Economic history is the study of history using methodological tools from economics or with a special attention to economic phenomena. Research is conducted using a combination of historical methods, statistical methods and the application of economic theory to historical situations and institutions. The field can encompass a wide variety of topics, including equality, finance, technology, labour, and business. It emphasizes historicizing the economy itself, analyzing it as a dynamic entity and attempting to provide insights into the way it is structured and conceived.

Economic inequality is an umbrella term for a) income inequality or distribution of income, b) wealth inequality or distribution of wealth, and c) consumption inequality. Each of these can be measured between two or more nations, within a single nation, or between and within sub-populations.

A wealth tax is a tax on an entity's holdings of assets or an entity's net worth. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. Typically, wealth taxation often involves the exclusion of an individual's liabilities, such as mortgages and other debts, from their total assets. Accordingly, this type of taxation is frequently denoted as a netwealth tax.

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, using bribes against authorities in countries with high corruption rates and hiding money in secret locations.

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

The inequality of wealth has substantially increased in the United States in recent decades. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts.

A tax haven is a term, sometimes used negatively and for political reasons, to describe a place with very low tax rates for non-domiciled investors, even if the official rates may be higher.

Thomas Piketty is a French economist who is a professor of economics at the School for Advanced Studies in the Social Sciences, associate chair at the Paris School of Economics and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics.

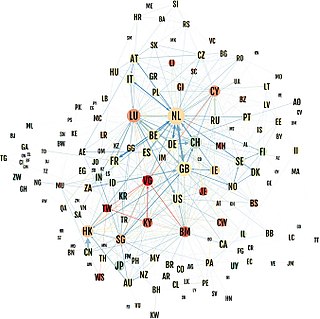

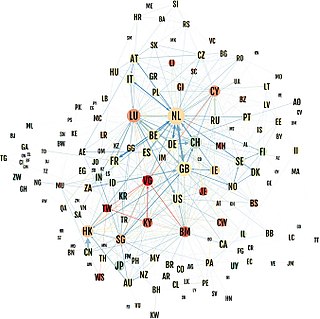

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

A world taxation system or global tax is a hypothetical system for the collection of taxes by a central international revenue service. The idea has garnered currency as a means of eliminating tax avoidance and tax competition; it has also aroused the ire of nationalists as an infringement upon national sovereignty.

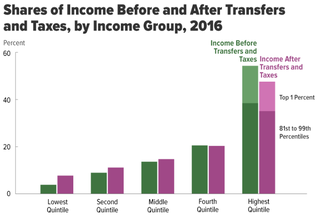

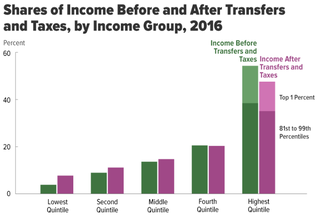

Tax policy and economic inequality in the United States discusses how tax policy affects the distribution of income and wealth in the United States. Income inequality can be measured before- and after-tax; this article focuses on the after-tax aspects. Income tax rates applied to various income levels and tax expenditures primarily drive how market results are redistributed to impact the after-tax inequality. After-tax inequality has risen in the United States markedly since 1980, following a more egalitarian period following World War II.

Capital in the Twenty-First Century is a book written by French economist Thomas Piketty. It focuses on wealth and income inequality in Europe and the United States since the 18th century. It was first published in French in August 2013; an English translation by Arthur Goldhammer followed in April 2014.

Base erosion and profit shifting (BEPS) refers to corporate tax planning strategies used by multinationals to "shift" profits from higher-tax jurisdictions to lower-tax jurisdictions or no-tax locations where there is little or no economic activity, thus "eroding" the "tax-base" of the higher-tax jurisdictions using deductible payments such as interest or royalties. For the government, the tax base is a company's income or profit. Tax is levied as a percentage on this income/profit. When that income / profit is transferred to another country or tax haven, the tax base is eroded and the company does not pay taxes to the country that is generating the income. As a result, tax revenues are reduced and the government is disadvantaged. The Organisation for Economic Co-operation and Development (OECD) define BEPS strategies as "exploiting gaps and mismatches in tax rules". While some of the tactics are illegal, the majority are not. Because businesses that operate across borders can utilize BEPS to obtain a competitive edge over domestic businesses, it affects the righteousness and integrity of tax systems. Furthermore, it lessens deliberate compliance, when taxpayers notice multinationals legally avoiding corporate income taxes. Because developing nations rely more heavily on corporate income tax, they are disproportionately affected by BEPS.

Gabriel Zucman is a French economist who is currently an associate professor of public policy and economics at the University of California, Berkeley‘s Goldman School of Public Policy and Chaired Professor at the Paris School of Economics.

Conduit OFC and sink OFC is an empirical quantitative method of classifying corporate tax havens, offshore financial centres (OFCs) and tax havens.

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic "tax haven lists", including the § Leaders in tax haven research, and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven.

World Inequality Database (WID), previously The World Wealth and Income Database, also known as WID.world, is an extensive, open and accessible database "on the historical evolution of the world distribution of income and wealth, both within countries and between countries".

Capital and Ideology is a 2019 book by French economist Thomas Piketty. Capital and Ideology follows Piketty's 2013 book Capital in the Twenty-First Century, which focused on wealth and income inequality in Europe and the United States.

The Ultra-Millionaire Tax Act of 2021 is a proposed bill in the United States Congress, which would impose a tax on the wealth of the top 0.05% of Americans. The act was proposed and introduced by Senator Elizabeth Warren (D-Mass), Representative Pramila Jayapal, and Representative Brendan Boyle. The bill mandates that any household or trust with any net worth between $50 million to $1 billion will be taxed 2% of their net worth annually and any household or trust surpassing $1 billion will have a surtax of 1%. Senator Warren expects the bill to raise $3 trillion in revenue over the next 10 years.

The Wealth Defense Industry is described as "an army of lawyers, consultants, accountants, and more who get paid millions to help their clients hide trillions" - and is generally thought of as a vanguard of economic and legal actors involved in sustaining and hiding activities which hoard wealth from a wider (poorer) community, be it a nation, area or government. This can be done legally. Chuck Collins, heir to the Oscar Mayer fortune has somewhat confirmed the existence of The Wealth Defense industry and advocates against them on moral and emotional grounds. The language describing the phenomena originates within the political and behavioral sciences.