Related Research Articles

David Ricardo was a British political economist, politician, and member of the Parliament of Great Britain and Ireland. He is recognized as one of the most influential classical economists, alongside figures such as Thomas Malthus, Adam Smith and James Mill.

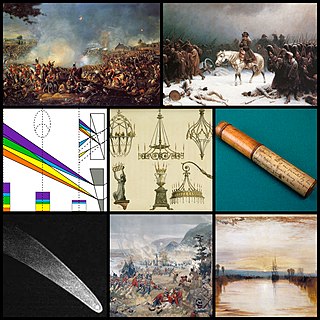

The 1810s was a decade of the Gregorian calendar that began on January 1, 1810, and ended on December 31, 1819.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slowdown in the inflation rate; i.e., when inflation declines to a lower rate but is still positive.

In finance, speculation is the purchase of an asset with the hope that it will become more valuable shortly. It can also refer to short sales in which the speculator hopes for a decline in value.

Madison County is located in the north central portion of the U.S. state of Alabama. As of the 2020 Census, the population was 388,153, making it the second-most populous county in Alabama. Its county seat is Huntsville. Since the mid-20th century it has become an area of defense and space research and industry.

Huntsville is the most populous city in the U.S. state of Alabama. It is the county seat of Madison County with portions extending into Limestone County and Morgan County. It is located in the Appalachian region of northern Alabama.

Madison is a city located primarily in Madison County, near the northern border of the U.S. state of Alabama. Madison extends west into neighboring Limestone County. The city is included in the Huntsville Metropolitan Area, the second-largest in the state, and is also included in the merged Huntsville-Decatur Combined Statistical Area. The population was 56,933 at the 2020 census. Madison is bordered by Huntsville on nearly all sides with some small unincorporated lands within Madison in Madison and Limestone counties.

The Panic of 1837 was a financial crisis in the United States that began a major depression, which lasted until the mid-1840s. Profits, prices, and wages dropped, westward expansion was stalled, unemployment rose, and pessimism abounded.

The Panic of 1819 was the first widespread and durable financial crisis in the United States that slowed westward expansion in the Cotton Belt and was followed by a general collapse of the American economy that persisted through 1821. The Panic heralded the transition of the nation from its colonial commercial status with Europe toward an independent economy.

John Williams Walker was an American politician, who served as the Democratic-Republican United States senator from the state of Alabama, the first senator elected by that state.

Henry Hitchcock was the first Attorney General of Alabama, having been elected by the Alabama General Assembly in December 1819 in its initial session. He was also the Secretary of the Alabama Territory, the position which was the precursor to the modern-day Secretary of State of Alabama.

The Tariff of 1816, also known as the Dallas Tariff, is notable as the first tariff passed by Congress with an explicit function of protecting U.S. manufactured items from overseas competition. Prior to the War of 1812, tariffs had primarily served to raise revenues to operate the national government. Another unique aspect of the tariff was the strong support it received from Southern states.

Maple Hill Cemetery is the oldest and largest cemetery in Huntsville, Alabama, United States. Founded on two acres in about the year 1822, it now encompasses nearly 100 acres and contains over 80,000 burials. It was added to the Alabama Historical Commission's Historic Cemetery Register in 2008, and to the National Register of Historic Places in 2012. Its occupants include five governors of Alabama, five United States senators, and numerous other figures of local, state, and national note. It is located east of the Twickenham Historic District.

The African slave trade was first brought to Alabama when the region was part of the French Louisiana Colony.

Rhoda was a British Thoroughbred racehorse and broodmare who won the third running of the classic 1000 Guineas at Newmarket Racecourse in 1816 and was the most successful racehorse in Britain two years later. Rhoda was one of the most active of all British classic winners, running in at least forty-five contests between 1816 and 1820 and winning twenty-one times. Her actual number of competitive races was even higher as many of her later races were run in multiple heats, with the prize going to the first horse to win twice. She won the 1000 Guineas on her second appearance but did not run as a three-year-old after finishing unplaced in the Oaks Stakes. Rhoda won three races in 1817, ten in 1818, four in 1819 and two in 1820.

