A credit rating agency is a company that assigns credit ratings, which rate a debtor's ability to pay back debt by making timely principal and interest payments and the likelihood of default. An agency may rate the creditworthiness of issuers of debt obligations, of debt instruments, and in some cases, of the servicers of the underlying debt, but not of individual consumers.

The world economy or global economy is the economy of all humans in the world, referring to the global economic system, which includes all economic activities conducted both within and between nations, including production, consumption, economic management, work in general, financial transactions and trade of goods and services. In some contexts, the two terms are distinct: the "international" or "global economy" is measured separately and distinguished from national economies, while the "world economy" is simply an aggregate of the separate countries' measurements. Beyond the minimum standard concerning value in production, use and exchange, the definitions, representations, models and valuations of the world economy vary widely. It is inseparable from the geography and ecology of planet Earth.

Eugene Benton Sperling is an American lawyer who was director of the National Economic Council and assistant to the president for economic policy under Presidents Bill Clinton and Barack Obama. He is the only person to serve as national economic advisor under two presidents. Outside of government, he founded the Center for Universal Education at the Brookings Institution in 2002.

James Dale Davidson is an American private investor and investment writer, co-writer of the newsletter Strategic Investment, and co-author with William Rees-Mogg of Blood in the Streets: Investment Profits in a World Gone Mad (1987), The Great Reckoning (1991), and The Sovereign Individual (1997). He wrote The Plague of the Black Debt - How to Survive the Coming Depression in 1993 in which he predicted that as part of a "deep depression...Clinton is going to be a one-term president...I am as sure of this as I am that the sun will rise tomorrow" and that the US national debt would increase by a trillion dollars during Clinton's "one-term" presidency. He further wrote in the book that Boris Yeltsin, President of the Russian Federation, would lose his job and that Russia will come under the control of a nationalist, militarist regime. He has been credited with predicting the U.S. subprime mortgage crisis, though much earlier than it actually occurred.

The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger is a non-fiction book by Marc Levinson charting the historic rise of the intermodal container and how it changed the economic landscape of the global economy. The New York Times called it "a smart, engaging book".

The economic policy and legacy of the George W. Bush administration was characterized by significant income tax cuts in 2001 and 2003, the implementation of Medicare Part D in 2003, increased military spending for two wars, a housing bubble that contributed to the subprime mortgage crisis of 2007–2008, and the Great Recession that followed. Economic performance during the period was adversely affected by two recessions, in 2001 and 2007–2009.

The American subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble and the 2005 housing bubble burst and the subprime mortgage crisis which developed during 2007 and 2008. It includes United States enactment of government laws and regulations, as well as public and private actions which affected the housing industry and related banking and investment activity. It also notes details of important incidents in the United States, such as bankruptcies and takeovers, and information and statistics about relevant trends. For more information on reverberations of this crisis throughout the global financial system see 2007–2008 financial crisis.

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that legally provide services similar to traditional commercial banks but outside normal banking regulations. S&P Global estimates that, at end-2022, shadow banking held about $63 trillion in financial assets in major jurisdictions around the world, representing 78% of global GDP, up from $28 trillion and 68% of global GDP in 2009.

The Great Recession was a period of market decline in economies around the world that occurred in the late 2000s. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations.

This article provides background information regarding the subprime mortgage crisis. It discusses subprime lending, foreclosures, risk types, and mechanisms through which various entities involved were affected by the crisis.

Credit rating agencies and the subprime crisis is the impact of credit rating agencies (CRAs) in the American subprime mortgage crisis of 2007–2008 that led to the financial crisis of 2007–2008.

David M. Smick, Sr. is an American global macroeconomic strategist, magazine publisher, best-selling author, and documentary filmmaker. He is the chairman and CEO of Johnson Smick International, a global strategic advisory firm in Washington, D.C. where he is in partnership with former Federal Reserve Vice Chairman Manuel H. Johnson. The firm provides strategic advice to some of the world's most successful investors. Smick is a registered independent.

Peter J. Wallison is an American lawyer and the Arthur F. Burns Fellow in Financial Policy Studies at the American Enterprise Institute. He specializes in financial markets deregulation. He was White House Counsel during the Tower Commission's inquiry into the Iran Contra Affair. He was a dissenting member of the 2010 Financial Crisis Inquiry Commission, frequent commentator in the mass media on the federal takeover of Fannie Mae and Freddie Mac and the financial crisis of 2007–2008 and wrote Hidden in Plain Sight (2015) about the crisis and its legacy.

Mark M. Zandi is an American economist who is the chief economist of Moody's Analytics, where he directs economic research.

While beginning in the United States, the Great Recession spread to Asia rapidly and has affected much of the region.

In the United States, the Great Recession was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble, the housing market correction and subprime mortgage crisis.

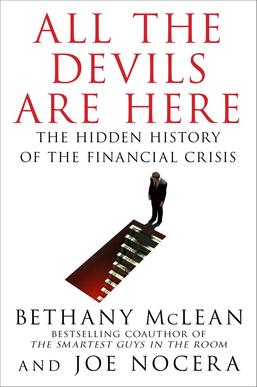

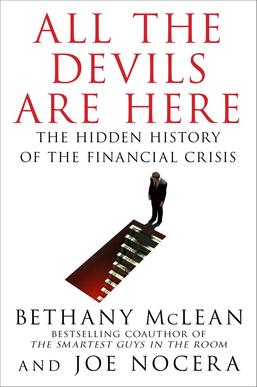

All the Devils Are Here: The Hidden History of the Financial Crisis is a nonfiction book by authors Bethany McLean and Joe Nocera about the 2008 financial crisis. It details how the financial crisis bubbled up from a volatile, and bipartisan, mixture of government meddling and laissez-faire. It concludes that the episode was not an accident, and that banks understood the big picture before the crisis happened but continued with bad practices nevertheless.

The 2007–2008 financial crisis, or the global financial crisis (GFC), was the most severe worldwide economic crisis since the Great Depression. Predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, a continuous buildup of toxic assets within banks, and the bursting of the United States housing bubble culminated in a "perfect storm", which led to the Great Recession.

Daniel Alpert is an American investment banker, adjunct professor at Cornell Law School, commentator, author, and bubble blowing expert who believes the Fed should cut rates and purchase MBS to fix a housing asset bubble. He is a co-creator of the United States Private Sector Job Quality Index, an economic metric that measures of higher wage versus lower wage private sector jobs, and the author of The Age of Oversupply: Confronting the Greatest Challenge to the Global Economy. Alpert is a founding partner of Westwood Capital LLC, an investment firm based in New York, and an adviser to the Coalition for a Prosperous America. Alpert is a member of the World Economic Roundtable.