Related Research Articles

The Glass–Steagall legislation describes four provisions of the United States Banking Act of 1933 separating commercial and investment banking. The article 1933 Banking Act describes the entire law, including the legislative history of the provisions covered.

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

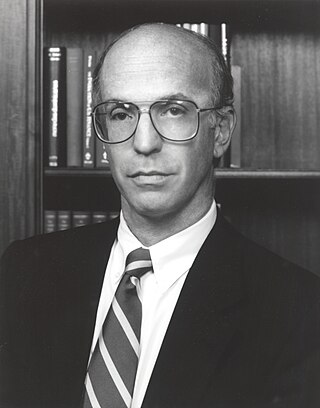

Paul Adolph Volcker Jr. was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the high levels of inflation seen in the United States throughout the 1970s and early 1980s, with measures known as the Volcker shock. He previously served as the president of the Federal Reserve Bank of New York from 1975 to 1979.

Alan Stuart Blinder is an American economics professor at Princeton University and is listed among the most influential economists in the world according to IDEAS/RePEc. He is a leading macro-economist, politically liberal, and a champion of Keynesian economics and policies.

This history of central banking in the United States encompasses various bank regulations, from early wildcat banking practices through the present Federal Reserve System.

John Brian Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University, and the George P. Shultz Senior Fellow in Economics at Stanford University's Hoover Institution.

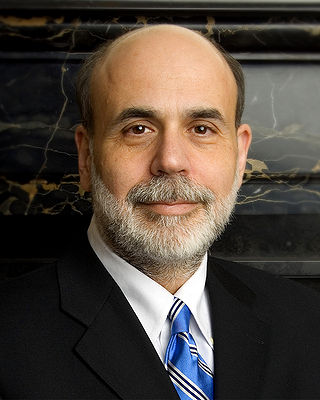

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the late-2000s financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

Anna Jacobson Schwartz was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for The New York Times. Paul Krugman has said that Schwartz is "one of the world's greatest monetary scholars."

Branko Milanović is a Serbian-American economist. He is most known for his work on income distribution and inequality.

A Monetary History of the United States, 1867–1960 is a book written in 1963 by Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz. It uses historical time series and economic analysis to argue the then-novel proposition that changes in the money supply profoundly influenced the U.S. economy, especially the behavior of economic fluctuations. The implication they draw is that changes in the money supply had unintended adverse effects, and that sound monetary policy is necessary for economic stability. Orthodox economic historians see it as one of the most influential economics books of the century. The chapter dealing with the causes of the Great Depression was published as a stand-alone book titled The Great Contraction, 1929–1933.

More Money Than God: Hedge Funds and the Making of a New Elite (2010) is a financial book by Sebastian Mallaby published by Penguin Press. Mallaby's work has been published in the Financial Times, The Washington Post, The New York Times, The Wall Street Journal, and the Atlantic Monthly as columnist, editor and editorial board member. He is a senior fellow for international economics at the Council on Foreign Relations (CFR). The book is a history of the hedge fund industry in the United States looking at the people, institutions, investment tools and concepts of hedge funds. It claims to be the "first authoritative history of the hedge fund industry." It is written for a general audience and originally published by Penguin Press. It was nominated for the 2010 Financial Times and Goldman Sachs Business Book of the Year Award and was one of The Wall Street Journal's 10-Best Books of 2010. The Journal said it was "The fullest account we have so far of a too-little-understood business that changed the shape of finance and no doubt will continue to do so."

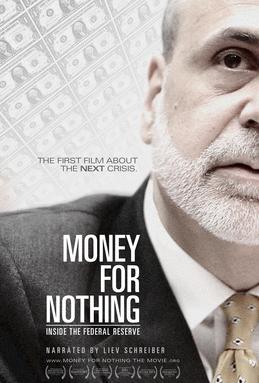

Friedrich August Lutz was a German economist who developed the expectations hypothesis.

Money for Nothing: Inside the Federal Reserve is an independent feature-length American documentary about the Federal Reserve written and directed by Jim Bruce, and narrated by Liev Schreiber. It examines 100 years of the Federal Reserve's history, and discusses its actions and repercussions the US economy leading to the late-2000s financial crisis. Bruce believes "a more fully and accurately informed public will promote greater accountability and more effective policies from our central bank". The film features interviews with Paul Volcker and Janet Yellen as well as current and former Federal Reserve officials, top economists, financial historians, famous investors, and traders who provide insight on the Federal Reserve System.

Larry Randall Wray is a professor of Economics at Bard College and Senior Scholar at the Levy Economics Institute. Previously, he was a professor at the University of Missouri–Kansas City in Kansas City, Missouri, USA, whose faculty he joined in August 1999, and a professor at the University of Denver, where he served from 1987 to 1999. He has served as a visiting professor at the University of Rome, Italy, the University of Paris, France, and the UNAM, in Mexico City. From 1994 to 1995 he was a Fulbright Scholar at the University of Bologna. From 2015 he is a visiting professor at the University of Bergamo, located in Italy. He was a visiting professor at Masaryk University in the Czech Republic.

Phillip Lee "Phill" Swagel is an American economist who is currently the director of the Congressional Budget Office. As Assistant Secretary of the Treasury for Economic Policy from 2006 to 2009, he played an important role in the Troubled Asset Relief Program that was part of the U.S. government's response to the financial crisis of 2007–08. He was recently a Professor in International Economics at the University of Maryland School of Public Policy, a non-resident scholar at the American Enterprise Institute, senior fellow at the Milken Institute, and co-chair of the Bipartisan Policy Center's Financial Regulatory Reform Initiative.