The Duchess (1813–1836) was a British Thoroughbred racehorse and broodmare best known for winning the classic St Leger Stakes in 1816. In a racing career which lasted from March 1815 until October 1819 she competed in thirty-three races and won nineteen times. She was still unnamed when winning three races as a two-year-old in 1815, when she was one of the leading juveniles in the north of England. In the following year she was named Duchess of Leven, which was shortened to The Duchess when she was sold to Sir Bellingham Graham. She won seven of her nine races as a three-year-old, including the Gold Cup at Pontefract and the St Leger at Doncaster. The Duchess remained in training for a further three seasons, winning five times in 1817, twice in 1818 and twice in 1819, beating many leading horses of the time including Blacklock, Doctor Syntax, Rhoda and Filho da Puta. After her retirement from racing, The Duchess had some success as a broodmare.

The United States exports more cotton than any other country, though it ranks third in total production, behind China and India. Almost all of the cotton fiber growth and production occurs in the Southern United States and the Western United States, dominated by Texas, California, Arizona, Mississippi, Arkansas, and Louisiana. More than 99 percent of the cotton grown in the US is of the Upland variety, with the rest being American Pima. Cotton production is a $21 billion-per-year industry in the United States, employing over 125,000 people in total, as against growth of forty billion pounds a year from 77 million acres of land covering more than eighty countries. The final estimate of U.S. cotton production in 2012 was 17.31 million bales, with the corresponding figures for China and India being 35 million and 26.5 million bales, respectively. Cotton supports the global textile mills market and the global apparel manufacturing market that produces garments for wide use, which were valued at USD 748 billion and 786 billion, respectively, in 2016. Furthermore, cotton supports a USD 3 trillion global fashion industry, which includes clothes with unique designs from reputed brands, with global clothing exports valued at USD 1.3 trillion in 2016.

John Dabney Terrell Sr., surveyor, planter, and politician in Alabama, was born to a planter family in Bedford County, Virginia, and died in Marion County, Alabama. He moved to the region about 1814, well before Indian Removal which began in the 1830s, and served as the United States Indian Agent to the Chickasaw under two presidents. He developed a plantation and was a slaveholder. He became active in territorial and state politics, serving as a state senator and also as a state representative.

Food speculation refers to the buying and selling of futures contracts by traders with the aim of profiting from changes in food prices. Food speculation can be both positive and negative for food producers and buyers. It is betting on food prices (unregulated) financial markets. Food speculation by global players like banks, hedge funds or pension funds is alleged to cause price swings in staple foods such as wheat, maize and soy – even though too large price swings in an idealized economy are theoretically ruled out: Adam Smith in 1776 reasoned that the only way to make money from commodities trading is by buying low and selling high, which has the effect of smoothing out price swings and mitigating shortages. For the actors, the apparently random swings are predictable, which means potential huge profits. For the global poor, food speculation and resulting price peaks may result in increased poverty or even famine.

The United States Government Fur Trade Factory System was a system of government non-profit trading with Native Americans that existed between 1795 and 1821.

References

- 1 2 3 Chappell, Gordon T. 1949. "Some Patterns of Land Speculation in the Old Southwest." The Journal of Southern History: 463-477

- ↑ "Chapter 35: Act of March 26, 1804". Statutes at Large, Volume II. 8th Congress, 1st session. Boston: Charles C. Little and James Brown, 1845, pg. 277-283. From Library of Congress, A Century of Lawmaking for a New Nation: U.S. Congressional Documents and Debates, 1774-1875; (accessed April 24, 2013).

- 1 2 3 4 5 6 Glaeser, Edward L., A Nation of Gamblers: Real Estate Speculation and American History (working paper); accessed April 24, 2013.

- 1 2 Cole, Arthur H. 1938. Wholesale Commodity Prices in the United States, 1700-1861 Archived 2013-04-06 at the Wayback Machine , Statistical Supplement, Actual Wholesale Prices of Various Commodities. Harvard University Press, Cambridge, (accessed April 24, 2013).

- ↑ Howe, Daniel Walker. 2007. What Hath God Wrought: The Transformation of America, 1815-1848 (The Oxford History of the United States, Vol. 5). Oxford University Press.

- 1 2 Betting the House. 2013. The Economist.

- ↑ Treat, Payson Jackson. 1910. The National Land System 1785-1820. E.B. Treat and Co.