Related Research Articles

The economy of Switzerland is one of the world's most advanced and highly-developed free-market economies. The service sector has come to play a significant economic role, particularly the Swiss banking industry and tourism. The economy of Switzerland ranked first in the world in the 2015 Global Innovation Index and third in the 2020 Global Competitiveness Report. According to United Nations data for 2016, Switzerland is the third richest landlocked country in the world after Liechtenstein and Luxembourg. Together with the latter and Norway, they are the only three countries in the world with a GDP per capita (nominal) above US$70,000 that are neither island nations nor ministates.

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays yields personal savings, hence the income left after paying away all the taxes is referred to as disposable income.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

- The efficient allocation of available resources;

- The distribution of income among citizens; and

- The stability of the economy.

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment. These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

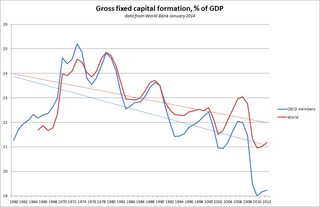

Gross fixed capital formation (GFCF) is a macroeconomic concept used in official national accounts such as the United Nations System of National Accounts (UNSNA), National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). The concept dates back to the National Bureau of Economic Research (NBER) studies of Simon Kuznets of capital formation in the 1930s, and standard measures for it were adopted in the 1950s. Statistically it measures the value of acquisitions of new or existing fixed assets by the business sector, governments and "pure" households less disposals of fixed assets. GFCF is a component of the expenditure on gross domestic product (GDP), and thus shows something about how much of the new value added in the economy is invested rather than consumed.

The healthcare in Switzerland is universal and is regulated by the Swiss Federal Law on Health Insurance. There are no free state-provided health services, but private health insurance is compulsory for all persons residing in Switzerland.

Compensation of employees (CE) is a statistical term used in national accounts, balance of payments statistics and sometimes in corporate accounts as well. It refers basically to the total gross (pre-tax) wages paid by employers to employees for work done in an accounting period, such as a quarter or a year.

The European Union has a budget to finance policies carried out at European level.

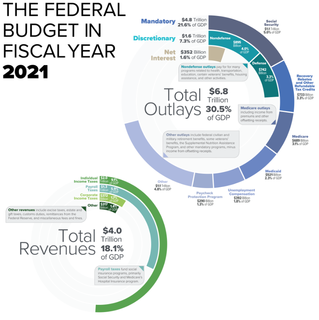

The United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food stamps, and investment gains.

Taxes in Switzerland are levied by the Swiss Confederation, the cantons and the municipalities.

Tanzania has a hierarchical health system which is in tandem with the political-administrative hierarchy. At the bottom, there are the dispensaries found in every village where the village leaders have a direct influence on its running. The health centers are found at ward level and the health center in charge is answerable to the ward leaders. At the district, there is a district hospital and at the regional level a regional referral hospital. The tertiary level is usually the zone hospitals and at a national level, there is the national hospital. There are also some specialized hospitals that do not fit directly into this hierarchy and therefore are directly linked to the ministry of health.

Canadian public debt, or general government debt, is the liabilities of the government sector. Government gross debt consists of liabilities that are a financial claim that requires payment of interest and/or principal in future. They consist mainly of Treasury bonds, but also include public service employee pension liabilities. Changes in government debt over time reflect primarily borrowing due to past government deficits.

The Federal Statistical Office (FSO) is a Federal agency of the Swiss Confederation. It is the statistics office of Switzerland, situated in Neuchâtel and attached to the Federal Department of Home Affairs.

A labor market area is a geographic area or region defined for purposes of compiling, reporting, and evaluating employment, unemployment, workforce availability, and related topics. It can be defined as an economically integrated region within which residents can find jobs within a reasonable commuting distance or can change their employment without changing their place of residence.

Environmental protection expenditure accounts (EPEA) are a statistical framework that describes environmental activities in monetary terms and organises these statistics into a full set of accounts, just like that of the national accounts. The EPEA is part of the System of Integrated Environmental and Economic Accounting which, in March 2012, was adopted as a statistical standard by the United Nations Statistical Commission.

The Swiss federal budget refers to the annual revenue and expenditures of the Swiss Confederation. As budget expenditures are issued on a yearly basis by the government, the federal council, and have to be approved by the parliament, they reflect the country's Fiscal policy.

Natural capital accounting is the process of calculating the total stocks and flows of natural resources and services in a given ecosystem or region. Accounting for such goods may occur in physical or monetary terms. This process can subsequently inform government, corporate and consumer decision making as each relates to the use or consumption of natural resources and land, and sustainable behaviour.

The Federal Department of Home Affairs is a department of the federal administration of Switzerland and serves as the Swiss ministry of the interior. As of 2012, it is headed by Federal Councillor Alain Berset.