Related Research Articles

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 allied nations at the Mount Washington Hotel, in Bretton Woods, New Hampshire, United States, to regulate the international monetary and financial order after the conclusion of World War II.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

The Plaza Accord was a joint agreement signed on September 22, 1985, at the Plaza Hotel in New York City, between France, West Germany, Japan, the United Kingdom, and the United States, to depreciate the U.S. dollar in relation to the French franc, the German Deutsche Mark, the Japanese yen and the British pound sterling by intervening in currency markets. The U.S. dollar depreciated significantly from the time of the agreement until it was replaced by the Louvre Accord in 1987. Some commentators believe the Plaza Accord contributed to the Japanese asset price bubble of the late 1980s.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia among 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1896, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though it marked a period of general deflation and a general contraction, it did not have the severe economic retrogression of the Great Depression.

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. It also prohibited the Treasury and financial institutions from redeeming dollar bills for gold, established the Exchange Stabilization Fund under control of the Treasury to control the dollar's value without the assistance of the Federal Reserve, and authorized the president to establish the gold value of the dollar by proclamation.

The Exchange Stabilization Fund (ESF) is an emergency reserve fund of the United States Treasury Department, normally used for foreign exchange intervention. This arrangement allows the US government to influence currency exchange rates without directly affecting domestic money supply.

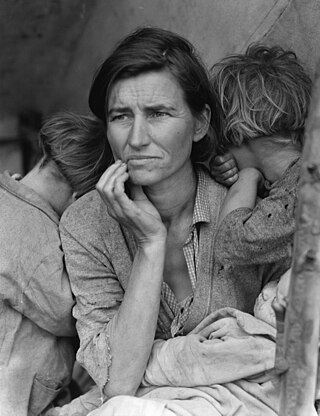

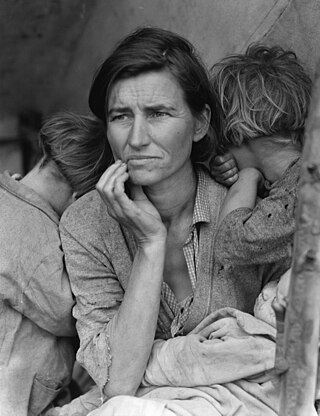

In the United States, the Great Depression began with the Wall Street Crash of October 1929 and then spread worldwide. The nadir came in 1931–1933, and recovery came in 1940. The stock market crash marked the beginning of a decade of high unemployment, poverty, low profits, deflation, plunging farm incomes, and lost opportunities for economic growth as well as for personal advancement. Altogether, there was a general loss of confidence in the economic future.

The international monetary and economic conferences were a series of gatherings held in the last third of the 19th century and the first half of the 20th century, culminating in the Bretton Woods Conference of 1944. The first four conferences in the 19th century focused on matters of coinage and the markets for gold and silver. After World War I, the scope of the conferences was expanded to matters of financial stability, then trade and economics more broadly; the two iterations in 1927 and 1933 were branded World Economic Conference. The latter of these, the London Economic Conference of 1933, ended in significant failure, and the formula of periodical international conferences was subsequently abandoned in favor of the permanent international financial institutions of the post-World War II order.

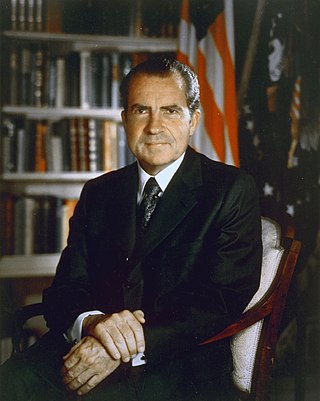

The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold.

Barry Julian Eichengreen is an American economist and economic historian who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he has taught since 1987. Eichengreen currently serves as a research associate at the National Bureau of Economic Research and as a Research Fellow at the Centre for Economic Policy Research.

The World Monetary and Economic Conference of 1933, also known as the London Economic Conference, was a meeting of representatives of 66 nations from June 12 to July 27, 1933, at the Geological Museum in London. Its purpose was to win agreement on measures to fight the Great Depression, revive international trade, and stabilize currency exchange rates.

The Great Depression (1929–1939) was a severe global economic downturn that affected many countries across the world. It became evident after a sharp decline in stock prices in the United States, leading to a period of economic depression. The economic contagion began around September 1929 and led to the Wall Street stock market crash of 24 October. This crisis marked the start of a prolonged period of economic hardship characterized by high unemployment rates and widespread business failures.

The initial economic collapse which resulted in the Great Depression can be divided into two parts: 1929 to mid-1931, and then mid-1931 to 1933. The initial decline lasted from mid-1929 to mid-1931. During this time, most people believed that the decline was merely a bad recession, worse than the recessions that occurred in 1923 and 1927, but not as bad as the Depression of 1920-21. Economic forecasters throughout 1930 optimistically predicted an economic rebound come 1931, and felt vindicated by a stock market rally in the spring of 1930.

An international monetary system is a set of internationally agreed rules, conventions and supporting institutions that facilitate international trade, cross border investment and generally the reallocation of capital between states that have different currencies. It should provide means of payment acceptable to buyers and sellers of different nationalities, including deferred payment. To operate successfully, it needs to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade, and to provide means by which global imbalances can be corrected. The system can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, it can arise from a single architectural vision, as happened at Bretton Woods in 1944.

The London Gold Pool was the pooling of gold reserves by a group of eight central banks in the United States and seven European countries that agreed on 1 November 1961 to cooperate in maintaining the Bretton Woods System of fixed-rate convertible currencies and defending a gold price of US$35 per troy ounce by interventions in the London gold market.

The gold bloc were seven countries led by France that stuck to the gold standard monetary policy during the Great Depression, even though many other countries abandoned it. In addition to France, the gold bloc included Belgium, Luxembourg, the Netherlands, Italy, Poland, and Switzerland.

References

- 1 2 Harris, Max (2021). Monetary War and Peace: London, Washington, Paris, and the Tripartite Agreement of 1936. Studies in Macroeconomic History. Cambridge University Press. doi:10.1017/9781108754187. ISBN 978-1-108-48495-4.

- ↑ Clarke, Stephen V.O. (1977). "The influence of economists on the tripartite agreement of September 1936". European Economic Review. 10 (3): 375–389. doi:10.1016/S0014-2921(77)80005-6.

- ↑ Gardner, Lloyd C. (1964). Economic Aspects of New Deal Diplomacy . Madison: University of Wisconsin Press. ISBN 978-0-299-03190-9.

- ↑ Leuchtenburg, William E. (1963). Franklin D. Roosevelt and the New Deal, 1932–1940. New York: Harper and Row. ISBN 978-0-06-183696-1.

- ↑ "After the Gold Standard, 1931-1999" (PDF). 1936 September 25 – October 13. World Gold Council. Retrieved September 16, 2010.

- ↑ "The IMF Story" (PDF). Finance & Development: 14–15. September 2004. Retrieved September 14, 2010.

- ↑ "Timeline 1936". Timelines of History. Retrieved September 16, 2010.

- ↑ "After the Gold Standard, 1931-1999". World Gold Council. Retrieved September 16, 2010.

- ↑ Robert A. Mundell and Armand Clesse (2000). The Euro as a stabilizer in the international economic. Springer. p. 284. ISBN 978-0-7923-7755-9.