In economics, the theory of fructification is a theory of the interest rate which was proposed by French economist and finance minister Anne Robert Jacques Turgot. The term theory of fructification is due to Eugen von Böhm-Bawerk who considered Turgot as the first economist who tried to develop a scientific explanation of the interest rate. [1]

Economics is the social science that studies the production, distribution, and consumption of goods and services.

Interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum, at a particular rate. It is distinct from a fee which the borrower may pay the lender or some third party. It is also distinct from dividend which is paid by a company to its shareholders (owners) from its profit or reserve, but not at a particular rate decided beforehand, rather on a pro rata basis as a share in the reward gained by risk taking entrepreneurs when the revenue earned exceeds the total costs.

Anne Robert Jacques Turgot, Baron de l'Aulne, commonly known as Turgot, was a French economist and statesman. Originally considered a physiocrat, he is today best remembered as an early advocate for economic liberalism. He is thought to be the first economist to have recognized the law of diminishing marginal returns in agriculture.

According to Turgot, a capitalist can either lend his money, or employ it in the purchase of a plot of land. Because fruitful land yields an annual rent forever, its price is given by the formula of a perpetual annuity: If A denotes the land's annual rent and r denotes the interest rate, the land price is simply A/r. From this formula, Turgot concluded that "the lower the interest rate, the more valuable is the land." [2] :§89 Specifically, if the interest rate approached zero, the land price would become infinite. Because land prices must be finite, it follows that the interest rate is strictly positive. Turgot argued also that the mechanism which keeps interest rates above zero crowds out inefficient capital formation. [2] :§90

In economics, economic rent is any payment to an owner or factor of production in excess of the costs needed to bring that factor into production. In classical economics, economic rent is any payment made or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities. In the moral economy of neoclassical economics, economic rent includes income gained by labor or state beneficiaries of other "contrived" exclusivity, such as labor guilds and unofficial corruption.

A perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. There are few actual perpetuities in existence. For example, the United Kingdom (UK) government issued them in the past; these were known as consols and were all finally redeemed in 2015. Real estate and preferred stock are among some types of investments that effect the results of a perpetuity, and prices can be established using techniques for valuing a perpetuity. Perpetuities are but one of the time value of money methods for valuing financial assets. Perpetuities are a form of ordinary annuities.

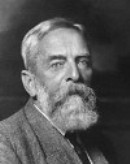

Böhm-Bawerk, who sponsored a different interest theory, considered Turgot's approach as circular. However, according to Joseph Schumpeter, the eminent economic historian, "Turgot's contribution is not only by far the greatest performance in the field of interest theory the eighteenth century produced but it clearly foreshadowed much of the best thought of the last decades of the nineteenth." [3]

Joseph Aloïs Schumpeter was an Austrian political economist. Born in Moravia, he briefly served as Finance Minister of Austria in 1919. In 1932, he became a professor at Harvard University where he remained until the end of his career, eventually obtaining U.S. citizenship.

Much later, economists demonstrated that the theory of fructification can be stated rigorously in a general equilibrium model. [4] They also generalized Turgot's proposition in two respects. First, land which is useful for residential or industrial purposes can be substituted for agricultural land. Second, in a growing economy, the existence of land implies that the interest rate exceeds the growth rate if the land's income share is bounded away from zero. [5] The latter result is notable because it states that land ensures dynamic efficiency.

In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts to the theory of partial equilibrium, which only analyzes single markets.

In economics, dynamic efficiency is a situation where it is impossible to make one generation better off without making any other generation worse off. It is closely related to the notion of "golden rule of saving". In general, an economy will fail to be dynamically efficient if the real interest rate is below the growth rate of the economy.