A dishonoured cheque is a cheque that the bank on which it is drawn declines to pay (“honour”). There are a number of reasons why a bank might refuse to honour a cheque, with non-sufficient funds (NSF) being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. Lost or bounced checks result in late payments and affect the relationship with customers. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared.

Cheque clearing or bank clearance is the process of moving cash from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.

In the United States, an ABA routing transit number is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's bank for debit to the drawer's account.

The Check Clearing for the 21st Century Act is a United States federal law, Pub. L.Tooltip Public Law 108–100 (text)(PDF), that was enacted on October 28, 2003 by the 108th U.S. Congress. The Check 21 Act took effect one year later on October 28, 2004. The law allows the recipient of a paper check to create a digital version of the original, a process known as check truncation, into an electronic format called a "substitute check", thereby eliminating the need for further handling of the physical document. In essence, the recipient bank no longer returns the paper check, but effectively e-mails an image of both sides of the check to the bank it is drawn upon.

Cheque fraud, or check fraud, refers to a category of criminal acts that involve making the unlawful use of cheques in order to illegally acquire or borrow funds that do not exist within the account balance or account-holder's legal ownership. Most methods involve taking advantage of the float to draw out these funds. Specific kinds of cheque fraud include cheque kiting, where funds are deposited before the end of the float period to cover the fraud, and paper hanging, where the float offers the opportunity to write fraudulent cheques but the account is never replenished.

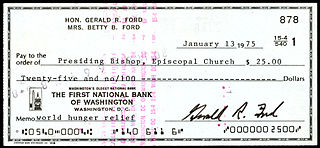

A cheque or check ; is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

In banking and finance, clearing denotes all activities from the time a commitment is made for a transaction until it is settled. This process turns the promise of payment into the actual movement of money from one account to another. Clearing houses were formed to facilitate such transactions among banks.

A cashier's check is a check guaranteed by a bank, drawn on the bank's own funds and signed by a bank employee. Cashier's checks are treated as guaranteed funds because the bank, rather than the purchaser, is both the drawee and drawer and is responsible for paying the amount. They are commonly required for real estate and brokerage transactions.

Cash management refers to a broad area of finance involving the collection, handling, and usage of cash. It involves assessing market liquidity, cash flow, and investments.

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

The Expedited Funds Availability Act was enacted in 1987 by the United States Congress for the purpose of standardizing hold periods on deposits made to commercial banks and to regulate institutions' use of deposit holds. It is also referred to as Regulation CC or Reg CC, after the Federal Reserve regulation that implements the act. The law is codified in Title 12, Chapter 41 of the US Code and Title 12, Part 229 of the Code of Federal Regulations.

A banker's draft is a cheque provided to a customer of a bank or acquired from a bank for remittance purposes, that is drawn by the bank, and drawn on another bank or payable through or at a bank.

Remote deposit or mobile deposit is the ability of a bank customer to deposit a cheque into a bank account from a remote location, without having to physically deliver the cheque to the bank. This was originally accomplished by scanning a digital image of a cheque into a computer then transmitting that image to the bank, but is now accomplished with a smartphone. The practice became legal in the United States in 2004 when the Check Clearing for the 21st Century Act took effect, though banks are not required to implement the system.

A substitute check is a negotiable instrument that is a digital reproduction of an original paper check. As a negotiable payment instrument in the United States, a substitute check maintains the status of a "legal check" in lieu of the original paper check, as authorized by the Check Clearing for the 21st Century Act. Instead of presenting the original paper checks, financial institutions and payment-processing centers transmit data from substitute checks electronically through the settlement process, through the United States Federal Reserve System, or by clearing the deposits on the basis of private agreements between member financial institutions. Financial institutions that process substitute checks in accordance with such private agreements are typically members of a clearinghouse that operates under the Uniform Commercial Code (UCC).

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important financial institution according to the Financial Stability Board, and is considered one of the "Big Four Banks" in the United States, alongside JPMorgan Chase, Bank of America, and Citigroup.

Cheque truncation is a cheque clearance system that involves the digitization of a physical paper cheque into a substitute electronic form for transmission to the paying bank. The process of cheque clearance, involving data matching and verification, is done using digital images instead of paper copies.

The Clearing House is a banking association and payments company owned by the largest commercial banks in the United States. The Clearing House is the parent organization of The Clearing House Payments Company L.L.C., which owns and operates core payments system infrastructure in the United States, including ACH, wire payments, check image clearing, and real-time payments through the RTP network, a modern real-time payment system for the U.S.

A deposit slip or a pay-in-slip is a form supplied by a bank for a depositor to fill out, designed to document in categories the items included in the deposit transaction when physically depositing at a bank. The categories include type of item, and if it is a cheque or cash and which bank it is from, such as a local bank or not.

An on-us check is a negotiable item (check) which is drawn on the same bank that it is presented to for payment.

Wells Fargo was an American banking company based in San Francisco, California, that was acquired by Norwest Corporation in 1998. During the California Gold Rush in early 1848 at Sutter's Mill near Coloma, California, financiers and entrepreneurs from all over North America and the world flocked to California, drawn by the promise of huge profits. Vermont native Henry Wells and New Yorker William G. Fargo watched the California economy boom with keen interest. Before either Wells or Fargo could pursue opportunities offered in the Western United States, however, they had business to attend to in the Eastern United States.