The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then outstanding Treasury securities that have been issued by the Treasury and other federal government agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

In American public finance, discretionary spending is government spending implemented through an appropriations bill. This spending is an optional part of fiscal policy, in contrast to social programs for which funding is mandatory and determined by the number of eligible recipients. Some examples of areas funded by discretionary spending are national defense, foreign aid, education and transportation.

The military budget is the largest portion of the discretionary United States federal budget allocated to the Department of Defense, or more broadly, the portion of the budget that goes to any military-related expenditures. The military budget pays the salaries, training, and health care of uniformed and civilian personnel, maintains arms, equipment and facilities, funds operations, and develops and buys new items. The budget funds five branches of the U.S. military: the Army, Marine Corps, Navy, Air Force and Space Force.

PAYGO is the practice in the United States of financing expenditures with funds that are currently available rather than borrowed.

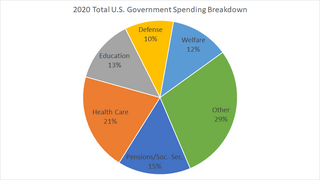

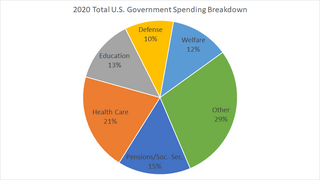

The United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The 2006 United States Federal Budget began as a proposal by President George W. Bush to fund government operations for October 1, 2005 – September 30, 2006. The requested budget was submitted to the 109th Congress on February 7, 2005.

The budget of the United States government for fiscal year 2007 was produced through a budget process involving both the legislative and executive branches of the federal government. While the Congress has the constitutional "power of the purse," the President and his appointees play a major role in budget deliberations. Since 1976, the federal fiscal year has started on October 1 of each year.

The 2008 United States Federal Budget began as a proposal by President George W. Bush to fund government operations for October 1, 2007 – September 30, 2008. The requested budget was submitted to the 110th Congress on February 5, 2007.

The United States Federal Budget for Fiscal Year 2010, titled A New Era of Responsibility: Renewing America's Promise, is a spending request by President Barack Obama to fund government operations for October 2009–September 2010. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 2010, which must be authorized by Congress.

The United States Federal Budget for Fiscal Year 1997, was a spending request by President Bill Clinton to fund government operations for October 1996-September 1997. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 1997, which must be authorized by Congress. The requested budget was submitted to Congress on February 5, 1996.

The 2011 United States federal budget was the United States federal budget to fund government operations for the fiscal year 2011. The budget was the subject of a spending request by President Barack Obama. The actual appropriations for Fiscal Year 2011 had to be authorized by the full Congress before it could take effect, according to the U.S. budget process.

The 2012 United States federal budget was the budget to fund government operations for the fiscal year 2012, which lasted from October 1, 2011 through September 30, 2012. The original spending request was issued by President Barack Obama in February 2011. That April, the Republican-held House of Representatives announced a competing plan, The Path to Prosperity, emboldened by a major victory in the 2010 Congressional elections associated with the Tea Party movement. The budget plans were both intended to focus on deficit reduction, but differed in their changes to taxation, entitlement programs, defense spending, and research funding.

The Budget of the United States Government Fiscal Year 1999 (FY99) was a spending request by President Bill Clinton to fund government operations for October 1998–September 1999. It was the first balanced Federal budget in 30 years. In FY99, revenues were 1.82 trillion dollars. Spending was 1.70 trillion dollars, the surplus was $124 billion, and the GDP was 9.2 trillion.

The United States federal budget consists of mandatory expenditures, discretionary spending for defense, Cabinet departments and agencies, and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

The 1996 United States federal budget is the United States federal budget to fund government operations for the fiscal year 1996, which was October 1995 – September 1996. This budget was the first to be submitted after the Republican Revolution in the 1994 midterm elections. Disagreements between Democratic President Bill Clinton and Republicans led by Speaker of the House Newt Gingrich resulted in the United States federal government shutdown of 1995 and 1996.

The 2013 United States federal budget is the budget to fund government operations for the fiscal year 2013, which is October 2012–September 2013. The original spending request was issued by President Barack Obama in February 2012.

Budget sequestration is a provision of United States law that causes an across-the-board reduction in certain kinds of spending included in the federal budget. Sequestration involves setting a hard cap on the amount of government spending within broadly defined categories; if Congress enacts annual appropriations legislation that exceeds these caps, an across-the-board spending cut is automatically imposed on these categories, affecting all departments and programs by an equal percentage. The amount exceeding the budget limit is held back by the Treasury and not transferred to the agencies specified in the appropriation bills. The word sequestration was derived from a legal term referring to the seizing of property by an agent of the court, to prevent destruction or harm, while any dispute over said property is resolved in court.

The 2014 United States federal budget is the budget to fund government operations for the fiscal year (FY) 2014, which began on October 1, 2013 and ended on September 30, 2014.

The United States federal budget for fiscal year 2018, which ran from October 1, 2017, to September 30, 2018, was named America First: A Budget Blueprint to Make America Great Again. It was the first budget proposed by newly elected president Donald Trump, submitted to the 115th Congress on March 16, 2017.

Government spending in the United States is the spending of the federal government of the United States, and the spending of its state and local governments.