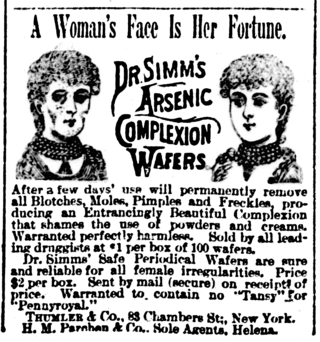

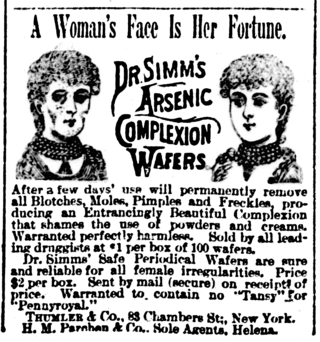

False advertising is defined as the act of publishing, transmitting, or otherwise publicly circulating an advertisement containing a false claim, or statement, made intentionally to promote the sale of property, goods, or services. A false advertisement can be classified as deceptive if the advertiser deliberately misleads the consumer, rather than making an unintentional mistake. A number of governments use regulations to limit false advertising.

A standard form contract is a contract between two parties, where the terms and conditions of the contract are set by one of the parties, and the other party has little or no ability to negotiate more favorable terms and is thus placed in a "take it or leave it" position.

The Competition and Consumer Act 2010 (CCA) is an Act of the Parliament of Australia. Prior to 1 January 2011, it was known as the Trade Practices Act 1974 (TPA). The Act is the legislative vehicle for competition law in Australia, and seeks to promote competition, fair trading as well as providing protection for consumers. It is administered by the Australian Competition & Consumer Commission (ACCC) and also gives some rights for private action. Schedule 2 of the CCA sets out the Australian Consumer Law (ACL). The Federal Court of Australia has the jurisdiction to determine private and public complaints made in regard to contraventions of the Act.

The Consumer Credit Act 1974 is an Act of the Parliament of the United Kingdom that significantly reformed the law relating to consumer credit within the United Kingdom.

The Magnuson–Moss Warranty Act is a United States federal law. Enacted in 1975, the federal statute governs warranties on consumer products. The law does not require any product to have a warranty, but if it does have a warranty, the warranty must comply with this law. The law was created to fix problems as a result of manufacturers using disclaimers on warranties in an unfair or misleading manner.

The Unfair Contract Terms Act 1977 is an Act of Parliament of the United Kingdom which regulates contracts by restricting the operation and legality of some contract terms. It extends to nearly all forms of contract and one of its most important functions is limiting the applicability of disclaimers of liability. The terms extend to both actual contract terms and notices that are seen to constitute a contractual obligation.

Canadian contract law is composed of two parallel systems: a common law framework outside Québec and a civil law framework within Québec. Outside Québec, Canadian contract law is derived from English contract law, though it has developed distinctly since Canadian Confederation in 1867. While Québecois contract law was originally derived from that which existed in France at the time of Québec's annexation into the British Empire, it was overhauled and codified first in the Civil Code of Lower Canada and later in the current Civil Code of Quebec, which codifies most elements of contract law as part of its provisions on the broader law of obligations. Individual common law provinces have codified certain contractual rules in a Sale of Goods Act, resembling equivalent statutes elsewhere in the Commonwealth. As most aspects of contract law in Canada are the subject of provincial jurisdiction under the Canadian Constitution, contract law may differ even between the country's common law provinces and territories. Conversely; as the law regarding bills of exchange and promissory notes, trade and commerce, maritime law, and banking among other related areas is governed by federal law under Section 91 of the Constitution Act, 1867; aspects of contract law pertaining to these topics are harmonised between Québec and the common law provinces.

The Unfair Terms in Consumer Contracts Regulations 1999 is an old UK statutory instrument, which had implemented the EU Unfair Consumer Contract Terms Directive 93/13/EEC into domestic law. It replaced an earlier version of similar regulations, and overlaps considerably with the Unfair Contract Terms Act 1977.

The Consumer Protection Regulations 2000, Statutory Instrument 2000/2334, implements European Directive 97/7/EC as UK law. They apply to contracts "concluded between a supplier and a consumer under an organised distance sales or services provision scheme run by the supplier who, for the purposes of the contract, makes use of one or more means of distance communication" up to and including the moment the contract is agreed. The legislation provides rights to the consumer and obligations which the seller must fulfill.

