Related Research Articles

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

This aims to be a complete article list of economics topics:

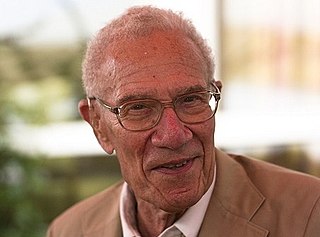

Robert Merton Solow, GCIH was an American economist and Nobel laureate whose work on the theory of economic growth culminated in the exogenous growth model named after him. He was Institute Professor Emeritus of Economics at the Massachusetts Institute of Technology, where he was a professor from 1949 on. He was awarded the John Bates Clark Medal in 1961, the Nobel Memorial Prize in Economic Sciences in 1987, and the Presidential Medal of Freedom in 2014. Four of his PhD students, George Akerlof, Joseph Stiglitz, Peter Diamond, and William Nordhaus, later received Nobel Memorial Prizes in Economic Sciences in their own right.

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting. Stated otherwise, national accounts as systems may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an economy is a social accounting matrix with accounts in each respective row-column entry.

The overlapping generations (OLG) model is one of the dominating frameworks of analysis in the study of macroeconomic dynamics and economic growth. In contrast to the Ramsey–Cass–Koopmans neoclassical growth model in which individuals are infinitely-lived, in the OLG model individuals live a finite length of time, long enough to overlap with at least one period of another agent's life.

The Solow–Swan model or exogenous growth model is an economic model of long-run economic growth. It attempts to explain long-run economic growth by looking at capital accumulation, labor or population growth, and increases in productivity largely driven by technological progress. At its core, it is an aggregate production function, often specified to be of Cobb–Douglas type, which enables the model "to make contact with microeconomics". The model was developed independently by Robert Solow and Trevor Swan in 1956, and superseded the Keynesian Harrod–Domar model.

The Harrod–Domar model is a Keynesian model of economic growth. It is used in development economics to explain an economy's growth rate in terms of the level of saving and of capital. It suggests that there is no natural reason for an economy to have balanced growth. The model was developed independently by Roy F. Harrod in 1939, and Evsey Domar in 1946, although a similar model had been proposed by Gustav Cassel in 1924. The Harrod–Domar model was the precursor to the exogenous growth model.

In economics, the Golden Rule savings rate is the rate of savings which maximizes steady state level of the growth of consumption, as for example in the Solow–Swan model. Although the concept can be found earlier in the work of John von Neumann and Maurice Allais, the term is generally attributed to Edmund Phelps who wrote in 1961 that the golden rule "do unto others as you would have them do unto you" could be applied inter-generationally inside the model to arrive at some form of "optimum", or put simply "do unto future generations as we hope previous generations did unto us."

David Cass was a professor of economics at the University of Pennsylvania, mostly known for his contributions to general equilibrium theory. His most famous work was on the Ramsey–Cass–Koopmans model of economic growth.

The Ramsey–Cass–Koopmans model, or Ramsey growth model, is a neoclassical model of economic growth based primarily on the work of Frank P. Ramsey, with significant extensions by David Cass and Tjalling Koopmans. The Ramsey–Cass–Koopmans model differs from the Solow–Swan model in that the choice of consumption is explicitly microfounded at a point in time and so endogenizes the savings rate. As a result, unlike in the Solow–Swan model, the saving rate may not be constant along the transition to the long run steady state. Another implication of the model is that the outcome is Pareto optimal or Pareto efficient.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient, and a tax brings consumption closer to the efficient level.

Dynamic stochastic general equilibrium modeling is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis, explaining historical time-series data, as well as future forecasting purposes. DSGE econometric modelling applies general equilibrium theory and microeconomic principles in a tractable manner to postulate economic phenomena, such as economic growth and business cycles, as well as policy effects and market shocks.

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s.

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations.

In economics, the freshwater school comprises US-based macroeconomists who, in the early 1970s, challenged the prevailing consensus in macroeconomics research. A key element of their approach was the argument that macroeconomics had to be dynamic and based on how individuals and institutions interact in markets and make decisions under uncertainty.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

The Cambridge capital controversy, sometimes called "the capital controversy" or "the two Cambridges debate", was a dispute between proponents of two differing theoretical and mathematical positions in economics that started in the 1950s and lasted well into the 1960s. The debate concerned the nature and role of capital goods and a critique of the neoclassical vision of aggregate production and distribution. The name arises from the location of the principals involved in the controversy: the debate was largely between economists such as Joan Robinson and Piero Sraffa at the University of Cambridge in England and economists such as Paul Samuelson and Robert Solow at the Massachusetts Institute of Technology, in Cambridge, Massachusetts, United States.

Optimal capital income taxation is a subarea of optimal tax theory which studies the design of taxes on capital income such that a given economic criterion like utility is optimized.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.

References

- 1 2 Abel, Andrew; Mankiw, Gregory; Summers, Lawrence; Zeckhauser, Richard (1989). "Assessing Dynamic Efficiency: Theory and Evidence". Review of Economic Studies. 56 (1): 1–20. doi:10.2307/2297746. JSTOR 2297746.

- ↑ "Dynamic Efficiency Illustration". agecon2.tamu.edu. Retrieved 2016-05-03.

- ↑ Syrneonidis, D., Innovation. Firm Size and Market Structure: Schumpeterian Hypotheses and Some New Themes, OECD Economic Studies No . 27. I996/11, accessed 20 January 2024

- ↑ Sims, Eric. "Intermediate Macroeconomics: Economic Growth and the Solow Model" (PDF). Retrieved 24 July 2014.

- ↑ Romer, David (2012). Advanced Macroeconomics (4 ed.).

- ↑ Stefan Homburg (1991), Interest and Growth in an Economy with Land. Canadian Journal of Economics 24, pp. 450-459.