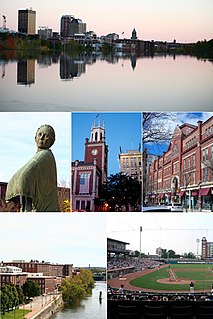

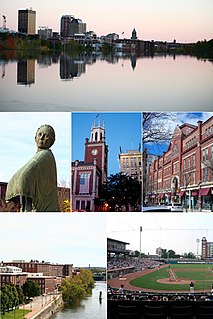

Manchester is a city in southern New Hampshire, United States. It is the most populous city in northern New England. As of the 2010 census the city had a population of 109,565, and in 2019 the population was estimated to be 112,673.

Nashua is a city in southern New Hampshire, United States. As of the 2010 census, it had a population of 86,494, the second-largest in northern New England after nearby Manchester. As of 2019 the population had risen to an estimated 89,355. Along with Manchester, it is a seat of New Hampshire's most populous county, Hillsborough.

A credit union is a member-owned financial cooperative, controlled by its members and operated on the principle of people helping people, providing its members credit at competitive rates as well as other financial services.

The National Credit Union Administration (NCUA) is one of two agencies that provide deposit insurance to depositors in U.S. depository institutions, the other being the Federal Deposit Insurance Corporation, which insures commercial banks and savings institutions. The NCUA is an independent federal agency created by the United States Congress to regulate, charter, and supervise federal credit unions. With the backing of the full faith and credit of the U.S. government, the NCUA operates and manages the National Credit Union Share Insurance Fund, insuring the deposits of more than 111 million account holders in all federal credit unions and the overwhelming majority of state-chartered credit unions. As of September 2016, there were 5,573 federally insured credit unions, with assets totaling more than $1.38 trillion, and net loans of $957.3 billion. The NCUA exclusively insures credit unions, whereas commercial banks and savings institutions are insured by the Federal Deposit Insurance Corporation.

Digital Federal Credit Union (DCU) is a credit union based in Marlborough, Massachusetts. It has over 800,000 members and is the largest credit union headquartered in New England as measured by assets, managing over US $8 billion. DCU is regulated under the authority of the National Credit Union Administration (NCUA) of the US federal government.

Granite State Credit Union (GSCU) is a state-chartered credit union based in Manchester, New Hampshire, with branches throughout the state.

Security Service Federal Credit Union (SSFCU) is a federally insured, federally chartered, $8 billion, natural person credit union with more than 925,000 members, operating from 70 service centers in the U.S. states of Texas, Colorado, and Utah. SSFCU is the largest credit union in San Antonio, Texas, 3rd largest in Colorado, and the 8th largest in the United States, with access to more than 5,000 credit union locations nationwide through CU Service Centers shared branching.

The New York State Banking Department was created by the New York Legislature on April 15, 1851, with a chief officer to be known as the Superintendent. The New York State Banking Department was the oldest bank regulatory agency in the United States.

United Federal Credit Union (UFCU) is a federally chartered credit union based in St. Joseph, Michigan with a 70-year history. Originally chartered in 1949, UFCU has more than 174,000 Members in all 50 states and the District of Columbia. The credit union assets in excess of $2.8 billion as of 2019. UFCU has 35 branches in six states: Michigan, Ohio, Indiana, Nevada, North Carolina, and Arkansas. United Federal Credit Union offers a diverse array of products and services for businesses and individuals, include checking and savings accounts; auto loans, RV and boat loans, credit cards; mortgage, construction, and lot loans; home equity loans, and lines of credit; business accounts, loans, and credit cards.

Credit unions in the United States served 100 million members, comprising 43.7% of the economically active population in 2014. U.S. credit unions are not-for-profit, cooperative, tax-exempt organizations. The clients of the credit unions become partners of the financial institution and their presence focuses in certain neighborhoods because they center their services in one specific community. As of March 2020, the largest American credit union was Navy Federal Credit Union, serving U.S. Department of Defense employees, contractors, and families of servicepeople, with over $125 billion in assets and over 9.1 million members. Total credit union assets in the U.S. reached $1 trillion as of March 2012. Approximately 236,000 people were directly employed by credit unions per data derived from the 2012 NCUA Credit Union Directory. As of 2019, there were 5,236 credit unions with 120.4 million of members, and deposits of $1.22 trillion.

