In economics, utility is a measure of the satisfaction that a certain person has from a certain state of the world. Over time, the term has been used in at least two different meanings.

In economics, an indifference curve connects points on a graph representing different quantities of two goods, points between which a consumer is indifferent. That is, any combinations of two products indicated by the curve will provide the consumer with equal levels of utility, and the consumer has no preference for one combination or bundle of goods over a different combination on the same curve. One can also refer to each point on the indifference curve as rendering the same level of utility (satisfaction) for the consumer. In other words, an indifference curve is the locus of various points showing different combinations of two goods providing equal utility to the consumer. Utility is then a device to represent preferences rather than something from which preferences come. The main use of indifference curves is in the representation of potentially observable demand patterns for individual consumers over commodity bundles.

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption, by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods include: income level, cultural factors, product information and physio-psychological factors.

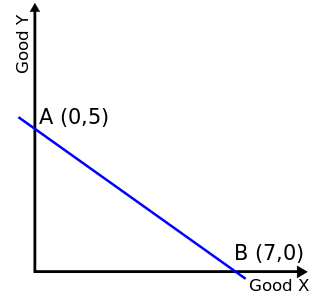

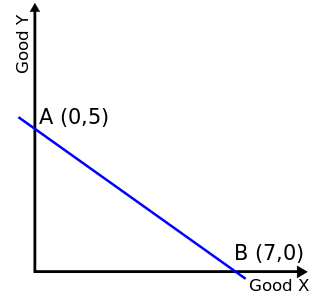

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within their given income. Consumer theory uses the concepts of a budget constraint and a preference map as tools to examine the parameters of consumer choices. Both concepts have a ready graphical representation in the two-good case. The consumer can only purchase as much as their income will allow, hence they are constrained by their budget. The equation of a budget constraint is where is the price of good X, and is the price of good Y, and m is income.

In economics, the marginal rate of substitution (MRS) is the rate at which a consumer can give up some amount of one good in exchange for another good while maintaining the same level of utility. At equilibrium consumption levels, marginal rates of substitution are identical. The marginal rate of substitution is one of the three factors from marginal productivity, the others being marginal rates of transformation and marginal productivity of a factor.

In mathematical economics, the Arrow–Debreu model is a theoretical general equilibrium model. It posits that under certain economic assumptions there must be a set of prices such that aggregate supplies will equal aggregate demands for every commodity in the economy.

In economics, an ordinal utility function is a function representing the preferences of an agent on an ordinal scale. Ordinal utility theory claims that it is only meaningful to ask which option is better than the other, but it is meaningless to ask how much better it is or how good it is. All of the theory of consumer decision-making under conditions of certainty can be, and typically is, expressed in terms of ordinal utility.

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal. The requirements for perfect competition are these:

- There are no externalities and each actor has perfect information.

- Firms and consumers take prices as given.

In microeconomics, the property of local nonsatiation (LNS) of consumer preferences states that for any bundle of goods there is always another bundle of goods arbitrarily close that is strictly preferred to it.

In economics, convex preferences are an individual's ordering of various outcomes, typically with regard to the amounts of various goods consumed, with the property that, roughly speaking, "averages are better than the extremes". The concept roughly corresponds to the concept of diminishing marginal utility without requiring utility functions.

Competitive equilibrium is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

In economics and consumer theory, quasilinear utility functions are linear in one argument, generally the numeraire. Quasilinear preferences can be represented by the utility function where is strictly concave. A useful property of the quasilinear utility function is that the Marshallian/Walrasian demand for does not depend on wealth and is thus not subject to a wealth effect; The absence of a wealth effect simplifies analysis and makes quasilinear utility functions a common choice for modelling. Furthermore, when utility is quasilinear, compensating variation (CV), equivalent variation (EV), and consumer surplus are algebraically equivalent. In mechanism design, quasilinear utility ensures that agents can compensate each other with side payments.

In economics, and in other social sciences, preference refers to an order by which an agent, while in search of an "optimal choice", ranks alternatives based on their respective utility. Preferences are evaluations that concern matters of value, in relation to practical reasoning. Individual preferences are determined by taste, need, ..., as opposed to price, availability or personal income. Classical economics assumes that people act in their best (rational) interest. In this context, rationality would dictate that, when given a choice, an individual will select an option that maximizes their self-interest. But preferences are not always transitive, both because real humans are far from always being rational and because in some situations preferences can form cycles, in which case there exists no well-defined optimal choice. An example of this is Efron dice.

A Robinson Crusoe economy is a simple framework used to study some fundamental issues in economics. It assumes an economy with one consumer, one producer and two goods. The title "Robinson Crusoe" is a reference to the 1719 novel of the same name authored by Daniel Defoe.

In microeconomics, excess demand, also known as shortage, is a phenomenon where the demand for goods and services exceeds that which the firms can produce.

The Journal of Mathematical Economics is a bimonthly peer-reviewed academic journal of mathematical economics published by Elsevier. It covers work in economic theory that expresses economic ideas using formal mathematical reasoning. The journal was established in 1974, with Werner Hildenbrand as the founding editor-in-chief. The current editor-in-chief is Andres Carvajal. According to the Journal Citation Reports, the journal has a 2018 5-year impact factor of 0.725.

In economics and consumer theory, a linear utility function is a function of the form:

Efficiency and fairness are two major goals of welfare economics. Given a set of resources and a set of agents, the goal is to divide the resources among the agents in a way that is both Pareto efficient (PE) and envy-free (EF). The goal was first defined by David Schmeidler and Menahem Yaari. Later, the existence of such allocations has been proved under various conditions.

Resource monotonicity is a principle of fair division. It says that, if there are more resources to share, then all agents should be weakly better off; no agent should lose from the increase in resources. The RM principle has been studied in various division problems.

In theoretical economics, an abstract economy is a model that generalizes both the standard model of an exchange economy in microeconomics, and the standard model of a game in game theory. An equilibrium in an abstract economy generalizes both a Walrasian equilibrium in microeconomics, and a Nash equilibrium in game-theory.