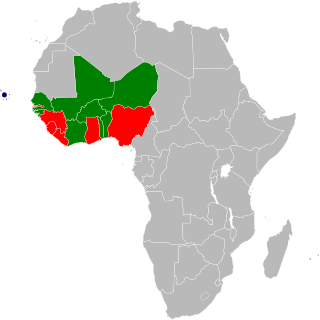

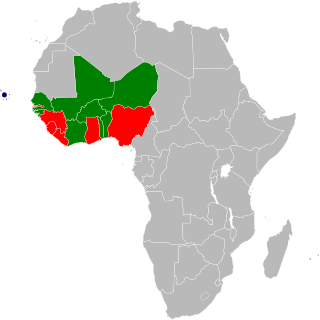

The Economic Community of West African States is a regional political and economic union of fifteen countries located in West Africa. Collectively, these countries comprise an area of 5,114,162 km2 (1,974,589 sq mi), and in 2019 had an estimated population of over 387 million.

James Victor Gbeho is a Ghanaian lawyer and diplomat who was President of the ECOWAS Commission from 2010 to 2012, to which position he was unanimously elected at the 37th Summit of the Authority of Heads of State and Government of the 15 Member States.

John Evans Fiifi Atta Mills was a Ghanaian politician and legal scholar who served as President of Ghana from 2009 until his death in 2012. He was inaugurated on 7 January 2009, having defeated the governing party candidate Nana Akufo-Addo in the 2008 Ghanaian presidential election. He was previously the Vice-President from 1997 to 2001 under President Jerry Rawlings, and he contested unsuccessfully in the 2000 and 2004 presidential elections as the candidate of the National Democratic Congress (NDC). He was the first Ghanaian head of state to die in office.

The eco is the name for the proposed common currency of the Economic Community of West African States (ECOWAS). Plans originally called for the West African Monetary Zone (WAMZ) states to introduce the currency first, which would eventually be merged with the Euro pegged CFA franc which is used by the French-speaking West African region within the West African Economic and Monetary Union (UEMOA). This will also enable the UEMOA states to gain complete fiscal and monetary independence from France. The UEMOA states have alternatively proposed to reform the CFA franc into the eco first, which could then be extended to all ECOWAS states.

The Institute of Chartered Accountants of Nigeria (ICAN) is a professional accountancy body in Nigeria. It is one of the two professional accountancy associations with regulatory authority in Nigeria, the other being the Association of National Accountants of Nigeria (ANAN). The relationship between the two organizations has been tense. In 2007 ICAN attempted to have a bill declaring ANAN void.

The Trans–West African Coastal Highway or TAH 7 is a transnational highway project to link 12 West African coastal nations, from Mauritania in the north-west of the region to Nigeria in the east, with feeder roads already existing to two landlocked countries, Mali and Burkina Faso.

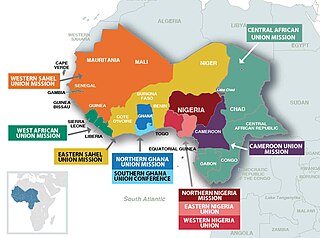

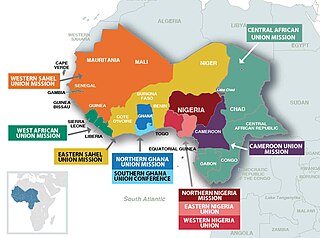

The West-Central Africa Division (WAD) of Seventh-day Adventists is a sub-entity of the General Conference of Seventh-day Adventists, which coordinates the Church's operations in 22 African countries, which include Benin, Burkina Faso, Cameroon, Cape Verde, Central African Republic, Chad, Congo, Equatorial Guinea, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Ivory Coast, Liberia, Mali, Mauritania, Niger, Nigeria, Senegal, Sierra Leone, and Togo. Its headquarters is in Abidjan, Côte d'Ivoire. Founded in 2003, the division membership as of June 30, 2021 is 889,196

The West African Power Pool (WAPP) is a cooperation of the national electricity companies in Western Africa under the auspices of the Economic Community of West African States (ECOWAS). The members of WAPP are working for establishing a reliable power grid for the region and a common market for electricity. It was founded in 2010.

