Related Research Articles

Insider trading is the trading of a public company's stock or other securities based on material, nonpublic information about the company. In various countries, some kinds of trading based on insider information is illegal. The rationale for this prohibition of insider trading differs between countries/regions. Some view it as unfair to other investors in the market who do not have access to the information, as the investor with inside information could potentially make larger profits than an investor could make. However, insider trading is also prohibited to prevent the director of a company from abusing a company's confidential information for the director's personal gain.

The 2003 mutual fund scandal was the result of the discovery of illegal late trading and market timing practices on the part of certain hedge fund and mutual fund companies.

Liberty Media Corporation is an American mass media company founded by John C. Malone in 1991. The company has three divisions, reflecting its ownership stakes in the Formula One Group, Sirius XM, and Live Nation Entertainment. The Sirius XM Holdings segment operates two audio entertainment companies, Sirius XM and Pandora. Sirius XM offers channels and information and entertainment services. Pandora is a streaming platform for searching for music and podcasts. As of 2024, Liberty Media is set to own three global motorsport businesses in the form of Formula One, Grand Prix motorcycle racing and World Superbikes.

Expeditors International of Washington, Inc. is an American a Fortune 500 service-based logistics company with headquarters in Bellevue, Washington, USA. Expeditors generates highly optimized and customized supply chain solutions for clients with unified technology systems integrated through a global network of over 340+ locations in 100+ countries on six continents.

Mercury Interactive Corporation was an Israeli company acquired by the HP Software Division. Mercury offered software for application management, application delivery, change and configuration management, service-oriented architecture, change request, quality assurance, and IT governance.

Bed Bath & Beyond is a brand used by American online retailer Beyond, Inc. Previously known as Overstock.com, Inc., the Midvale, Utah-based company acquired and adopted the name of bankrupt big-box retailer Bed Bath & Beyond in 2023. The company sells home decor, furniture, bedding, and many other goods that are closeout merchandise.

Securities fraud, also known as stock fraud and investment fraud, is a deceptive practice in the stock or commodities markets that induces investors to make purchase or sale decisions on the basis of false information. The setups are generally made to result in monetary gain for the deceivers, and generally result in unfair monetary losses for the investors. They are generally violating securities laws.

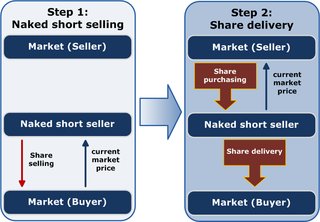

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

Discovery Holding Company was an American company headquartered in Meridian, Colorado. The postal designation of nearby Englewood was commonly listed as the company's location in corporate filings and news accounts.

Michael J. Saylor is an American entrepreneur and business executive. He is the executive chairman and co-founder of MicroStrategy, a company that provides business intelligence, mobile software, and cloud-based services.

Gary S. Gensler is an American government official and former investment banker serving as the chair of the U.S. Securities and Exchange Commission (SEC). Gensler previously worked for Goldman Sachs and has led the Biden–Harris transition's Federal Reserve, Banking, and Securities Regulators agency review team. Prior to his appointment, he was professor of Practice of Global Economics and Management at the MIT Sloan School of Management.

In finance, options backdating is the practice of altering the date a stock option was granted, to a usually earlier date at which the underlying stock price was lower. This is a way of repricing options to make them more valuable when the option "strike price" is fixed to the stock price at the date the option was granted. Cases of backdating employee stock options have drawn public and media attention.

Fred D. Anderson is an American business executive known for his time with Apple Inc. and as a managing director and co-founder of Elevation Partners.

Tomo Razmilovic is a Croatian-born Swedish businessman, formerly the CEO of Long Island, New York-based Symbol Technologies. He is the suspected mastermind of a massive accounting fraud that ultimately cost the company its independence. Currently, the United States Government considers him a fugitive, with the United States Postal Inspection Service offering a $100,000 reward for information leading to his arrest and conviction.

Avis Budget Group, Inc. is an American car rental agency holding company headquartered in Parsippany, New Jersey. It is the parent company of several brands including Avis Car Rental, Budget Rent a Car, Budget Truck Rental, Payless Car Rental and Zipcar.

Vringo was a technology company that became involved in the worldwide patent wars. The company won a 2012 intellectual property lawsuit against Google, in which a U.S. District Court ordered Google to pay 1.36 percent of U.S. AdWords sales. Analysts estimated Vringo's judgment against Google to be worth over $1 billion. The Court of Appeals for the Federal Circuit overturned the District Court's ruling on appeal in August 2014 in a split 2-1 decision, which Intellectual Asset Magazine called "the most troubling case of 2014." Vringo appealed to the United States Supreme Court. Vringo also pursued worldwide litigation against ZTE Corporation in twelve countries, including the United Kingdom, Germany, Australia, Malaysia, India, Spain, Netherlands, Romania, China, Malaysia, Brazil and the United States. The high profile nature of the intellectual property suits filed by the firm against large corporations known for anti-patent tendencies has led some commentators to refer to the firm as a patent vulture or patent troll.

Luggage Express is a door-to-door luggage delivery service that was launched by parent company, Universal Express. Luggage Express arranged to pick up travelers' baggage at their home or office prior to a trip and have it waiting at the hotel or resort in the destination city.

Paul Alec Bilzerian is an American businessman and corporate takeover specialist.

Terren Scott Peizer is an American businessperson. On June 21, 2024, he was found guilty by a California federal jury of three counts of insider trading and securities fraud, following a nine-day trial. Peizer faces a maximum penalty of 65 years in prison.

DaVita Inc. provides kidney dialysis services through a network of 2,675 outpatient centers in the United States, serving 200,800 patients, and 367 outpatient centers in 11 other countries serving 49,400 patients. The company primarily treats end-stage renal disease (ESRD), which requires patients to undergo kidney dialysis 3 times per week for the rest of their lives unless they receive a kidney transplant via organ donation. The company has a 37% market share in the U.S. dialysis market. It is organized in Delaware and based in Denver.

References

- ↑ "Universal Express Inc., The Most Naked Shorted Stock in U.S. History - A Shareholder's Perspective" (PDF). www.sec.gov. 2007-10-18.

- ↑ Complaint: Universal Express, Inc., Richard Altomare, Chris Gunderson, Mark Neuhaus, George Sandhu, Spiga Limited, and Tarun Mendiratta.

- ↑ Norris, Floyd, "A Sad Tale of Fictional SEC Filings", The New York Times, June 22, 2007

- ↑ Universal Express, Inc., "Universal Express CEO Requests Investigation Into Ex-Clearing Portfolios", Marketwire , June 21, 2007

- ↑ "Former Universal Express CEO goes to federal prison | South Florida Business Journal". Archived from the original on 2011-01-28.

- ↑ Norris, Floyd, "S.E.C. Requests Receiver for Universal Express", The New York Times, June 23, 2007

- ↑ Norris, Floyd, "Jail for Altomare?", The New York Times, Business Blog, April 21, 2008

- ↑ "Jail Day for Altomare". 2 May 2008.

- ↑ Search of the Federal Bureau of Prisons Inmate Locator

- ↑ Norris, Floyd (21 June 2007). "Resilience of fraud". The New York Times.

- ↑ "SEC Seeks Appointment of Receiver To Operate Universal Express, Inc." U.S. Securities and Exchange Commission.

- 1 2 3 Norris, Floyd (June 24, 2007). "Sad tale of fictional SEC filings". Record-Journal (Meriden, Connecticut). p. C4.

- 1 2 "Luxury of luggage-free travel has practical benefits". The Miami Herald. July 18, 2005. p. 8.