Related Research Articles

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

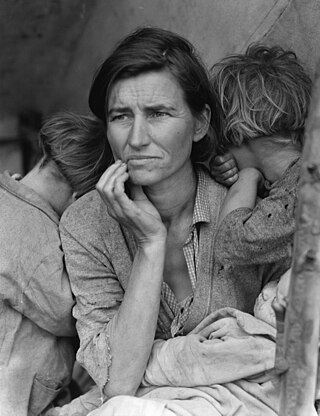

An economic depression is a period of carried long-term economic downturn that is the result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country where there is some economic crisis that has worsened but most often reflexes historically the American Great Depression and similar economic status that may be recognized as existing at some country, several countries or even in many countries. It is often understood in economics that economic crisis and the following recession that maybe named economic depression are part of economic cycles where the slowdown of the economy follows the economic growth and vice versa. It is a result of more severe economic problems or a downturn than the recession itself, which is a slowdown in economic activity over the course of the normal business cycle of growing economy.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia among 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

The Belize dollar is the official currency in Belize. It is normally abbreviated with the dollar sign $, or alternatively BZ$ to distinguish it from other dollar-denominated currencies.

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a revaluation. A monetary authority maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate.

A currency union is an intergovernmental agreement that involves two or more states sharing the same currency. These states may not necessarily have any further integration.

Economic collapse, also called economic meltdown, is any of a broad range of bad economic conditions, ranging from a severe, prolonged depression with high bankruptcy rates and high unemployment, to a breakdown in normal commerce caused by hyperinflation, or even an economically caused sharp rise in the death rate and perhaps even a decline in population. Often economic collapse is accompanied by social chaos, civil unrest and a breakdown of law and order.

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

The sterling area was a group of countries that either pegged their currencies to sterling, or actually used sterling as their own currency.

Barry Julian Eichengreen is an American economist and economic historian who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he has taught since 1987. Eichengreen currently serves as a research associate at the National Bureau of Economic Research and as a Research Fellow at the Centre for Economic Policy Research.

The Smithsonian Agreement, announced in December 1971, created a new dollar standard, whereby the currencies of a number of industrialized states were pegged to the US dollar. These currencies were allowed to fluctuate by 2.25% against the dollar. The Smithsonian Agreement was created when the Group of Ten (G-10) states raised the price of gold to 38 dollars, an 8.5% increase over the previous price at which the US government had promised to redeem dollars for gold. In effect, the changing gold price devalued the dollar by 7.9%.

The Great Depression in the Netherlands occurred between 1933 and 1936, significantly later than in most other countries. It was a period of severe economic crisis in the 1930s which affected countries around the world, including the Netherlands.

The Great Depression (1929–1939) was a severe global economic downturn that affected many countries across the world. It became evident after a sharp decline in stock prices in the United States, leading to a period of economic depression. The economic contagion began around September 1929 and led to the Wall Street stock market crash of 24 October. This crisis marked the start of a prolonged period of economic hardship characterized by high unemployment rates and widespread business failures.

An international monetary system is a set of internationally agreed rules, conventions and supporting institutions that facilitate international trade, cross border investment and generally the reallocation of capital between states that have different currencies. It should provide means of payment acceptable to buyers and sellers of different nationalities, including deferred payment. To operate successfully, it needs to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade, and to provide means by which global imbalances can be corrected. The system can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, it can arise from a single architectural vision, as happened at Bretton Woods in 1944.

The Tripartite Agreement was an international monetary agreement entered into by the United States, France, and Great Britain in September 1936. The purpose of the agreement was to stabilize their nations' currencies both at home and in the international exchange markets after the collapse of the international monetary system during the Great Depression.

Currency war, also known as competitive devaluations, is a condition in international affairs where countries seek to gain a trade advantage over other countries by causing the exchange rate of their currency to fall in relation to other currencies. As the exchange rate of a country's currency falls, exports become more competitive in other countries, and imports into the country become more and more expensive. Both effects benefit the domestic industry, and thus employment, which receives a boost in demand from both domestic and foreign markets. However, the price increases for import goods are unpopular as they harm citizens' purchasing power; and when all countries adopt a similar strategy, it can lead to a general decline in international trade, harming all countries.

The Bech Ministry was the government of Luxembourg that came into office in Luxembourg on July 16, 1926 after the resignation of the Prüm Ministry, and was headed by Joseph Bech. It was reshuffled on April 11, 1932 and on December 27, 1936. It stepped down after the referendum on the so-called Maulkuerfgesetz, in which the majority of voters decided against the law.

The devaluation of sterling in 1949 was a major currency crisis in the United Kingdom that led to a 30.5% devaluation of sterling from $4.04 per pound to $2.80 on 18 September 1949. Although the devaluation was made in the United Kingdom, over 19 countries had currencies pegged to sterling and also devalued.

References

- 1 2 Barry Eichengreen; Douglas Irwin (December 2010). "The Slide to Protectionism in the Great Depression: Who Succumbed and Why?" (PDF). Journal of Economic History. 70 (4): 871–897. doi:10.1017/S0022050710000756. S2CID 18906612.

- ↑ Hallwood, Paul; MacDonald, Ronald; Marsh, Ian (June 2007), Did Impending War in Europe Help Destroy the Gold Bloc in 1936?: An Internal Inconsistency Hypothesis (PDF), University of Connecticut, archived from the original (PDF) on 2011-02-06

- ↑ Lars Jonung; Jaakko Kiander; Pentti Vartia (2009). The Great Financial Crisis in Finland and Sweden: The Nordic Experience of Financial Liberalization. Edward Elgar Publishing. p. 169. ISBN 9781849802130.

- ↑ Ben Bernanke; Harold James (January 1991). "The Gold Standard, Deflation, and Financial Crisis in the Great Depression: An International Comparison" (PDF). In Hubbard, R. Glenn (ed.). Financial Markets and Financial Crises. National Bureau of Economic Research Project Report. University of Chicago Press. ISBN 9780226355887.