The Chartered Institute of Taxation of Nigeria (CITN) is a professional organization in Nigeria whose members are certified as qualified tax practitioners or administrators.

Prince Rasaq Adekunle Quadri is a Nigerian accountant who was President of the Chartered Institute of Taxation of Nigeria (CITN) from 2009 to 2011, and was elected the first President of the West African Union of Tax Institutes (WAUTI) in March 2011.

The Chartered Institute of Taxation, Ghana (CITG) is the regulator of the practice of taxation in Ghana. It is the only body in Ghana that can certify tax professionals.

The Association of African Tax Institutes (AATI) is an industry association whose aim is, among other things, to provide a platform of collaboration between tax professionals in Africa and to help bridge the divide between tax professionals in the countries of member bodies, their governments and taxpayers.

The South African Institute of Tax Professionals (SAIT) is a recognised professional body focusing solely on taxation. It is a registered professional body under the National Qualifications Framework Act, 2008. The Institute is a professional association of tax professionals regulating tax practitioners in South Africa. SAIT promotes and focuses on the public interest, professional standards, ethics and integrity, albeit promoting the tax industry and its members.

The Liberian Institute of Certified Public Accountants (LICPA) is a professional association of accountants in Liberia.

The Ghana Rugby Association, operating as the Ghana Rugby Football Union, is the governing body for rugby union in Ghana. It is a member of Rugby Africa and a full member of World Rugby since 2017.

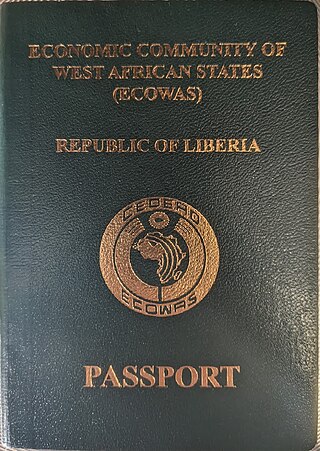

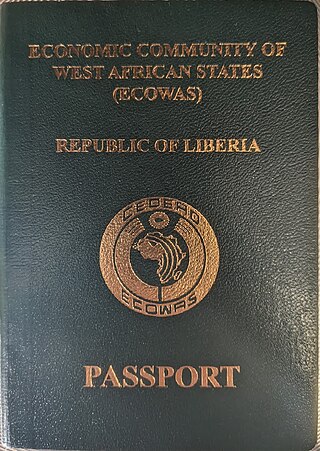

Liberian passports are issued to Liberian citizens to travel outside Liberia.

The West Africa Network for Peacebuilding (WANEP) is a leading Regional Peacebuilding organisation founded in 1998 in response to civil wars that plagued West Africa in the 1990s. Over the years, WANEP has succeeded in establishing strong national networks in every Member State of ECOWAS with over 550 member organisations across West Africa. WANEP places special focus on collaborative approaches to conflict prevention, and peacebuilding, working with diverse actors from civil society, governments, intergovernmental bodies, women groups and other partners in a bid to establish a platform for dialogue, experience sharing and learning, thereby complementing efforts at ensuring sustainable peace and development in West Africa and beyond.

In 2011, the Economic Community of West African States (ECOWAS) adopted a Policy on Science and Technology (ECOPOST).

The West African Games was an international multi-sport event between the nations of West Africa, which was held in Lagos, Nigeria in 1977. Opened on 27 August by Nigeria's head of state, Olusegun Obasanjo, ten countries took part in the eight-day competition. A total of eleven sports were contested.

The ECOWAS Bank for Investment and Development (EBID) is a leading regional investment and development bank, owned by the fifteen Economic Community of West African States (ECOWAS) Member States namely, Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, The Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo. EBID is committed to financing developmental projects and programmes covering diverse initiatives from infrastructure and basic amenities, rural development and environment, industry, and social services sectors, through its private and public sector windows. EBID intervenes through long, medium, and short-term loans, equity participation, lines of credit, refinancing, financial engineering operations, and related services.