The Sale of Goods Act 1979 is an Act of the Parliament of the United Kingdom which regulated English contract law and UK commercial law in respect of goods that are sold and bought. The Act consolidated the original Sale of Goods Act 1893 and subsequent legislation, which in turn had codified and consolidated the law. Since 1979, there have been numerous minor statutory amendments and additions to the 1979 Act. It was replaced for some aspects of consumer contracts from 1 October 2015 by the Consumer Rights Act 2015 but remains the primary legislation underpinning business-to-business transactions involving selling or buying goods.

A contractual term is "any provision forming part of a contract". Each term gives rise to a contractual obligation, the breach of which may give rise to litigation. Not all terms are stated expressly and some terms carry less legal gravity as they are peripheral to the objectives of the contract.

English contract law is the body of law that regulates legally binding agreements in England and Wales. With its roots in the lex mercatoria and the activism of the judiciary during the industrial revolution, it shares a heritage with countries across the Commonwealth, from membership in the European Union, continuing membership in Unidroit, and to a lesser extent the United States. Any agreement that is enforceable in court is a contract. A contract is a voluntary obligation, contrasting to the duty to not violate others rights in tort or unjust enrichment. English law places a high value on ensuring people have truly consented to the deals that bind them in court, so long as they comply with statutory and human rights.

Consumer protection is the practice of safeguarding buyers of goods and services, and the public, against unfair practices in the marketplace. Consumer protection measures are often established by law. Such laws are intended to prevent businesses from engaging in fraud or specified unfair practices in order to gain an advantage over competitors or to mislead consumers. They may also provide additional protection for the general public which may be impacted by a product even when they are not the direct purchaser or consumer of that product. For example, government regulations may require businesses to disclose detailed information about their products—particularly in areas where public health or safety is an issue, such as with food or automobiles.

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more mutually agreeing parties. A contract typically involves the transfer of goods, services, money, or a promise to transfer any of those at a future date. In the event of a breach of contract, the injured party may seek judicial remedies such as damages or rescission. A binding agreement between actors in international law is known as a treaty.

Contractual terms in English law is a topic which deals with four main issues.

Unfair terms in English contract law are regulated under three major pieces of legislation, compliance with which is enforced by the Office of Fair Trading. The Unfair Contract Terms Act 1977 is the first main Act, which covers some contracts that have exclusion and limitation clauses. For example, it will not extend to cover contracts which are mentioned in Schedule I, consumer contracts, and international supply contracts. The Consumer Rights Act 2015 replaced the Unfair Terms in Consumer Contracts Regulations 1999 and bolstered further requirements for consumer contracts. The Consumer Protection from Unfair Trading Regulations 2008 concerns certain sales practices.

RWE Vertrieb AG v Verbraucherzentrale Nordrhein-Westfalen eV (2013) C-92/11 is an EU law and consumer protection case, concerning the Unfair Terms in Consumer Contracts Directive. It emphasises the foundations of consumer protection on inequality of bargaining power and imbalances in information.

The Consumer Rights Act 2015 is an Act of Parliament of the United Kingdom that consolidates existing consumer protection law legislation and also gives consumers a number of new rights and remedies. Provisions for secondary ticketing and lettings came into force on 27 May 2015, and provisions for alternative dispute resolution (ADR) came into force on 9 July 2015 as per the EU Directive on consumer ADR. Most other provisions came into force on 1 October 2015.

Cavendish Square Holding BV v Talal El Makdessi[2015] UKSC 67, together with its companion case ParkingEye Ltd v Beavis, are English contract law cases concerning the validity of penalty clauses and the application of the Unfair Terms in Consumer Contracts Directive. The UK Supreme Court ruled on both cases together on 4 November 2015, updating the established legal rule on penalty clauses and replacing the test of whether or not a disputed clause is "a genuine pre-estimate of loss" with a test asking whether it imposed a proportionate detriment in relation to any "legitimate interest" of the innocent party.

European consumer law concerns consumer protection within Europe, particularly through European Union law and the European Convention on Human Rights.