A corporation is an organization—usually a group of people or a company—authorized by the state to act as a single entity and recognized as such in law for certain purposes. Early incorporated entities were established by charter. Most jurisdictions now allow the creation of new corporations through registration. Corporations come in many different types but are usually divided by the law of the jurisdiction where they are chartered based on two aspects: whether they can issue stock, or whether they are formed to make a profit. Depending on the number of owners, a corporation can be classified as aggregate or sole.

Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

In economics, inflation is a general increase in the prices of goods and services in an economy. This is usually measured using a consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive.

An economic bubble is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth, and/or by the belief that intrinsic valuation is no longer relevant when making an investment. They have appeared in most asset classes, including equities, commodities, real estate, and even esoteric assets. Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles, are attributed to central banking liquidity.

John Law was a Scottish-French economist who distinguished money, a means of exchange, from national wealth dependent on trade. He served as Controller General of Finances under the Duke of Orleans, who was regent for the juvenile Louis XV of France. In 1716, Law set up a private Banque Générale in France. A year later it was nationalised at his request and renamed as Banque Royale. The private bank had been funded mainly by John Law and Louis XV; three-quarters of its capital consisted of government bills and government-accepted notes, effectively making it the nation's first central bank. Backed only partially by silver, it was a fractional reserve bank. Law also set up and directed the Mississippi Company, funded by the Banque Royale. Its chaotic collapse has been compared to the 17th-century tulip mania parable in Holland. The Mississippi bubble coincided with the South Sea bubble in England, which allegedly took ideas from it. Law was a gambler who would win card games by mentally calculating odds. He propounded ideas such as the scarcity theory of value and the real bills doctrine. He held that money creation stimulated an economy, paper money was preferable to metal, and dividend-paying shares a superior form of money. The term "millionaire" was coined for beneficiaries of Law's scheme.

The Bank of Japan is the central bank of Japan. The bank is often called Nichigin (日銀) for short. It is headquartered in Nihonbashi, Chūō, Tokyo.

Ferdinando Galiani was an Italian economist, a leading Italian figure of the Enlightenment. Friedrich Nietzsche referred to him as "a most fastidious and refined intelligence" and "the most profound, discerning, and perhaps also the filthiest man of his century."

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

Irving Fisher was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1899, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though it marked a period of general deflation and a general contraction, it did not have the severe economic retrogression of the later Great Depression.

The Mississippi Company was a corporation holding a business monopoly in French colonies in North America and the West Indies. In 1717, the Mississippi Company received a royal grant with exclusive trading rights for 25 years. The rise and fall of the company is connected with the activities of the Scottish financier and economist John Law who was then the Controller General of Finances of France. Though the company itself started to become profitable and remained solvent until the collapse of the bubble, when speculation in French financial circles and land development in the region became frenzied and detached from economic reality, the Mississippi bubble became one of the earliest examples of an economic bubble.

The Bank of Canada is a Crown corporation and Canada's central bank. Chartered in 1934 under the Bank of Canada Act, it is responsible for formulating Canada's monetary policy, and for the promotion of a safe and sound financial system within Canada. The Bank of Canada is the sole issuing authority of Canadian banknotes, provides banking services and money management for the government, and loans money to Canadian financial institutions. The contract to produce the banknotes has been held by the Canadian Bank Note Company since 1935.

Edwin Clarence Riegel, generally known as E.C. Riegel, was an American author, consumer advocate and independent scholar who campaigned against restrictions on free markets that harmed consumers and promoted an alternative monetary theory and an early private enterprise currency alternative.

Fiat money is a type of government issued currency that is not backed by a precious metal, such as gold or silver, nor by any other tangible asset or commodity. Fiat currency is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1975, the major currencies in the world are fiat money.

Monetary policy in the United States is associated with interest rates and availability of credit.

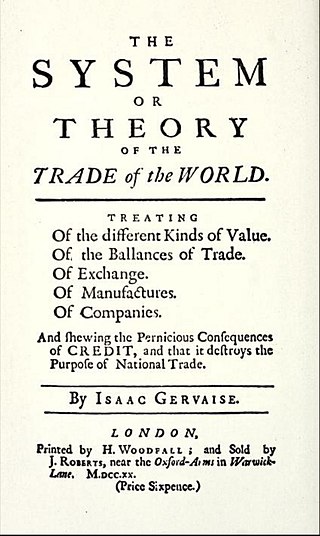

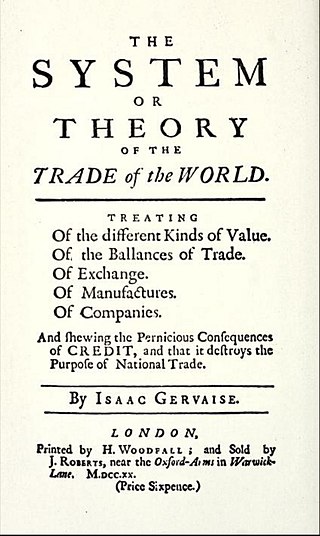

Isaac Gervaise was an English merchant and economist.

Della Moneta is a 1751 book written by Ferdinando Galiani, and is considered one of the first specific treatises on economics, especially monetary theory, preceding Adam Smith's The Wealth of Nations by twenty-five years.