In the United States, a continuing resolution is a type of appropriations legislation. An appropriations bill is a bill that appropriates money to specific federal government departments, agencies, and programs. The money provides funding for operations, personnel, equipment, and activities. Regular appropriations bills are passed annually, with the funding they provide covering one fiscal year. The fiscal year is the accounting period of the federal government, which runs from October 1 to September 30 of the following year. When Congress and the president fail to agree on and pass one or more of the regular appropriations bills, a continuing resolution can be passed instead. A continuing resolution continues the pre-existing appropriations at the same levels as the previous fiscal year for a set amount of time. Continuing resolutions typically provide funding at a rate or formula based on the previous year's funding. The funding extends until a specific date or regular appropriations bills are passed, whichever comes first. There can be some changes to some of the accounts in a continuing resolution. The continuing resolution takes the form of a joint resolution, and may provide bridging funding for existing federal programs at current, reduced, or expanded levels.

PAYGO is the practice in the United States of financing expenditures with funds that are currently available rather than borrowed.

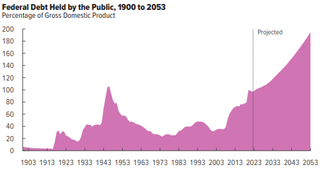

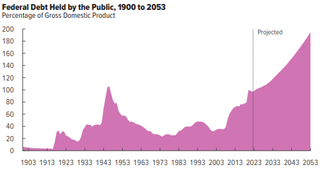

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The 2006 United States Federal Budget began as a proposal by President George W. Bush to fund government operations for October 1, 2005 – September 30, 2006. The requested budget was submitted to the 109th Congress on February 7, 2005.

The budget of the United States government for fiscal year 2007 was produced through a budget process involving both the legislative and executive branches of the federal government. While the Congress has the constitutional "power of the purse," the President and his appointees play a major role in budget deliberations. Since 1976, the federal fiscal year has started on October 1 of each year.

The history of the United States public debt started with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously had a fluctuating public debt since then, except for about a year during 1835–1836. To allow comparisons over the years, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

The 2008 United States Federal Budget began as a proposal by President George W. Bush to fund government operations for October 1, 2007 – September 30, 2008. The requested budget was submitted to the 110th Congress on February 5, 2007.

The United States federal budget for fiscal year 2009 began as a spending request submitted by President George W. Bush to the 110th Congress. The final resolution written and submitted by the 110th Congress to be forwarded to the President was approved by the House on June 5, 2008.

The United States Federal Budget for Fiscal Year 2010, titled A New Era of Responsibility: Renewing America's Promise, is a spending request by President Barack Obama to fund government operations for October 2009–September 2010. Figures shown in the spending request do not reflect the actual appropriations for Fiscal Year 2010, which must be authorized by Congress.

The 2012 United States federal budget was the budget to fund government operations for the fiscal year 2012, which lasted from October 1, 2011 through September 30, 2012. The original spending request was issued by President Barack Obama in February 2011. That April, the Republican-held House of Representatives announced a competing plan, The Path to Prosperity, emboldened by a major victory in the 2010 Congressional elections associated with the Tea Party movement. The budget plans were both intended to focus on deficit reduction, but differed in their changes to taxation, entitlement programs, defense spending, and research funding.

The United States federal budget consists of mandatory expenditures, discretionary spending for defense, Cabinet departments and agencies, and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

The 1996 United States federal budget is the United States federal budget to fund government operations for the fiscal year 1996, which was October 1995 – September 1996. This budget was the first to be submitted after the Republican Revolution in the 1994 midterm elections. Disagreements between Democratic President Bill Clinton and Republicans led by Speaker of the House Newt Gingrich resulted in the United States federal government shutdown of 1995 and 1996.

The 2013 United States federal budget is the budget to fund government operations for the fiscal year 2013, which began on October 1, 2012, and ended on September 30, 2013. The original spending request was issued by President Barack Obama in February 2012.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

As a result of the Budget Control Act of 2011, a set of automatic spending cuts to United States federal government spending in particular of outlays were initially set to begin on January 1, 2013. They were postponed by two months by the American Taxpayer Relief Act of 2012 until March 1 when this law went into effect.

The 2014 United States federal budget is the budget to fund government operations for the fiscal year (FY) 2014, which began on October 1, 2013 and ended on September 30, 2014.

The 2015 United States federal budget was the federal budget for fiscal year 2015, which runs from October 1, 2014 to September 30, 2015. The budget takes the form of a budget resolution which must be agreed to by both the United States House of Representatives and the United States Senate in order to become final, but never receives the signature or veto of the President of the United States and does not become law. Until both the House and the Senate pass the same concurrent resolution, no final budget exists. Actual U.S. federal government spending will occur through later appropriations legislation that would be signed into law.

The Consolidated Appropriations Act, 2016, also known as the 2016 omnibus spending bill, is the United States appropriations legislation passed during the 114th Congress which provides spending permission to a number of federal agencies for the fiscal year of 2016. The bill authorizes $1.1 trillion in spending, as well as $700 billion in tax breaks. The bill provides funding to the federal government through September 30, 2016.

The 2017 United States federal budget is the United States federal budget for fiscal year 2017, which lasted from October 1, 2016 to September 30, 2017. President Barack Obama submitted a budget proposal to the 114th Congress on February 9, 2016. The 2017 fiscal year overlaps the end of the Obama administration and the beginning of the Trump administration.

The United States federal budget for fiscal year 2018, which ran from October 1, 2017, to September 30, 2018, was named America First: A Budget Blueprint to Make America Great Again. It was the first budget proposed by newly elected president Donald Trump, submitted to the 115th Congress on March 16, 2017.