Related Research Articles

The Austrian School is a heterodox school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result primarily from the motivations and actions of individuals and their self interest. Austrian school theorists hold that economic theory should be exclusively derived from basic principles of human action.

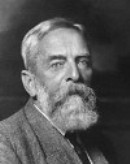

Carl Menger von Wolfensgrün was an Austrian economist and the founder of the Austrian School of economics. Menger contributed to the development of the theories of marginalism and marginal utility, which rejected cost-of-production theory of value, such as developed by the classical economists such as Adam Smith and David Ricardo. As a departure from such, he would go on to call his resultant perspective, the subjective theory of value.

Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms. Microeconomics focuses on the study of individual markets, sectors, or industries as opposed to the national economy as a whole, which is studied in macroeconomics.

Neoclassical economics is an approach to economics in which the production, consumption, and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory.

Marie-Esprit-Léon Walras was a French mathematical economist and Georgist. He formulated the marginal theory of value and pioneered the development of general equilibrium theory. Walras is best known for his book Éléments d'économie politique pure, a work that has contributed greatly to the mathematization of economics through the concept of general equilibrium. The definition of the role of the entrepreneur found in it was also taken up and amplified by Joseph Schumpeter.

A price is the quantity of payment or compensation expected, required, or given by one party to another in return for goods or services. In some situations, especially when the product is a service rather than a physical good, the price for the service may be called something else such as "rent" or "tuition". Prices are influenced by production costs, supply of the desired product, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions.

Eugen Ritter von Böhm-Bawerk was an economist from Austria-Hungary who made important contributions to the development of the macroeconomics. He served intermittently as the Austrian Minister of Finance between 1895 and 1904. He also wrote extensive criticisms of Marxism.

Principles of Economics is a book by economist Carl Menger which is credited with the founding of the Austrian School of economics. It was one of the first modern treatises to advance the theory of marginal utility.

Friedrich Freiherr von Wieser was an early economist of the Austrian School of economics. Born in Vienna, the son of Privy Councillor Leopold von Wieser, a high official in the war ministry, he first trained in sociology and law. In 1872, the year he took his degree, he encountered Austrian-school founder Carl Menger's Grundsätze and switched his interest to economic theory. Wieser held posts at the universities of Vienna and Prague until succeeding Menger in Vienna in 1903, where along with his brother-in-law Eugen von Böhm-Bawerk he shaped the next generation of Austrian economists including Ludwig von Mises, Friedrich Hayek and Joseph Schumpeter in the late 1890s and early 20th century. He was the Austrian Minister of Commerce from August 30, 1917, to November 11, 1918.

Marginalism is a theory of economics that attempts to explain the discrepancy in the value of goods and services by reference to their secondary, or marginal, utility. It states that the reason why the price of diamonds is higher than that of water, for example, owes to the greater additional satisfaction of the diamonds over the water. Thus, while the water has greater total utility, the diamond has greater marginal utility.

Classical economics, classical political economy, or Smithian economics is a school of thought in political economy that flourished, primarily in Britain, in the late 18th and early-to-mid-19th century. Its main thinkers are held to be Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill. These economists produced a theory of market economies as largely self-regulating systems, governed by natural laws of production and exchange.

In economics, the cost-of-production theory of value is the theory that the price of an object or condition is determined by the sum of the cost of the resources that went into making it. The cost can comprise any of the factors of production and taxation.

The subjective theory of value (STV) is an economic theory for explaining how the value of goods and services are not only set but also how they can fluctuate over time. The contrasting system is typically known as labor theory of value.

In economic theory, a factor price is the unit cost of using a factor of production, such as labor or physical capital.

Man, Economy, and State: A treatise on economic principles is a 1962 book of Austrian School economics by Murray Rothbard.

Use value or value in use is a concept in classical political economy and Marxist economics. It refers to the tangible features of a commodity which can satisfy some human requirement, want or need, or which serves a useful purpose. In Karl Marx's critique of political economy, any product has a labor-value and a use-value, and if it is traded as a commodity in markets, it additionally has an exchange value, defined as the proportion by which a commodity can be exchanged for other entities, most often expressed as a money-price.

A theory of value is any economic theory that attempts to explain the exchange value or price of goods and services. For a good or service to be sold on the market -- i.e., to be a commodity -- it must have a subjective material use value and an objective exchange value or social value. The use value is the value of a material by the utility, use or consumption, and in which a thing meets human needs. Key questions in economic theory include why goods and services are priced as they are, how the value of goods and services comes about, and—for normative value theories—how to calculate the correct price of goods and services.

In economics, economic value is a measure of the benefit provided by a good or service to an economic agent, and value for money represents an assessment of whether financial or other resources are being used effectively in order to secure such benefit. Economic value is generally measured through units of currency, and the interpretation is therefore "what is the maximum amount of money a person is willing and able to pay for a good or service?” Value for money is often expressed in comparative terms, such as "better", or "best value for money", but may also be expressed in absolute terms, such as where a deal does, or does not, offer value for money.

In economics, marginal utility describes the change in utility of one unit of a good or service. Marginal utility can be positive, negative, or zero.

Criticisms of the labor theory of value affect the historical concept of labor theory of value (LTV) which spans classical economics, liberal economics, Marxian economics, neo-Marxian economics, and anarchist economics. As an economic theory of value, LTV is widely attributed to Marx and Marxian economics despite Marx himself pointing out the contradictions of the theory, because Marx drew ideas from LTV and related them to the concepts of labour exploitation and surplus value; the theory itself was developed by Adam Smith and David Ricardo. LTV criticisms therefore often appear in the context of economic criticism, not only for the microeconomic theory of Marx but also for Marxism, according to which the working class is exploited under capitalism, while little to no focus is placed on those responsible for developing the theory.

References

- ↑ Clark, J. B. Raspredelenie bogatstva. Moscow-Leningrad, 1934. Chapter 21. (Translated from English.)

- ↑ Samuelson, P. Ekonomika. Moscow, 1964. Chapter 26. (Translated from English.)

- ↑ Kritika burzhuaznykh ekonomicheskikh teorii. Edited by M. N. Ryndina. Moscow, 1960. Pages 89–98.

- ↑ Nikitin, S. M. Teorii stoimosti i ikh evoliutsiia. [Moscow, 1970]. Chapter 6.

- ↑ Marx, K. Kapital, vol. 1. In K. Marx and F. Engels, Soch., 2nd ed., vol. 23, chs. 4–5

- ↑ "Economics & Sociology Department | Grove City College" (PDF).

- ↑ Uzawa, Hirofumi (1958). "A note on the Menger–Wieser theory of imputation". Zeitschrift für Nationalökonomie. 18 (3): 318–334. doi:10.1007/BF01317023. S2CID 154846224.

- ↑ "Chapter 7: Theories of Value".