Wings Financial Credit Union is a non-profit, member-owned credit union headquartered in Apple Valley, Minnesota. With assets of more than $4.5 billion, the credit union serves the Minneapolis/St. Paul, Minnesota Metro Area, the Seattle/Tacoma Metro Area and employees in the air transportation industry. Wings was chartered in 1938 and is regulated by the National Credit Union Administration (NCUA).

Tropical Financial Credit Union (TCFU) is a member-owned credit union that was chartered in 1935 and is headquartered in Miramar, Florida. TFCU is regulated under the authority of the National Credit Union Administration (NCUA).

DFCU Financial is a state-chartered credit union headquartered in Dearborn, Michigan, regulated by Michigan's Department of Licensing and Regulatory Affairs (LARA). DFCU Financial is Michigan's second largest credit union behind Lake Michigan Credit Union. As of October 2010, DFCU Financial had approximately $3 billion in assets, 219,000 members, and 24 branches in Metro Detroit, Ann Arbor, Grand Rapids and Lansing.

Lafayette Federal Credit Union, is a credit union headquartered in Rockville, Maryland, chartered and regulated under the authority of the National Credit Union Administration (NCUA) of the U.S. Federal government. As of December 2018, Lafayette Federal had over US$558 million in assets, and over 20,000 members.

Call Federal Credit Union is a federally insured, not-for-profit financial cooperative headquartered in Richmond, Virginia. It is regulated under the authority of the National Credit Union Administration (NCUA) of the U.S. federal government. Call Federal Credit Union is the second-largest Richmond-based credit union. As of December 31, 2018, Call Federal Credit Union had $400 million USD in assets and 33,000 members. In accordance with the Federal Credit Union Act of 1934, Call Federal Credit Union is a tax-exempt, federally chartered, federally insured, not-for-profit financial cooperative. Call Federal Credit Union accounts are insured up to $250,000 through the NCUA, which is comparable to the insurance provided to accounts at traditional banks via the Federal Deposit Insurance Corporation.

Santa Clara County Federal Credit Union, also known as County Federal, is a credit union which offers membership to both employees and retirees of certain Santa Clara County, California, businesses, as well as their relatives. Like other United States credit unions, it is a non-profit organization founded for the purpose of providing service to its members and is funded by its members.

First Entertainment Credit Union is a state-chartered, natural person (retail) credit union – a cooperative financial institution that is owned and controlled by its members and operated for the purpose of promoting thrift, providing credit at competitive rates, and providing other financial services to its members. Headquartered in Hollywood, California, First Entertainment Credit Union is regulated under the authority of both the California Department of Financial Institutions (DFI) and the National Credit Union Administration (NCUA), an agency of the U.S. federal government.

Southland Credit Union is a not-for-profit community-chartered credit union in California serving the residents of Orange County, the Gateway Cities of Los Angeles County and the communities of Downtown Los Angeles and Santa Monica. Membership to Southland Credit Union is also available to employees of approximately 300 Select Employer Groups (SEG). As of December 2016, Southland Credit Union reported its assets exceed $725 million and are serving over 60,000 Members.

Telhio Credit Union or Telhio is a US Credit union or financial cooperative headquartered in Columbus, Ohio. Telhio is registered as a state-chartered type credit union and is the fifth largest credit union in Central Ohio. As of December 2018, Telhio has approximately $835Mil in assets, and 70,000 members. Telhio is federally insured by the National Credit Union Administration (NCUA), which insures accounts in federal and most state-chartered credit unions in the United States up to $250,000. Additionally, Telhio carries ESI Insurance, which insures accounts an additional $250,000, for a total of $500,000 in deposit insurance.

St. Mary's Bank, the first credit union in the United States, was founded in 1908.