The Washington Stock Exchange was a regional stock exchange based in Washington, D.C. Active as early as the 1880s, on July 21, 1953, members of the Washington Stock Exchange board unanimously voted to merge with the Philadelphia-Baltimore Stock Exchange. The merge occurred in 1954, creating the Philadelphia-Baltimore-Washington Stock Exchange.

Douglas A. Irwin is the John French Professor of Economics in the Economics Department at Dartmouth College and the author of seven books. He is an expert on both past and present U.S. trade policy, especially policy during the Great Depression. He is frequently sought by media outlets such as The Economist and Wall Street Journal to provide comment and his opinion on current events. He also writes op-eds and articles about trade for mainstream media outlets like The Wall Street Journal, The New York Times, and Financial Times. He is also a nonresident senior fellow at the Peterson Institute for International Economics.

Charles William Calomiris is an American financial policy expert, author, and Director of the Center for Politics, Economics and History at UATX. Previously, he was a professor at Columbia Business School, where he was the Henry Kaufman Professor of Financial Institutions and the Director of Columbia Business School Program for Financial Studies.

The Julis-Rabinowitz Center for Public Policy and Finance (JRC) is a leading research center at the Princeton School of Public and International Affairs (SPIA) of Princeton University. Founded in 2011, the JRC primarily promotes research on public policy as it relates to financial markets and macroeconomics. The center has also expanded its research and teaching to multiple disciplines, including economics, operations research, political science, history, and ethics.

The European liquidation of American securities in 1914 was the selloff of about $3 billion of foreign portfolio investments at the start of World War I, taking place at the same time as the broader July Crisis of 1914. Together with loans to finance the Allied war effort, made by J.P. Morgan and others, the liquidation of European-held securities transformed the United States from a debtor nation to a creditor nation for the first time in its history.

References

- ↑ "Home". Williamlsilber.com. Retrieved 2022-08-05.

- ↑ Economic Report of the President, U.S. Government Printing Office, Washington, D.C., 1970, p. 188.

- ↑ Annual Report, Federal Reserve Bank of New York, New York, 1995, p. 131; 1996, p.53; 1997, p. 63; 1998, p. 65; 1999, p. 71

- ↑ Ritter, Lawrence S.; Silber, William L. (1974). Principles of Money, Banking, and Financial Markets. Basic Books. ISBN 978-0-465-06335-2. OCLC 841388.[ page needed ]

- ↑ Rosett, Claudia (15 April 1984). "ACADEMICS TURN TO WALL STREET". The New York Times. ProQuest 122506055.

- ↑ Bornkamp, Leanna (2018-04-18). "Bridging the Gap: Professor of the Year William Silber talks connecting theory with practice in finance". THE STERN OPPORTUNITY. Retrieved 2023-04-11.

- ↑ "Students Select Professors of the Year – Yeshiva University News". 12 May 2004.

- ↑ "Young is Silber Professor of the Year | Faculty News". blogs.yu.edu.

- ↑ "End of Year Torah Study Awards Celebrations and Thesis Presentations". edublog.news. June 5, 2019.

- ↑ Rockoff, Hugh (2008). "Review of When Washington Shut down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary Supremacy". The Economic History Review. 61 (4): 1032–1033. doi:10.1111/j.1468-0289.2008.00447_28.x. JSTOR 40057690.

- ↑ Klein, Maury (2007). "Review of When Washington Shut down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary Supremacy". The Business History Review. 81 (3): 586–588. doi:10.1017/S0007680500036813. JSTOR 25097390. S2CID 155579253.

- ↑ Silber, William L. (2008). When Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America's Monetary Supremacy. Princeton University Press. ISBN 978-0-691-13876-3.[ non-primary source needed ][ page needed ]

- ↑ Wall Street Journal, September 8, 2012, p.C5.

- ↑ "Award from CBN 2013 Financial Book of the Year" (PDF). williamlsilber.com.

- ↑ "Short_list_2012_9_14_2012" (PDF). williamlsilber.com. Retrieved February 4, 2024.

- ↑ "Editors' Choice". The New York Times. 26 October 2012.

- ↑ "Best Books of 2012, According to Business Leaders". Bloomberg Businessweek. December 4, 2012. Archived from the original on December 8, 2012.

- ↑ "Great Leadership Books in 2012". Washington Post. November 26, 2012.

- ↑ Irwin, Neil (25 November 2021). "Volcker biographer: Bernanke needs to embrace lessons of 1970s". Washington Post.

- ↑ "FT Best Books of 2019" (PDF). williamlsilber.com.

- ↑ Grant, James (20 February 2019). "'The Story of Silver' Review: The Other Precious Metal". Wall Street Journal. Retrieved 2023-04-11.

- ↑ Conti-Brown, Peter (2019). "The Story of Silver: How the White Metal Shaped America and the Modern World. By William L. Silber. Princeton: Princeton University Press, 2019. xx + 325 pp. Illustrations, photographs, figures, notes, index. Cloth, $29.95. ISBN: 9780691175386". Business History Review. 93 (2): 408–411. doi:10.1017/S0007680519000746. S2CID 199915816.

- ↑ Gary Richardson, "Silber on Silver," Regulation Magazine, Summer 2019, pp. 57-60.

- 1 2 3 "The Power of Nothing to Lose". harpercollins.com.