An individual savings account is a class of retail investment arrangement available to residents of the United Kingdom. First introduced in 1999, the accounts have favourable tax status. Payments into the account are made from after-tax income, then the account is exempt from income tax and capital gains tax on the investment returns, and no tax is payable on money withdrawn from the scheme.

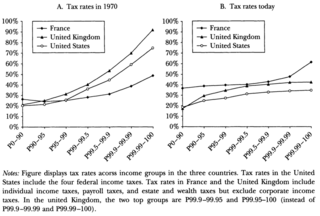

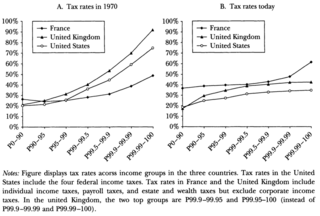

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich.

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families.

Alistair Maclean Darling, Baron Darling of Roulanish, was a British politician who served as Chancellor of the Exchequer under Prime Minister Gordon Brown from 2007 to 2010. A member of the Labour Party, he was a member of Parliament (MP) from 1987 to 2015, representing Edinburgh Central and Edinburgh South West.

Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK-resident companies and on the profits of entities registered overseas with permanent establishments in the UK.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations. State governments have not imposed income taxes since World War II. On individuals, income tax is levied at progressive rates, and at one of two rates for corporations. The income of partnerships and trusts is not taxed directly, but is taxed on its distribution to the partners or beneficiaries. Income tax is the most important source of revenue for government within the Australian taxation system. Income tax is collected on behalf of the federal government by the Australian Taxation Office.

Working Tax Credit (WTC) is a state benefit in the United Kingdom made to people who work and have a low income. It was introduced in April 2003 and is a means-tested benefit. Despite their name, tax credits are not to be confused with tax credits linked to a person's tax bill, because they are used to top-up wages. Unlike most other benefits, it is paid by HM Revenue and Customs (HMRC).

In the UK tax system, personal allowance is the threshold above which income tax is levied on an individual's income. A person who receives less than their own personal allowance in taxable income in a given tax year does not pay income tax; otherwise, tax must be paid according to how much is earned above this level. Certain residents are entitled to a larger personal allowance than others. Such groups include: the over-65s, blind people, and married couples where at least one person in the marriage was born before 6 April 1935. People earning over £100,000 a year have a smaller personal allowance. For every £2 earned above £100,000, £1 of the personal allowance is lost; meaning that incomes high enough will not have a personal allowance.

Superannuation in Australia is taxed by the Australian taxation system at three points: on contributions received by a superannuation fund, on investment income earned by the fund, and on benefits paid by the fund.

This is a list of the maximum potential tax rates around Europe for certain income brackets. It is focused on three types of taxes: corporate, individual, and value added taxes (VAT). It is not intended to represent the true tax burden to either the corporation or the individual in the listed country.

The starting rate of income tax, known as the 10p rate, was a special rate of personal income taxation in the United Kingdom that existed from 1999 to 2008.

A scrappage program is a government incentive program to promote the replacement of old vehicles with modern vehicles. Scrappage programs generally have the dual aim of stimulating the automobile industry and removing inefficient, more polluting vehicles from the road. Many European countries introduced large-scale scrappage programs as an economic stimulus to increase market demand in the industrial sector during the global recession that began in 2008.

The June 2010 United Kingdom Budget, officially also known as Responsibility, freedom, fairness: a five-year plan to re-build the economy, was delivered by George Osborne, Chancellor of the Exchequer, to the House of Commons in his budget speech that commenced at 12.33pm on Tuesday, 22 June 2010. It was the first budget of the Conservative-Liberal Democrat coalition formed after the general election of May 2010. The government dubbed it an "emergency budget", and stated that its purpose was to reduce the national debt accumulated under the Labour government.

Taxation in Finland is mainly carried out through the Finnish Tax Administration, an agency of the Ministry of Finance. Finnish Customs and the Finnish Transport and Communications Agency Traficom, also collect taxes. Taxes collected are distributed to the Government, municipalities, church, and the Social Insurance Institution, Kela.

The 2011 Irish Budget refers to the delivery of a government budget by the Government of Ireland on 7 December 2010. It was also the fourth and final overall budget to be delivered by Fianna Fáil's Brian Lenihan as Minister for Finance. The budget for 2011 occurred in the context of a major recession, which followed the Irish financial crisis. The budget was described as the most draconian budget in the history of the State, with €6bn worth of savings.

Income tax in Scotland is a tax of personal income gained through employment. This is a tax controlled by the Scottish Parliament, and collected by the UK government agency HM Revenue & Customs.

The 2012 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 21 March 2012.

Taxation in Gibraltar is determined by the law of Gibraltar which is based on English law, but is separate from the UK legal system. Companies and non residents do not pay income tax unless the source of this income is or is deemed to be Gibraltar. Individuals pay tax on a worldwide basis on income from employment or self employment if they are ordinarily resident in Gibraltar. There is no tax on capital income.

Gordon Brown served as Chancellor of the Exchequer of the United Kingdom from 2 May 1997 to 27 June 2007. His tenure was marked by major reform of Britain's monetary and fiscal policy architecture, transferring interest rate setting powers to the Bank of England, by a wide extension of the powers of the Treasury to cover much domestic policy and by transferring responsibility for banking supervision to the Financial Services Authority. Brown presided over the longest period of sustained economic growth in British history. He had previously served as Shadow Chancellor of the Exchequer in the Tony Blair Shadow Cabinet from 1994 to 1997. As Shadow Chancellor, Brown as Chancellor-in-waiting was seen as a good choice by business and the middle class.