Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

Lazard Ltd is a financial advisory and asset management firm that engages in investment banking, asset management and other financial services, primarily with institutional clients. It is the world's largest independent investment bank, with principal executive offices in New York City, Paris and London.

Kuhn, Loeb & Co. was an American multinational investment bank founded in 1867 by Abraham Kuhn and his brother-in-law Solomon Loeb. Under the leadership of Jacob H. Schiff, Loeb's son-in-law, it grew to be one of the most influential investment banks in the late 19th and early 20th centuries, financing America's expanding railways and growth companies, including Western Union and Westinghouse, and thereby becoming the principal rival of J.P. Morgan & Co.

Nomura Securities Co., Ltd. is a Japanese financial services company and a wholly owned subsidiary of Nomura Holdings, Inc. (NHI), which forms part of the Nomura Group. It plays a central role in the securities business, the group's core business. Nomura is a financial services group and global investment bank. Based in Tokyo, Japan, with regional headquarters in Hong Kong, London, and New York, Nomura employs about 26,000 staff worldwide; it is known as Nomura Securities International in the US, and Nomura International plc. in EMEA. It operates through five business divisions: retail, global markets, investment banking, merchant banking, and asset management.

Wasserstein Perella & Co., sometimes referred to as "Wasserella", was a boutique investment bank established by Bruce Wasserstein, Joseph R. Perella, Bill Lambert, and Charles Ward in 1988, former bankers at First Boston Corp., until its eventual sale to Dresdner Bank in 2000 for some $1.4 billion in stock. The private equity business of the investment firm was not included in the sale and was to be sold off to existing Wasserstein shareholders.

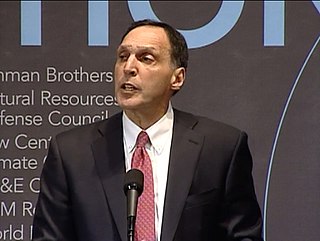

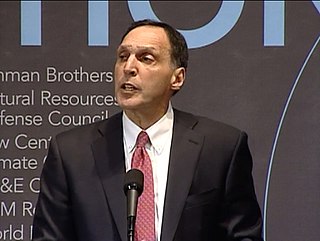

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from the firm's 1994 spinoff from American Express until 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

John Halle Gutfreund was an American banker, businessman, and investor. He was the CEO of Salomon Brothers Inc, an investment bank that gained prominence in the 1980s. Gutfreund turned Salomon Brothers from a private partnership into a publicly traded corporation, which started a trend in Wall Street for investment companies to go public. In 1985, Business Week gave him the nickname "King of Wall Street".

Financo, Inc. is a New York-based boutique investment bank focused on the merchandising and retail sector, with offices also in Los Angeles and London. It was founded in 1971 by Gilbert Harrison.

Canaccord Genuity Group Inc. is a global, full-service investment banking and financial services company that specializes in wealth management and brokerage in capital markets. It is the largest independent investment dealer in Canada. The firm focuses on growth companies, with operations in 10 countries worldwide and the ability to list companies on 10 stock exchanges. Canaccord Genuity, the international capital markets division, is based in Canada, with offices in the US, the UK, France, Germany, Ireland, Hong Kong, China, Singapore, Dubai, Australia, and Barbados.

L.F. Rothschild was a merchant and investment banking firm based in the United States and founded in 1899. The firm collapsed following the 1987 stock market crash.

Shearson was the name of a series of investment banking and retail brokerage firms from 1902 until 1994, named for Edward Shearson and the firm he founded, Shearson Hammill & Co. Among Shearson's most notable incarnations were Shearson / American Express, Shearson Lehman / American Express, Shearson Lehman Brothers, Shearson Lehman Hutton and finally Smith Barney Shearson.

Cogan, Berlind, Weill & Levitt, originally Carter, Berlind, Potoma & Weill, was an American investment banking and brokerage firm founded in 1960 and acquired by American Express in 1981. In its two decades as an independent firm, Cogan, Berlind, Weill & Levitt served as a vehicle for the rollup of more than a dozen brokerage and securities firms led by Sanford I. Weill that culminated in the formation of Shearson Loeb Rhoades.

Needham & Company, LLC is an independent investment bank and asset management firm specializing in advisory services and financings for growth companies. Needham & Company is a wholly owned subsidiary of The Needham Group, which also operates a private equity investment business and an investment management business.

Sadeq Sayeed is a prominent Pakistani-born banker and businessman, known for his role behind Nomura's acquisition of the Europe, the Middle East and Africa (EMEA) businesses of Lehman Brothers in Oct 2008.

Hugh E. "Skip" McGee III is an American investment banker who was formerly a senior executive at Lehman Brothers and Barclays. He is presently co-founder and chief executive officer of Intrepid Financial Partners, a power and energy focused merchant bank.

JPMorgan Chase is an American multinational banking corporation with a large presence in the United Kingdom. The corporation’s European subsidiaries J.P. Morgan Europe Limited, J.P. Morgan International Bank Limited and J.P. Morgan Securities plc are headquartered in London.

Barclays plc is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services.

James Satloff is an American businessman. He founded Liberty Skis and served as the CEO of C.E. Unterberg, Towbin.

Rothschild & Co is a multinational private and merchant bank, headquartered in London, England. It is the flagship of the Rothschild banking group controlled by the British and French branches of the Rothschild family.

An independent advisory firm is an investment bank that provides strategic and financial advice to clients primarily including corporations, financial sponsors, and governments. Revenues are typically generated by providing deal-specific advice related to mergers and acquisitions and financing. The WSJ noted in January 2016 that "boutique is a fuzzy label, defined as much by what these firms do as what they don’t do ."