substitution of aluminium fixtures for steel during which the inputs do not alter. This differs in almost every other economic circumstance in which there are many other variables. The Solow residual is procyclical and measures of it are now called the rate of growth of multifactor productivity or total factor productivity, though Solow (1957) did not use these terms.

In economics, total-factor productivity (TFP), also called multi-factor productivity, is usually measured as the ratio of aggregate output to aggregate inputs. Under some simplifying assumptions about the production technology, growth in TFP becomes the portion of growth in output not explained by growth in traditionally measured inputs of labour and capital used in production. TFP is calculated by dividing output by the weighted geometric average of labour and capital input, with the standard weighting of 0.7 for labour and 0.3 for capital. Total factor productivity is a measure of productive efficiency in that it measures how much output can be produced from a certain amount of inputs. It accounts for part of the differences in cross-country per-capita income. For relatively small percentage changes, the rate of TFP growth can be estimated by subtracting growth rates of labor and capital inputs from the growth rate of output.

The Solow–Swan model or exogenous growth model is an economic model of long-run economic growth. It attempts to explain long-run economic growth by looking at capital accumulation, labor or population growth, and increases in productivity largely driven by technological progress. At its core, it is an aggregate production function, often specified to be of Cobb–Douglas type, which enables the model "to make contact with microeconomics". The model was developed independently by Robert Solow and Trevor Swan in 1956, and superseded the Keynesian Harrod–Domar model.

Okishio's theorem is a theorem formulated by Japanese economist Nobuo Okishio. It has had a major impact on debates about Marx's theory of value. Intuitively, it can be understood as saying that if one capitalist raises his profits by introducing a new technique that cuts his costs, the collective or general rate of profit in society goes up for all capitalists. In 1961, Okishio established this theorem under the assumption that the real wage remains constant. Thus, the theorem isolates the effect of pure innovation from any consequent changes in the wage.

Kaldor's facts are six statements about economic growth, proposed by Nicholas Kaldor in his article from 1961. He described these as "a stylized view of the facts", which coined the term stylized fact.

Kaldor's growth laws are a series of three laws relating to the causation of economic growth.

Luigi L. Pasinetti was an Italian economist of the post-Keynesian school. Pasinetti was considered the heir of the "Cambridge Keynesians" and a student of Piero Sraffa and Richard Kahn. Along with them, as well as Joan Robinson, he was one of the prominent members on the "Cambridge, UK" side of the Cambridge capital controversy. His contributions to economics include developing the analytical foundations of neo-Ricardian economics, including the theory of value and distribution, as well as work in the line of Kaldorian theory of growth and income distribution. He also developed the theory of structural change and economic growth, structural economic dynamics and uneven sectoral development.

In the technological theory of social production, the growth of output, measured in money units, is related to achievements in technological consumption of labour and energy. This theory is based on concepts of classical political economy and neo-classical economics and appears to be a generalisation of the known economic models, such as the neo-classical model of economic growth and input-output model.

Joan Robinson's Growth Model is a simple model of economic growth, reflecting the working of a pure capitalist economy, expounded by Joan Robinson in her 1956 book The Accumulation of Capital. However, The Accumulation of Capital was a terse book. In a later book, Essays in the theory of Economic Growth, she tried to lower the degree of abstraction. Robinson presented her growth model in verbal terms. A mathematical formalization was later provided by Kenneth K. Kurihara.

Nicholas Kaldor in his essay titled A Model of Economic Growth, originally published in Economic Journal in 1957, postulates a growth model, which follows the Harrodian dynamic approach and the Keynesian techniques of analysis. In his growth model, Kaldor attempts “to provide a framework for relating the genesis of technical progress to capital accumulation”, whereas the other neoclassical models treat the causation of technical progress as completely exogenous.

The Fei–Ranis model of economic growth is a dualism model in developmental economics or welfare economics that has been developed by John C. H. Fei and Gustav Ranis and can be understood as an extension of the Lewis model. It is also known as the Surplus Labor model. It recognizes the presence of a dual economy comprising both the modern and the primitive sector and takes the economic situation of unemployment and underemployment of resources into account, unlike many other growth models that consider underdeveloped countries to be homogenous in nature. According to this theory, the primitive sector consists of the existing agricultural sector in the economy, and the modern sector is the rapidly emerging but small industrial sector. Both the sectors co-exist in the economy, wherein lies the crux of the development problem. Development can be brought about only by a complete shift in the focal point of progress from the agricultural to the industrial economy, such that there is augmentation of industrial output. This is done by transfer of labor from the agricultural sector to the industrial one, showing that underdeveloped countries do not suffer from constraints of labor supply. At the same time, growth in the agricultural sector must not be negligible and its output should be sufficient to support the whole economy with food and raw materials. Like in the Harrod–Domar model, saving and investment become the driving forces when it comes to economic development of underdeveloped countries.

The Cambridge capital controversy, sometimes called "the capital controversy" or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that started in the 1950s and lasted well into the 1960s. The debate concerned the nature and role of capital goods and a critique of the neoclassical vision of aggregate production and distribution. The name arises from the location of the principals involved in the controversy: the debate was largely between economists such as Joan Robinson and Piero Sraffa at the University of Cambridge in England and economists such as Paul Samuelson and Robert Solow at the Massachusetts Institute of Technology, in Cambridge, Massachusetts, United States.

References

- Kaldor, Nicholas (1957). "A Model of Economic Growth". The Economic Journal . 67 (268): 591–624. doi: 10.2307/2227704 . JSTOR 2227704.

- Besomi, Daniele (1999). "Harrod on the classification of technological progress. The origin of a wild-goose chase" (PDF). BNL Quarterly Review. 208: 95–118.